Sugar: On The Boil

The All India Sugar Trade Association has trimmed production estimates by 3% for the crop year spanning October 2022 to September 2023.

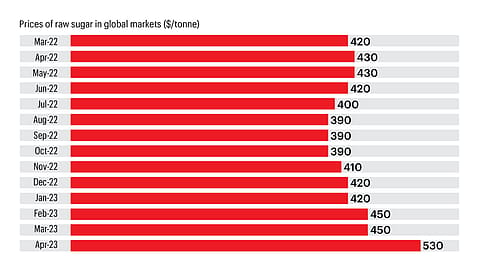

GLOBAL RAW SUGAR futures recently hit an 11-year high even as domestic prices have been trending higher on lower output concerns over fears of a prolonged El Nino effect. The All India Sugar Trade Association has trimmed production estimates by 3% for the crop year spanning October 2022 to September 2023. While 65% of sugar produced is consumed for industrial uses, rising sugar prices could result in higher inflation given food products' weightage of 24.38% in the WPI. If sugar prices stay elevated, FMCG players' margins could also come under pressure over the next couple of quarters.

Tea: A Brewing Storm

TEA PRICES at the world's tea auction houses, driven to recent highs during the pandemic, are now stagnant. The Economist Intelligence Unit predicts that the average price of auctioned tea will decline by 4.5% to $2.90 in 2023 and stay low in 2024. That's bad news as Indian tea exports have averaged around $3.50 in the current season (April-October 23). A further decline in prices will compound the woes — poor demand and labour strife — at India's largest tea-producing region in West Bengal and North-East.

RBD Palmolein: Rising, But Slowly

RISING GLOBAL BIODIESEL production and the El Nino effect have kept palmolein prices on the boil. Indonesia, the world's biggest producer of palm oil, has raised the mandatory blend of palm oil in biodiesel to 35% from 30% earlier. Prices are expected to trade between 4,000 and 5,000 ringgit ($1,106) per tonne from now until August, which will keep margins of Indian FMCG (food) players under pressure.