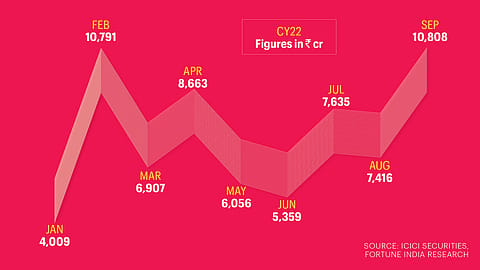

ETF Flows Set to Cross $10 Billion in CY22

The clamour for passive fund schemes — exchange-traded funds — is on the rise in India. Assets under management for ETFs have grown from around ₹5,400 cr as of 2014 to around ₹4 lakh cr currently.

WITH ACTIVE fund managers increasingly finding it tough to outperform their respective category indices, the clamour for passive fund schemes, exchange traded funds (ETFs), is on the rise in India. The assets under management for ETFs have grown from around ₹5,400 crore as of 2014 to around ₹4 lakh crore currently. While EPFO flows are fuelling the growth of ETF, individual investors, too, are warming up to these funds. In fact, in the nine months of CY22, ETF flows have touched ₹67,644 crore ($8.17 billion), clocking an average of ₹7,516 crore a month. Assuming the average flow will continue for the remaining three months, the year would end with total flows of over ₹90,000 crore ($10.87 billion).