The Ellas of Bharat Biotech: The gift of the jab

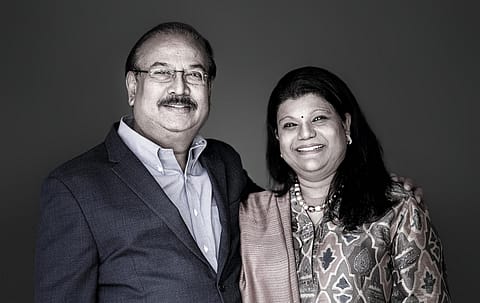

Bharat Biotech, founded by Krishna Ella and his wife Suchitra, has been at the forefront of making vaccines for a while. Yet it took a global pandemic for the spotlight to shine on the company.

[UPDATE: On April 29, Bharat Biotech revised the price of Covaxin to ₹400 per dose for state governments, recognising the enormous challenges to the healthcare system.]

It was September 2019. Dr. T. Jacob John had just finished giving a speech at Bharat Biotech International Limited (BBIL) in Hyderabad and was touring its manufacturing facility. It was then that John—a paediatrician and renowned virologist who set up the clinical virology department in Christian Medical College, Vellore, in the late ’60s—saw something that took him by surprise: a bio-safety level 3, or BSL-3, facility. Surprising because while BBIL was making 16 different vaccines, including six for viral diseases, none of them were so deadly as to require such a state-of-the-art safety facility.

Little did John or BBIL realise how prescient that would turn out to be.

Mere months later, BBIL, started by Krishna M. Ella and his wife Suchitra in 1996, was one of two Indian companies that plunged headlong into manufacturing a vaccine candidate for SARSCoV-2, the virus strain that causes Covid-19. The other was Serum Institute of India (SII), the world’s largest vaccine manufacturer. But there was one major difference. While SII would merely produce the Covishield vaccine being developed by the U.K.-based partnership of AstraZeneca and Oxford University, BBIL, true to its roots, would both develop and produce its candidate, Covaxin.

“I’ve not asked Krishna,” says John. “But knowing his personality, he must have thought to himself, ‘I’m an Indian, therefore what little I can do to help India I will do’.” He wasn’t far from the truth. “I believe that the ‘I’ in India should always stand for innovation. That’s the principle I work on,” says the 65-year-old Ella, chairman and managing director of BBIL.

And BBIL has stood by that principle for the past 25 years. It has more than 140 patents and has delivered more than 4 billion doses of vaccines worldwide. “If you take a look at their history, there was the H1N1 vaccine (in 2010), a vaccine for Japanese encephalitis (2014), and the Rotavirus vaccine (2015). This company has a long history of being concentrated on the research and development (R&D) side of biotechnology, which is a niche,” says Vishal Bali, executive chairman, Asia Healthcare Holdings. He cements his point by noting that Indian pharma companies traditionally spend just about 6% of their revenue on R&D. In India, known as the vaccine capital of the world, “here is a company that is led by R&D,” adds Bali.

BBIL has spent about $70 million so far on Covaxin, which is indigenously developed in collaboration with the Indian Council of Medical Research (ICMR). Ella was keen to partner with a government entity, and ICMR in particular, to get access to its “best asset”—the National Institute of Virology (NIV) in Pune. Not only was the SARS-CoV-2 strain sourced from NIV, but the institute also helped BBIL in animal trials. “This project is a demonstration of world-class Indian skill, Indian knowledge, and Indian technology,” says Suneeta Reddy, managing director, Apollo Hospitals Enterprise. “Beyond the immediate, for me, this is the perfect moment to seize and create R&D capability in India. We are a large nation, and we deserve world-class R&D focussed on understanding our own complex heterogeneous population.”

More Stories from this Issue

Perhaps that was why Ella, who has a Ph.D. in molecular biology, did things a bit differently. While some pharma majors developed adenovirus-based vaccines, like AstraZeneca’s Covishield and Russia’s Sputnik V, the likes of Pfizer and Moderna used the new, more modern mRNA platform. Ella, though, opted for a tried and tested technology, one he says has been around for “over 100 years.”

