No material refinancing risk, near-term liquidity requirement: Adani Group

The Adani group's gross debt stood at ₹2.26 lakh crore ($27.7 billion) at the end of September 2022.

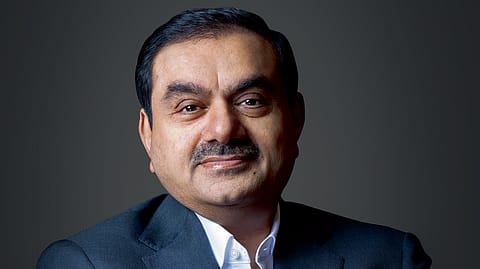

Gautam Adani-led Adani Group on Wednesday said its businesses are generating consistent cash flows and there is no material refinancing risk.

There is no near-term liquidity requirement as there is no significant debt maturity, the ports-to-energy conglomerate said in a credit note to calm jittery investors.

The Adani group's gross debt stood at ₹2.26 lakh crore ($27.7 billion) at the end of September 2022. Its cash balances increased to ₹31,646 crore in December from 29,754 crore in September.

"Adani portfolio companies operate in utility and infrastructure businesses with more than 81% of EBITDA being generated from core infrastructure businesses providing assured and consistent cash flow generation," the credit note said.

Adani portfolio companies have consistently delivered, with a strong cash-flow generation profile, underpinned by the long-term contractual framework for the projects, as well as a robust asset base, it added.

The Ahmedabad-based conglomerate said it has a "strong asset base which has been built over three decades that supports the resilient critical infrastructure and guarantees best-in-class asset performance over the entire life cycle." The group's portfolio of assets stood at ₹3.71 lakh crore ($45.2 billion) as of September 2022.

The statement comes three weeks after U.S. short seller Hindenburg Research accused the Adani group of "brazen stock manipulation" in order to artificially pump share prices of its listed companies. The conglomerate has lost $125 billion in market capitalisation since the release of the Hindenburg report on January 24.

Recommended Stories

Adani Enterprises, the group's flagship firm which acts as an incubator for the portfolio, on Tuesday posted a net profit of ₹820 crore for the third quarter against a loss of ₹12 crore in the year-ago period.

"Over the years, Adani Enterprises has focused on building emerging infrastructure businesses, contributing to nation-building and divesting them into separate listed entities. Having successfully built unicorns like Adani Ports & SEZ, Adani Transmission, Adani Power, Adani Green Energy, Adani Total Gas and Adani Wilmar, the company has contributed significantly to making India self-reliant with our portfolio of robust businesses. This has also led to robust returns to our shareholders at a CAGR of 38% over 25+ years," the credit note pointed out.

Adani Enterprises currently has a portfolio of 8 airports which aim to service 200 million customers. Its road subsidiary has a portfolio of 14 roads.

The board of Adani Enterprises abruptly called off its fully subscribed follow-on public offering (FPO) earlier this month in a bid to protect investors from any potential financial losses due to market volatility.

(INR CR)

However, according to Gautam Adani, the current market volatility is temporary. "Adani Enterprises will continue to work with the twin objectives of moderate leverage and looking at strategic opportunities to expand and grow," the Adani Group chairman said on Tuesday.