Budget 2023: Electric 2-wheelers to be cheaper after duty cuts on Li-ion battery components

Given its pole position in adoption rates, on more competitive TCO, the electric two-wheeler sector will benefit the most from the govt's decision to exempt components of Li-ion batteries.

In a major fillip to the battery electric vehicle (BEV) industry, the government has announced to exempt customs duties on capital goods on lithium-ion (Li-ion) batteries. “To further provide impetus to green mobility, customs duty exemption is being extended to import of capital goods and machinery required for the manufacture of lithium-ion cells for batteries used in electric vehicles,” says Nirmala Sitharaman, union minister of finance, in her budget speech. She has also announced that the number of basic customs duty rates on goods, other than textiles and agriculture, is from 21 to 13. “As a result, there are minor changes in the basic customs duties, cesses and surcharges on some items including toys, bicycles, automobiles and naphtha.”

To the uninitiated, in terms of cost, the battery of a BEV is its most intensive component. Even though the government’s Production-Linked Incentives (PLI) scheme for the auto industry, which includes advanced chemistry cells (ACC), has attracted investment to the tune of ₹74,850 crore, a motley group of localised and imported components make up a BEV. “There are still many parts of EV componentry—such as lithium cells, permanent magnets for electric motors, semiconductors etc that will need to be imported,” says Sohinder Gill, director general, Society of Manufacturers of Electric Vehicles (SMEV). Gill adds that the industry expected rationalisation of customs duty on such essential imports to help keep the EV prices in check. “The continuation of the customs duty-free status for machinery used to produce lithium-ion batteries could result in some stabilisation in battery pricing.”

India currently does not manufacture Li-ion cells or have access to raw materials which is required in its manufacturing. The industry is heavily dependent on imports to serve the BEV industry. Industry estimates suggest that China and South Korea currently have the lion’s share in Li-ion battery supply and technology—with a market share of 35-40% each. Japan controls about 20% of the market share, making the cumulative market share of these three countries close to 90%. Competing against the inexpensive Chinese Li-ion batteries is a major roadblock in battery manufacturing in India, and the uncertainty around the extent of EV adoption in India has not led to the large-scale indigenisation of battery manufacturing. However, given the increasing rates of adoption, there is a gradual shift towards manufacturing critical components of BEVs, including cells.

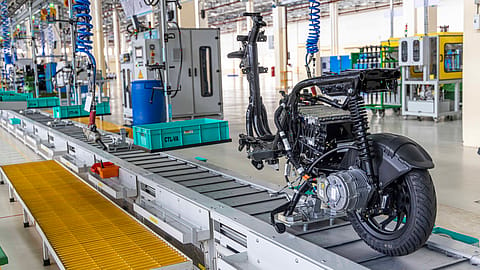

Any reduction in the Li-ion battery prices will drive up the penetration rate of BEVs in India, especially in the two-wheeler sector. This is because the country is the largest market in the world, having 375- 400 million two-wheelers plying on the road, and is seeing the fastest rate of adoption. According to a report by RedSeer Strategy Consultants, electric-two wheelers make up about 94% of the total BEV market—which crossed cumulative sales of one million units in 2022. The penetration rate is also the highest in this segment, as electric-two wheelers make up about 3.6% of all two-wheelers in India.

“The reduction of indirect taxes from 21 to 13, as well as exemption on custom duties on capital goods and machinery required for the manufacture of lithium-ion cells will lead to faster adoption of electric vehicles in the country. This will further aid the development of an efficient EV ecosystem,” says Jeetender Sharma, managing director and founder, Okinawa Autotech—one of the largest electric two-wheeler manufacturers in India. Shamsher Dewan, senior vice president and group head, corporate ratings, ICRA, concurs. “Customs duty exemption on the import of capital assets for manufacturing lithium-ion cells for batteries used in electric vehicles shall facilitate EV ecosystem development and aid faster penetration,” he says.

The RedSeer report reads that India’s electric two-wheeler consists of more than 150 brands, and is skewed in terms of manufacturing. Currently, there are more than 100 importers and/or assemblers—OEMs importing/domestic outsourcing completely knocked down (CKD) kits, and prefer domestic assembly of Modules and battery packs. While some OEMs have varying degrees of in-house, licensed, or outsourced technologies, only a handful of OEMs—Ola Electric, Exide, and Reliance—have set up/are setting up their cell R&D and manufacturing. Ather Energy, meanwhile, has employed in-house battery manufacturing.