BBIL developed Covaxin using the wholevirion inactivated vero cell-platform technology in which the vaccine contains a dead virus protein that, while noninfectious, triggers the immune system to mount a defensive reaction. Such so-called inactivated virus vaccines also use an aluminium adjuvant—Alhydroxiquim-II in the case of Covaxin—to increase immune response. It’s the same technology used to make vaccines for diseases such as influenza, polio, Pertussis (whooping cough), rabies, and Japanese encephalitis. Or, “the ones we all get in our childhood vaccination schedule,” says Ameera Shah, promoter and managing director, Metropolis Healthcare. “Compared to a Covishield, or even mRNA vaccines, there are certain significant benefits to the Covaxin methodology,” she adds.

India's drug regulator gave both Covaxin and Covishield emergency use authorisation (EUA) in early January this year and, a few days later, kicked off the world’s largest inoculation drive. In April, India approved the Sputnik V vaccine and has said it will speed up approval for other foreign-made vaccines already granted EUA in other countries. That paves the way for possible imports of the Pfizer, J&J, Novavax, and Moderna vaccines amid a deadlier second wave of the pandemic that has ravaged India since March. More worryingly, many states have said they are running low on vaccine stocks. More than 100 million vaccine doses have been administered as of early April, but only to frontline and healthcare workers, those above 45, and those with comorbidities. Now, given the severity, everyone above the age of 18 years will be eligible for vaccination from May 1.

“Considering that a lot of the people who are getting infected now are of a younger age group, it is just unfortunate that we weren’t allowing vaccinations to people below 45 years,” says Shah, whose diagnostics chain has been at the forefront of Covid-19 testing. “Part of it is because of supply issues.” And that may be the issue for some time to come as production capacities build up, even as the central government has earmarked ₹1,500 crore for BBIL, and ₹3,000 crore for SII.

(INR CR)

SII has the capacity to manufacture about 70 million to 100 million doses of Covishield each month, according to the government’s Department of Biotechnology. But BBIL can manufacture only about 12.5 million Covaxin doses per month. It will ramp up its production capacity to 700 million doses annually, but Ella says there are inherent issues in mass-producing such an indigenous vaccine. “In terms of complexity, it’s 100 times more than the adenovirus platform [of Covishield],” says Ella. It’s a topic of heated discussion even between him and his wife Suchitra, who is the joint managing director of BBIL. “She asks why we are lagging behind. I say, ‘I would love to produce more, but it’s not an easy technology’.”

The couple is part of a long list of family-led companies in India’s pharma industry. But it wasn’t a joint decision to start BBIL. After 12 years in the U.S., it was Suchitra, an economics graduate, who had to convince Krishna to return home to start BBIL. Krishna handled the scientific and technological aspects, while Suchitra worked to get the company off the ground with a capital of ₹12.5 crore—from scouring land, writing letters to the governments, and even getting utility connections. Not only their talents but their personalities are also very different. While Suchitra can take days to make a decision, Krishna requires seconds.

But it takes more than seconds to decide on a vaccine’s safety-versus-efficacy debate. Efficacy, says John, is a rain cheque-promise as the World Health Organization has set a 50% pass mark. “I give more importance to safety and take whatever efficacy is coming as a promise,” he says. While Ella is understandably reticent to talk about the competition, the Oxford-AstraZeneca vaccine has had its share of challenges.

The vaccine has been plagued with safety issues, with many countries, especially in the European Union, having found rare cases of blood clots in adults who had been vaccinated. As a result, Australia has suspended the use of the vaccine for people under the age of 50, while South Korea and the Philippines have suspended its use to those under 60. Denmark has taken a stand to ban the vaccine outright, while other countries are weighing up the risk benefits. BBIL, meanwhile, is also facing issues relating to its exports to Brazil.

The efficacy of the two made-in-India vaccines are comparable—Covaxin has a 78% efficacy rate, while Covishield’s is 70% to 90%. Yet, notwithstanding the concerns in other countries, Covishield accounts for roughly 90% of the doses administered in India so far. One likely reason that Covaxin is lagging is the criticism BBIL copped over the lack of clinical data when India approved the vaccine for emergency use.

