Lanco's season in the sun

Why the future looks bright for India’s leading power producer and trader’s solar venture.

SO WHY HAVE METHUMKURD AND CHAWARDHAL suddenly turned into hotspots? These two villages in Chhattisgarh’s Rajnandgaon district will soon be on the global energy map thanks to Lanco Solar, a subsidiary of the Rs 1,303 crore Lanco Infratech. The Gurgaon-based sand-to-power company, and India’s largest independent power producer, will set up the country’s first end-to-end solar photovoltaic manufacturing unit by 2012.

Think solar power in India and the desert regions of Rajasthan and Gujarat spring to mind. These areas do provide the maximum solar power generation potential, but that’s not what Lanco Solar was looking for. The special economic zone (SEZ) that it has set up in Chhattisgarh, spread over two villages, goes way beyond power generation.

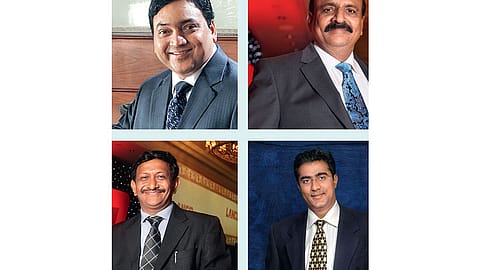

It will house factories that will manufacture all the equipment needed to generate solar power— from polysilicon ingots (sand is converted into a pure form of silicon), to wafers (thin slices cut from polysilicon ingots), to photovoltaic modules (a number of wafers joined together) that generate solar power. These factories don’t need the sun; they needed land and fiscal incentives, which the Chhattisgarh government provided. They also need plenty of power. “We were looking for a state that has, or will have, surplus power. We believe Chhattisgarh will have a power surplus in the next couple of years,” says G. Bhaskara Rao, executive vice chairman and one of the founder-promoters of 25-year-old Lanco Infratech.

Lanco estimates that by September 2012, the SEZ will have produced some 1,250 tonnes of polysilicon ingots and wafers, capable of producing 80 MW of solar power.

“The plan is to be able to meet 15% of the country’s solar manufacturing needs,” says V. Saibaba, Lanco Solar’s CEO and a veteran of the renewable energy sector, with years of experience in multinational organisations such as Suzlon Energy, General Electric, Vestas (India) and APV Pasilac. “Ultimately our aim is to produce equipment capable of generating 250 MW of power by the end of the second phase in 2014.”

Amit Kumar, director, energy-environment technology development division, New Delhi-based The Energy and Research Institute (TERI), believes there’s a large market for solar generation equipment. “If the targets set by the Jawaharlal Nehru National Solar Mission—1,000 MW of power by 2013 and 22,000 MW by 2022—were to be met, then 250 MW of solar equipment would be used in the domestic market. They would not to look for markets beyond Indian shores,” he says.

According to L. Madhusudhan Rao, executive chairman of Lanco Infratech, the country’s solar power generation capacity will touch 68,000 MW by 2021-22. That’s three times the government’s target. Arvind Mahajan, executive director and head, energy and natural resources of global consulting firm KPMG, also believes that the government’s estimates are conservative. He predicts that between 2017 and 2022, India alone will add 57,500 MW of solar power.

“Once solar power achieves grid parity (when the cost of solar power equals the cost of conventional power) by 2018-19, India will see a huge jump in rooftop photovoltaic solar panels in residential colonies. These may replace 30% of the diesel currently used for energy generation,” says Mahajan.

Ajay Mathur, director-general, Bureau of Energy Efficiency, says that as soon as the cost of solar power touches Rs 9 per kilowatt per hour, it will achieve grid parity with diesel and a shift to solar power is imminent. Saibaba expects solar tariff to dip to Rs 7 per kilowatt hour by 2014-15.

SUCH DEVELOPMENTS PRESENT immense opportunities for players here. According to a KPMG report titled The Rising Sun: A point of view on the solar energy sector in India, the total investments required only in projects or applications is estimated to be around $110 billion (Rs 4.9 lakh crore) between 2012 and 2022. For solar-specific products, the market could be as large as $30 billion.

Little wonder then, that Lanco Solar officials are confident that there’s enough demand for the equipment made in Chattisgarh. “Nearly 60% of the items manufactured at this SEZ will be used to meet our own demand because the requirement is so large. The rest will be used for our global projects,” says Rao.

