Fortune 500 India: RIL’s consumer bet

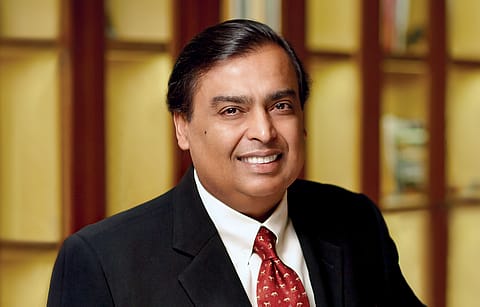

Mukesh Ambani has expanded the Reliance empire by betting big on telecom and retail.

“I BELIEVE, IN THE NEXT 20 years, as a human civilisation, we will collectively achieve more than what has been achieved in the last 300 years,” Mukesh Ambani told shareholders of Reliance Industries Ltd. during a meeting in 2016.

Little wonder then that the 64-year-old RIL chairman managed to turn the tide during the peak of Covid in 2020, at a time when the entire world was grappling with the raging virus.

The billionaire sealed deals worth ₹2,92,847 crore — ₹2,39,723 crore of investments and ₹53,124 crore of rights issue — during 2020-21.

At one point, the nation-wide lockdown in March 2020 had threatened to jeopardise Mukesh’s plans to make RIL net debt-free with equity capital from strategic investors as the transportation fuel and retail businesses virtually came to a standstill.

It’s share price increased 130% in five and a half months since the market crashed in March 2020. It became the first Indian company to hit $200 billion in market capitalisation in September last year. Thanks to the company’s 13% weightage on the Sensex last year, the index moved up 40% during the same period.

Working on many fronts at the same time, Mukesh has shifted his focus on building a renewable energy giant. RIL’s new subsidiary, Reliance New Energy Solar (RNESL), is eyeing global acquisitions to enter the segment in a big way.

Consumer-driven

More Stories from this Issue

Founder Dhirubhai Ambani had conceived the company largely as a B2B [business-to-business] firm. During its journey from yarn trading to petroleum refining, RIL had only one major consumer-facing business — clothing brand Vimal. Under Mukesh’s watch, RIL forayed into telecom, power distribution and financial products. After Dhirubhai’s death when the business was split between the two siblings, Mukesh had the B2B business — petroleum refining and petrochemicals. With cash flow accumulation from the petroleum business, investors put pressure on Mukesh to foray into high-yielding ventures. But his entry into retail in 2006 faced political resistance, delaying its expansion. Though he bought spectrum in 2010, his entry into telecom was also delayed, triggering speculations that RIL was not able to find the right code to crack the consumer business.

But Mukesh has been unstoppable since the launch of Reliance Jio in 2016. Jio disrupted the telecom industry by offering free voice calls and pricing data much lower than prevailing rates. While other operators struggled to catch up with Jio — some of them even shutting shop — Mukesh continued the blitz by building a digital ecosystem. Over the last six years, Jio has launched several applications and services, including news, entertainment, games and financial services. JPL developed JioMeet in line with video-conferencing app Zoom in three months. It was Mukesh who put together the tech team in March 2020 to develop JioMeet.

And the story goes on. JPL launched the JioPhone Next in a joint venture with Google during Diwali. The smartphone’s operating system — Pragati OS — has been developed jointly by Jio and Google and the phone has a Qualcomm processor. The broadband service, JioFiber, has over four million connected premises. The optical-fibre network is physically present outside 16 million premises, according to the company. An average home consumes almost 300GB of data per month, five hours a day, on the Jio set-top box. In 2020, Mukesh announced the First Day First Show offering — one movie a week through the JioFiber network.

The data-focussed business emerged as India’s largest telecom operator in February this year, thanks to the faster adoption of digital interfaces during the pandemic. Currently, Jio has 440 million customers. JPL reported a net profit of ₹12,537 crore in 2020-21, and an operating revenue of ₹73,503 crore. The contribution of telecom to JPL’s overall revenue/ Ebitda remained at 95-97% after the second-quarter result, according to Citi Research.

(INR CR)

In line with its consumer focus, the company’s grocery-to-jewellery retail business has also picked up pace in the last five years. Reliance Retail modelled on Walmart and Tesco and focussed on profitability at the store level. By increasing the store number, it strengthened the brand portfolio and enhanced the supply chain. Beginning with Hamleys in 2019, the retail giant continued its buying spree in 2020 as well and in 2021 with the acquisitions of Kannan, Netmeds, Urban Ladder, Zivame, Just Dial and Milk Basket.

