‘We are in a market that is on steroids’

From being the exclusive privilege of a few, American Express wants to reposition itself in India as a credit card for the aspiring affluent and tap into the country’s growing consumerism.

Ever since it forayed into the Indian market in 1993, U.S. banking major American Express (Amex) has been known as the banker for the crème de la crème of the country—moneyed industrialists or professionals at the top of the corporate ladder. Its credit card was much sought after: many wanted it, but only a few were picked, that too, by invitation from the bank or existing cardholders, apart from high parameters for eligibility.

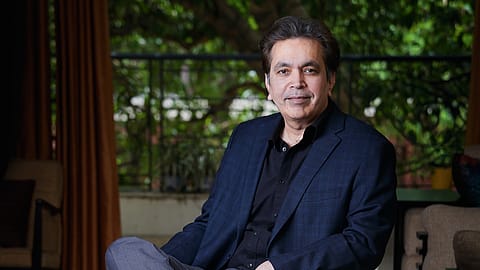

Not anymore. Amex in India, like in other parts of the world, is seeking to broaden its scale, reach and relevance, says Manoj Adlakha, 53, CEO of American Express Banking Corp. in India, in an interview with Fortune India.

Amex wants to be part of the young, aspirational professional’s spending habits and remain with them even after they become successful and wealthy in their later years, Adlakha says.

The bank is coming out with different products, expanding its merchant base, and rewards catalogue, and even tying up with other banks to offer its credit cards to a wide cross-section of the upper middle-class in the country. And the growth in non cash transactions since demonetisation is helping its cause. Edited excerpts:

Of late, we have seen Amex aggressively marketing its products in India through television and outdoor ad campaigns as well as on-the-ground activities. What is the objective?

We want to broaden our scale, reach, and relevance in India. We are adding on hundreds of thousands of new customers who we call members. And when you do that, you need to give them outlets or vantage points where they can use their card. In 2017, we added 180,000 new merchants in India. And in 2018, we met a similar target. What we have achieved in the past three years is five times what we did in the past three decades.

We want to cater to the affluent and aspiring affluent segments in India. And own the premium space with our brand proposition. At this point, 60% of the new customers coming to the Amex franchise for the first time are below 30 years of age. For the fourth year running, we have been adjudged as the most trusted credit card brand in India. Forrester’s Customer Experience Index [which measures and ranks brands according to customer experience] has also ranked Amex as the best credit card in India. We have seven different products on the consumer card side for whatever different requirements that customers may have. For us, a premium customer is anyone who earns over $25,000 a year and what we have seen in India is that this base is rising. These affluent customers are looking at Amex to provide them with privileges, access, experience, and service.

Recommended Stories

With several credit card products—even high end ones—on offer in India how easy/difficult is it for Amex to compete with the private and international banks that have a good foothold in the market? Is there enough room for growth?

In a market like India, cash is still king. In 2017, about 60% of India’s $2.5-trillion gross domestic product was on account of private consumption, which works out to around $1.5 trillion; of this only 10% of the transactions take place through credit cards, debit cards or mobile wallets. So digital payments as a space, including credit cards, is underpenetrated. So there is enough headroom for all of us to play with. The growth in transactions [in terms of billings] using credit cards is around 30% year-on-year and Amex’s growth is in line with that. We are in a market that is on steroids when it comes to the payments industry in India.

Our unique selling point is our service, brand, and experience. There is a premium attached to that. For example, if you are travelling abroad and misplace your card, we can have a free replacement card delivered to you in 24-48 hours. This is just a small example but it goes a long way in building customer loyalty.

We have very healthy growth rates in terms of billings and we are really moving the needle when it comes to adding merchants. We have also tied up with other partner banks like State Bank of India (SBI) and ICICI Bank who offer Amex cards to their customers.

(INR CR)

By offering credit cards to young and aspirational customers, isn’t Amex diluting its brand positioning as a product reserved exclusively for the elite?

I do not believe that. Scale and relevance is mission-critical for us. If you look at the minimum income threshold that we look at while issuing a new card at an entry level, it is 50% higher than that for our competitors. Our new customers may well be the millionaires of tomorrow and do we not want to play in that segment? I think we would miss a trick if we didn’t.

Has the corporate credit card business reached a stage of maturity for you or is there room to grow as well?

The commercial side of the business has really taken off over the past 7-10 years. What sets us apart is that we have a closed-loop network and can give a clear line of sight to a company’s CFO [chief financial officer] when it comes to expense management and help organisations in optimising processes and costs. We have a 60% share in the commercial credit cards market in India; globally we have relationships with 60% of the Fortune 500 companies.

How does Amex intend to engage with the digital ecosystem in India? Are there any plans to branch out into new financial products?

One of the companies in India in which we have made a strategic investment is digital payments firm MobiKwik. When we make such an investment we look at the potential of the business and the adjacent needs of our customers that can be fulfilled through such investments. We have ongoing discussions with fintech players and if any of them help in meeting the needs of our customers we are open to partnering with them.

(This story appeared in the March issue of the magazine.)