(INR CR)

A Mumbai-based consultant says Lanco’s real threat will be from Chinese manufacturers, who have captured more than 70% of the global market, because of the low-cost advantage. However, TERI’s Kumar disagrees. The Indian government does not encourage imports of such equipment from China, so there’s no threat of an invasion, he says.

As the only Indian company present across the value chain—from making polysilicon to putting solar-powered electricity on the national grid—Lanco Solar is sitting pretty. It also helps that the parent company understands engineering and construction, adds Saibaba. “We also understand the transmission business, and also get the dynamics of the market because we are the largest power trader in India.”

There’s some truth in that. Lanco Solar’s only Indian competitor, New Delhi-based Moser Baer Solar (MBSL), a subsidiary of Moser Baer India, also provides end-to-end solutions. (Tata BP Solar, another big player, only manufactures solar power equipment.) Rajiv Arya, CEO, MBSL, says that his firm is ahead in the race, having already commissioned 6 MW of solar power from its 5 MW plant in Tamil Nadu’s Sivaganga district and 1 MW plant in Jamuria in West Bengal.

MBSL has also made forays into the U.S., European, and Japanese markets. “Last year, we made 18 to 19 small installations, ranging between 5 MW and 10 MW, in the commercial and residential rooftop market in the U.S.,” says Arya. “We are also looking at markets in Germany, Italy, and France.”

In the thin film silicon technology category, not only does MBSL manufacture everything, it also has the technology to connect the power to the grid. But the company lacks the necessary experience in generating thermal power, transmission and distribution, or trading.

SO WHAT GIVES LANCO SOLAR the edge? Kumar believes that fund-raising is a key differentiator. “Since solar technology is still developing globally, smaller firms may find it difficult to raise funds from banks and institutional investors,” he says Kumar. Lanco’s strong balance sheet will make it easy.

Moreover, the fact that it has been set up in an SEZ will give it additional benefits such as tax breaks and reduced cost of land. With services across the value chain, it can also reduce the margins it would have had to pay other service providers.

In the solar generation space, Lanco Solar has already commissioned a 5 MW plant in Gujarat. It will also be commissioning 35 MW of solar photovoltaic projects in Gujarat by the end of this year. The company has also received a letter of intent from the Maharashtra State Power Generation Company to build a 75 MW crystalline technology-based photovoltaic solar power project in Maharashtra’s Dhule district. The Rs 884.18 crore project is expected to be fully operational by February 2012.

Lanco has also signed power purchase agreements for 100 MW of solar thermal, and 5 MW of solar photovoltaic energy under the bidding process of phase 1 of the National Solar Mission in Rajasthan. Its rivals include the Titan Energy-Karnataka Power Corporation combine’s 3 MW plant in the Kolar district of Karnataka and Azure Power’s 2 MW plant in Punjab.

WITH THE GLOBAL SOLAR business expected to touch 210 GW by 2020 from 40 GW in 2010 (according to International Energy Agency estimates) there are opportunities in Germany, Spain, and the U.S. Unlike other solar manufacturers with global ambitions, Lanco Solar has not tied up with established players. For example, rival MBSL has a distribution partnership with the U.S.-based Munroe Distributing. Instead, Lanco is looking to increase the sales of its products in these countries.

“We are leveraging our core competence of strong in-house design and engineering, procurement and construction, and operation and maintenance credentials, to bid for complete projects abroad,” says Saibaba. “But that is not to say that the company will not undertake turnkey projects such as engineering procurement and construction (EPC) of solar farms or manufacturing units,” he adds.

The company’s global strategy of project development activities abroad was initiated through Lanco Solar’s London-based office and a diversified team of experts based in six European countries, the U.S., and Canada. Currently, two projects in the U.S. and one each in Italy and Spain are being installed, along with a development pipeline of 100 MW.

“We have a few large contracts—a 680 kw end-to-end project in Spain, a 1 MW project in Italy, and a 400 kw project in New Jersey,” says Saibaba. “Our focus is on countries such as France, Italy, Germany, the U.S., and Canada. We want to enter greenfield projects as well—all the way from land acquisition to construction work.”

Lanco Infratech celebrates its silver jubilee in 2011 and has announced grand plans to commission solar EPC projects of 500 MW per annum, 400 MW per annum of own development projects, and 250 MW per annum of manufacturing by 2014 in the solar space. If the flashy new logo and India’s 250 to 300 sunny days a year is any indication, the heat is on.