Urban Ladder eyes a profit this quarter

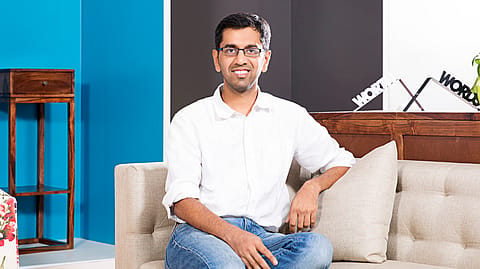

The furniture retailer’s CEO and co-founder Ashish Goel says the company’s decision to cut overheads and lay off some employees will see it turn a profit before tax in the April-June quarter.

Urban Ladder, which laid off around 90 employees in February this year, says it took some tough decisions last year to rationalise its costs, which will help the online furniture retailer turn a profit before tax in the April-June quarter.

The Bengaluru-headquartered company, which has opened 11 brick-and-mortar stores in a year since its decision to foray into offline retail, is also hinging on its omni-channel strategy to reach its goal of 15% market share in the overall furniture market in India and is focussed on expansion. The seven-year-old company also says that it has been recording 40% growth every year and its losses have come down by 40-50% year-on-year.

In an interview with Fortune India, Ashish Goel, CEO and co-founder, Urban Ladder, talks about his plans to scale up the business, post-IKEA market sentiment and recent layoffs in the company.

Has anything changed for Urban Ladder after IKEA’s launch in India in August last year?

IKEA is of course a fantastic brand, but as far as our own business data and what we’re hearing from customers is concerned, the impact on our business in Hyderabad has been negligible. There was a lot of apprehension before IKEA’s launch that we’ll get washed out in the tsunami. Good thing is that our numbers have stayed strong in Hyderabad. We’re also hearing that they [IKEA] are doing very well in the smaller products or what we call the general merchandise category—like cups, saucers, table cloths, small décor products etc. There’s also a reasonable market and, wholesaling and re-selling that happens around IKEA products. My understanding is that that’s a reasonable part of their overall offering. What we operate in, which is core furniture for a certain aspirational customer, I don’t think IKEA has created that much of a dent in the market. There has been marginal impact—around 5-7% [on market share]; for the largest brand in the world to launch in six months in India, it is not a big deal. All the hard work we have done for the last few years preparing for what happens when IKEA comes in has by and large paid off.

About 25% of Urban Ladder’s business comes from offline stores. How do you plan to scale it up?

We have our omni-channel model in place. We want to expand in the top 10 markets first. Next, we have a new range called Urban Ladder basics. It’s a range of almost 120 products which is at a price point which is more affordable for the budget customer. This year you’ll see us expanding and localising. Our core Urban Ladder customer, we have a 35-40% market share there. That’s our sweet spot. The reason for us to do retail is called segment B—people who are browsing online but something is coming in the way of them making the leap into the purchase. Let's think about the characteristic of this customer: this person is tech-savvy, knows Urban Ladder, a lot of times has done some thinking but they are not converting into buyers. C-segment people who are not browsing, not buying—that’s an entirely new market for us. We’re not focussing on that at all right now. We have enough work for our core audience for the next two years.

Recommended Stories

Last year, you had said you will open 20 stores by March-end. You missed that target.

We’re at 11 which is not good. Some things you learn the hard way. Real estate is a very important aspect of a furniture business. This has been a very big learning for us. Now we have set the model with 11 stores, so, we’re starting to experiment with franchisee stores, with our first one in Chennai is coming up soon. It might be a three-four months delay but whenever we’ll do it, we’ll do it well. Over the last one year, we have done a lot of things with which now in May and June, where we’ll be profitable at a full company level for the first time—profit before tax all inclusive. We have tightened a lot of fixed overheads, supply chain has become a lot more efficient, lots of hard decisions also we had to take. Now onwards whatever we generate has nothing to do with sustaining the organisation. Till now it was funding losses. Now on, our only focus is expansion.

You had to lay off around 90 employees recently. What was the reason?

We have always been a very high quality team, and a team of very committed members. Every team member who has transitioned out, it’s been very painful for us. The good thing is that as an organisation, we have been very strong on setting good processes even as a young company. In last couple of months when we had to do the layoffs, we needed to. There was no option. It was the right answer for the organisation to become profitable. We had set a goal and it was the right way. We had to take tough calls. It’s painful when it’s about good people who have trusted in you. We’re a very emotional organisation in that sense. It wouldn’t have been painful if we didn’t care.

(INR CR)

What happens when your competition, which includes traditional players like @home and newer ones like Pepperfry, also have stores in the same catchment area as yours?

There’s no barrier in that. We like that people are present around us. You give us a location where @home is there, Home Centre is there, Godrej Interio etc. is there and there’s a space which we can get, we’ll be thrilled to take that space because we know our product and services are better. And the core value proposition for the customer is better. For example, in our Kirti Nagar store (in Delhi)—where everybody is present—is probably the highest revenue grossing store in the market.