BBIL completed its phase 1 and phase 2 trials between July and September last year. “Safety was proven, immunogenicity (the ability to produce an immune response) was also proven,” recalls Suchitra. The phase 3 trials—often the last round of tests before a drug is approved or rejected—started in November and the results were yet to be publicly released when Covaxin was approved for emergency use in January. On the other hand, the U.K. authorities approved Covishield (known as Vaxzevria in the U.K.) based on interim phase 3 trial data AstraZeneca had submitted.

The nod for Covaxin did not sit well with many. The All India Drug Action Network, at the time, said it was “baffled” to see a vaccine approved, even under an accelerated process, without any efficacy data. But Suchitra counters that regulators were well aware of the trial data when they made their decision. “By early January, we had administered [Covaxin] to more than 20,000, or 85%, phase 3 volunteers, and the adverse events were negligible,” she says. “Nothing that we did was not known to the regulator.”

The Ellas have their supporters, especially in the “medical innovators” fraternity, which has learnt to handle criticism the hard way. “We have all learnt to take the naysayers with a pinch of salt,” says Vijay Chandru, cofounder of bioinformatics and genomic profiling company Strand. “Yes, it does deflate enthusiasm for a bit, but the confidence in doing good science keeps us going,” adds Chandru, who has known Ella for several years and considers BBIL one of the “jewels in the crown” of India’s biotech industry As it was, all doubts about Covaxin’s safety were finally laid to rest in March. The phase 3 trial data, released on March 3, showed Covaxin had an 81% efficacy rate. (A second interim result released on April 21 said the rate was at 78%, while it was 100% against severe Covid-19 disease.) But perhaps the bigger confidence booster-dose came on March 1, when Prime Minister Narendra Modi was inoculated with Covaxin. That surprised even Ella, who was sure Modi would take Covishield “as it’s a proven vaccine according to the media”. However, more than vindicated, Ella felt “honoured for Indian innovation”.

BBIL isn’t done with testing Covaxin. While most vaccines have a single- or two-dose schedule, inactivated virus vaccines like Covaxin need three. BBIL has been cleared to test the third, or the booster, dose. But while injectable vaccines only reduce the severity of infections, nasal-based ones actually prevent infections, says Ella. BBIL is developing a nasal-based Covid-19 vaccine that will be “100 times better than the injectable one,” he says, declining to share further details.

For now, the injectable vaccine itself is certainly an important landmark in the evolution of Indian biopharma, already at the forefront of the fight against tuberculosis, HIV, malaria, and polio. “This is yet another milestone in the country’s long list that has given us the reputation of being ‘the pharmacy of the world’,” says Vinita Gupta, CEO of Lupin, one of India’s top pharmaceutical companies. But Ella thinks the attention for BBIL is long overdue, or rather, misplaced. “Honestly, we should have got more recognition for our typhoid conjugate vaccine. It’s the first such vaccine in the world; no multinational has developed that vaccine. Since we are in a pandemic, Covaxin gets the attention,” he says.

BBIL's typhoid vaccine, Typbar TCV, is considered an important milestone in eradicating typhoid given its efficacy rate of 82%, higher than other typhoid vaccines. Typbar TCV is also a big revenue earner for BBIL, with sales in excess of ₹100 crore. BBIL’s biggest earner, however, is the Rotavirus vaccine, which rakes in revenue of about ₹200 crore annually.

Still, there’s no denying Covaxin will be BBIL’s single largest product in the next two years. Suchitra hesitates to talk numbers yet since they will depend on domestic procurement prices. Though manufacturers wanted to charge about ₹500 to ₹600 a dose, the central government procures all vaccines for ₹150 a dose. From May 1 though, the government said it will buy only 50% and manufacturers can sell the rest to state governments and private hospitals, at much higher prices. “Internationally, the price realisation is better [$15-$20 per dose],” says Suchitra. No surprise then that BBIL signed a deal with Pennsylvaniabased Ocugen to manufacture the vaccine for use in the U.S.

As the Covid-19 pandemic rages on, Covaxin and its subsequent nasal variant will continue to hog the limelight among all of BBIL’s vaccines, around 70% of which are for children. And adults? “Adults are the worst people for vaccination,” Ella quips. “After taking the vaccine they will start thinking every 10 minutes what’s happening in the reaction.” That’s something even a BSL-3 facility can’t protect Ella against.

(The story originally appeared in Fortune India's May 2021 issue).