In order to strengthen its fashion and lifestyle portfolio, Reliance Retail recently picked up sizeable stakes in brands, including Ritu Kumar and Manish Malhotra. It has also signed a master franchise agreement with Texas-based convenience stores chain 7-Eleven. The acquisition of Future Group companies, currently stuck in legal battles, is intended to enhance the company’s footprint across brands and categories, besides adding brick-and-mortar stores.

E-commerce venture JioMart is another significant move to counter the might of Amazon and Walmart-owned Flipkart. In May 2020, Reliance Retail launched JioMart in 200 cities across India. It is now present in 249 cities with 13,635 stores and 86 warehouses and fulfilment centres. Reliance Retail reported a net profit of ₹5,481 crore, higher by a marginal 0.6% year-on-year, on an operational revenue of ₹1.39 lakh crore in FY21.

Analysts at Goldman Sachs expect the company to continue gaining market share.

“We expect RIL’s core retail revenue to grow at a 36% compounded annual growth rate [CAGR] over the next four years to $43 billion,” says the financial services company. According to the report, e-commerce revenue is expected to touch 35% of the company’s total revenues at $15 billion in 2024-25. It projects 50% market share for RIL in online grocery by then, with 30% share in overall e-commerce.

In FY21, 50% of RIL’s consolidated earnings before interest, tax, depreci-ation and amortisation (Ebitda) came from the consumer business.

At RIL’s annual general meeting in 2019, Mukesh put forward the turnaround figures in an apparent response to sceptics who once had doubts about the success of the company’s consumer business.

Reengineering RIL

The consumer play ramp-up was part of RIL’s larger plan to de-risk the mainstay petroleum business. After the Paris Agreement on climate change (COP21), it became clear that there will be government interven-tions to reduce Greenhouse Gas (GHG) emission. The RIL management had foreseen the impact on the fossil fuel business, and initiated the transition from transportation fuel to chemical building blocks. The company plans to reduce fuel production and switch 70% of its output to chemicals. Though it’s cyclical, the chemical business enjoys a better margin than fuels.

Reliance invested around ₹1 lakh crore to expand its petrochemical capacity a couple of years ago and later announced a stake sale in oil-to-chemical business to Saudi Aramco. Meanwhile, Aramco Chairman Yasir Al-Rumayyan joined RIL’s board as an Independent Director. But the com-panies recently announced a re-evaluation of the deal, taking into account RIL’s foray into renewable energy.

Mukesh also announced a ₹75,000-crore plan for building 100 gigawatt (GW) of solar energy capacity in India by 2024. RIL plans to build four ‘Giga’ factories in Jamnagar to make solar photovoltaic cells, green hydrogen, batteries and fuel cells. With four back-to-back deals in October this year, the newly floated subsidiary — Reliance New Energy Solar Ltd. (RNESL) — has commenced its plan of action. It will acquire technologies initially before building ‘Giga’ factories in Jamnagar.

Norway-based REC Solar Holdings AS — acquired by RNESL for ₹5,782 crore — is known for its technological innovations, and superior, high efficiency and long-life solar cells and panels for clean and affordable solar power. The 25-year-old company has three manufacturing facilities — two in Norway for making solar-grade polysilicon and one in Singapore, for making PV cells and modules. RNESL will acquire a 40% stake for ₹2,850 crore in Sterling & Wilson Solar Ltd., one of the leading global engineering, procurement and construction (EPC) and operation and maintenance (O&M) companies in the renewables sector. It will also invest ₹337 crore in German firm NexWafe to get access to technologies for manufacturing solar wafers, and plans to build large-scale solar wafer manufacturing facilities as part of its ‘Giga’ factories.

In the fourth deal, RNESL signed a cooperation agreement with Denmark-based Stiesdal A/S for technology development, and manufacture of hydrogen electrolysers in India. One of its ‘Giga’ factories will manufacture hydrogen electrolysers as well. A $50-million investment has also been announced in US-based energy storage company Ambri.

“Reliance still needs the technology for fuel cell development, which we expect the company will acquire or license from one of the industry leaders such as Plug Power, Ballard, or Ceres,” according to analysts at Bernstein Research. The company is committed to becoming a large exporter of clean energy solutions.

Based on the company’s capital expenditure, Bernstein estimates that RIL is building a clean energy business worth $36 billion.

Mukesh is ambitious, and is setting new targets.