A dose of cautious optimism from the Reserve Bank

Governor Shaktikanta Das’ latest policy statement sees FY21 growth contracting by 9.5%, but also talks about the possibility of India renewing the “tryst with its pre-Covid growth trajectory”.

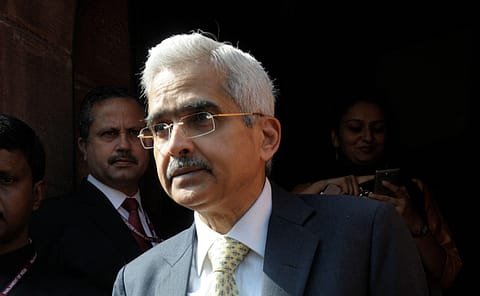

By his own admission, Reserve Bank of India (RBI) governor Shaktikanta Das is an optimist. But when he announced his much-awaited monetary policy statement on Friday, Das did temper that optimism with a degree of caution.

RBI’s cautious approach was manifested in its holding of key rates, with the central bank keeping the benchmark repo rate—the rate at which it lends short-term funds to banks—unchanged, keeping a watch on rising inflation numbers. Most analysts had anyway been betting on a pause from RBI for now, but with inflation expected to ease in the second half of the fiscal, some have said there could be scope for one more rate cut around February. Be that as it may, for now it’s a pause on rates from the central bank.

RBI’s October policy statement, which came just after three new external faces were appointed on its six-member Monetary Policy Committee (MPC), also put out a grim growth estimate—a contraction of 9.5%—for 2020-21. The optimist in Shaktikanta Das, however, came through despite this bleak growth forecast.

“I have always dared to be an optimist, believing firmly in the ability of humankind to overcome the pandemic. In the months gone by, when Covid-19 raged in fury across the world, our hopefulness might have appeared impudent, like a flame flickering amidst a gathering storm. Today, there is a turn in the wind, which suggests that it is not imprudent to dream of a brighter tomorrow even in the bleakest of times,” Das emphasised in his policy statement.

Underscoring his view, he said several high-frequency indicators are pointing to the easing of contractions across sectors and “the emergence of impulses of growth”. The governor’s cautious optimism was also matched by a dovish stance in general, with the MPC deciding to continue with its earlier accommodative stance as long as necessary to revive growth, and mitigate the impact of Covid-19 on the economy while ensuring inflation remains within target. However, while all other MPC members voted in favour of continuing with this stance at least during the current financial year and into the next fiscal, new MPC external member Jayanth R. Varma was the only one to vote against this.

“By all indications, the deep contractions of Q1:2020-21 are behind us; silver linings are visible in the flattening of the active caseload curve across the country. Barring the incidence of a second wave, India stands poised to shrug off the deathly grip of the virus and renew its tryst with its pre-Covid growth trajectory,” Governor Das said in his post-policy statement. With this view, and the continuing accommodative stance, economists will be of the opinion that another rate cut is likely sometime in early 2021.

In RBI’s view, the modest recovery in various high-frequency indicators in September 2020 could strengthen further in the second half of 2020-21 with progressive unlocking of economic activity. Agriculture and allied activities could also lead the revival by boosting rural demand. Manufacturing firms expect capacity utilisation to recover in the third quarter of 2020-21 and activity to gain some traction from Q3 onwards, RBI has pointed out. However, it added that both private investment and exports are likely to be subdued, especially as external demand is still “anaemic”.

More Stories from this Issue

“For the year 2020-21 as a whole, therefore, real GDP is expected to decline by 9.5%, with risks tilted to the downside. If, however, the current momentum of upturn gains ground, a faster and stronger rebound is eminently feasible,“ Das added.

Easing inflation and a big signal

A key element to note in the statement is the outlook on inflation, in line with the position several economists have been taking before the policy announcement. RBI’s assessment is that inflation will remain elevated in the September print, but gradually ease and move towards the target in the third and fourth quarter of 2020-21. The central bank's assessment has shown that supply chain disruptions and consequent mark-ups have been critical elements in stoking inflation and as supply chains are restored, prices will gradually begin easing. Crude prices are also expected to remain range-bound.

Against this background, the statement delivers what will be seen as a major sign that RBI is leaving room to cut rates at least once more before this fiscal ends. In Das' words: “The MPC has hence decided to look through the current inflation hump as transient and address the more urgent need to revive growth and mitigate the impact of Covid-19. This has provided the space for continuing with the accommodative stance with forward guidance as set out in the MPC’s resolution.”

(INR CR)

Pause on rates, but liquidity push continues

As expected, with rates on pause, RBI did turn aggressively to other measures to continue on its path of boosting liquidity and ensuring there is no shortage of funds for growth.

Keeping an eye on sectors which have a multiplier effect and both forward and backward linkages, the central bank has now allowed on-tap targeted long-term repo operations (TLTRO) to the extent of ₹1 lakh crore, with tenor of up to three to five years, and a floating rate linked to the repo rate. The liquidity availed by the banks under this facility will have to be deployed in corporate bonds, commercial papers, and nonconvertible debentures issued by entities in specific sectors over and above the outstanding level of their investments in such instruments as on September 30, 2020.

Besides the fresh TLTRO facility, RBI will also conduct outright and special open market operations (OMO) to infuse liquidity into the system and the size of these auctions will be raised to ₹20,000 crore. It will also conduct OMOs in state development loans (SDLs) to further impart liquidity in that market and facilitate efficient pricing.

Das has also pointed out that financial stability and the orderly development of the yield curve is a shared responsibility of the RBI and the market participants. The augmented borrowing programme for 2020-21, he explained, has been necessitated due to the exigencies imposed by the pandemic in the form of the fiscal stimulus and the loss of tax revenue. “While this has imposed pressures on the market in the form of expanded supply of paper, the RBI stands ready to conduct market operations as required through a variety of instruments to assuage these pressures, dispel any illiquidity in financial markets and maintain orderly market conditions,” he said, adding that market participants, on their part, need to take a broader time perspective and display bidding behaviour that “reflects a sensitivity to the signals from the RBI in the conduct of monetary policy and debt management”. Enough signal, that, from a central bank.

The latest policy pronouncements from RBI and governor Das are, by all accounts, indicative of current realities. Vigilant on inflation, keen to push growth and revive a pandemic-hit economy, the RBI has attempted to strike a careful balance between its task of inflation management and the responsibility as the country’s central bank of standing as a pillar of support for the economy. All along, it has depended upon data and the signals emanating from the key sectors of the economy. It is now up to the various economic participants to make the fullest use of the framework set out in the October policy.