RIL sails in a sulking market

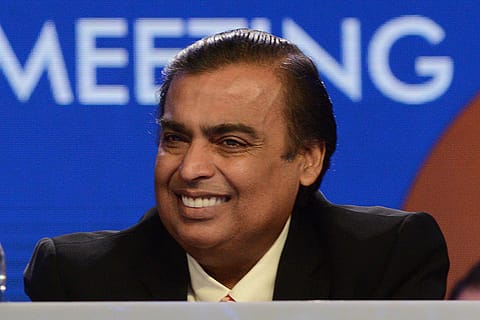

The Mukesh Ambani-led firm gains 9.72% a day after its AGM, while the benchmark Sensex plunges nearly 700 points

A day after its 42nd Annual General Meeting (AGM), shares of Reliance Industries (RIL) gained 9.72% to close at Rs 1,275, while the benchmark S&P BSE Sensex on Tuesday tanked 624 points, or 1.7%, to end at 36,958. The performance of the S&P BSE MidCap and SmallCap indices was no different as they closed lower by 307 points (2.25%) and 180 points (1.42%), respectively.

Analysts attributed the big fall in the first trading day of the week to negative global factors. “Indian markets have been tagging-along global markets in palpable risk-off sentiment due to multiple challenges of intensification of the U.S.-China trade war, sell-off in Argentina and Hong Kong markets,” says Jagannadham Thunuguntla, senior vice president and head of research (wealth) at Mumbai-based Centrum Broking. The market was closed on Monday on account of Bakri Id holiday.

Only three stocks in the 30-share Sensex closed the day in the green. Power Grid Corporation, Sun Pharmaceuticals, and RIL contributed 0.23, 16.58, and 358.13 points, respectively to the index. The later had an eventful AGM on August 12, where chairman Mukesh Ambani, India’s richest man, made numerous announcements which resulted in 4.08 times spurt in RIL’s trading volume on the BSE on August 13.

“Despite the best-day-in-a-decade performance by the Reliance stock on the back of pro-investor statements in its AGM, it couldn’t save the day for the Indian market,” says Thunuguntla.

Among the key AGM announcements, RIL and Saudi Aramco agreed to a non-binding letter of intent regarding a proposed investment in RIL’s oil to chemicals (O2C) division, comprising the refining, petrochemicals and fuels marketing businesses. “Saudi Aramco’s potential 20% stake is based upon an enterprise value of $75 billion for the O2C division,” said a RIL release. “This would be one of the largest foreign investments ever made in India.”

Sabri Hazarika, oil and gas analyst at Mumbai-based Emkay Global Financial Services, who values the O2C division at $67 billion, says the premium valuation by Aramco implies its strategic intent to gain a long-term foothold in the lucrative Indian market through the consistently most profitable refiner. “For RIL, a secured supply source in a volatile oil market is positive strategically,” Hazarika said in his note.

Aramco will supply 0.5mb/d (million barrels per day) of crude on a long-term basis to RIL’s Jamnagar refinery. While Emkay has a ’hold’ rating on RIL, the 12-month target price of ‘Rs 1,375 a share offers an upside of 18.4% on the August 9 closing price of ‘Rs 1,161. “The Aramco deal implies ‘100/share upside,” highlights Hazarika.

Recommended Stories

At the AGM, Ambani talked about the listing of its retail and telecom business, which, in addition to the proposed Saudi Aramco deal, will help RIL to be a net debt-free company by March 2021. Ambani said he expects the deal close by March 2020.

Initially, Aramco’s ownership, Hazarika believes, could be through instruments like OCPS (optionally convertible preference shares), allowing RIL to retain equity control in the business, including its cash flows for funding other businesses. “In five years, after Jio/retail listing and KG-D6 capex, cash requirement from O2C should subside,” notes Hazarika. “Aramco will have a seat on the board and the subsidiary may also be listed.”

According to ball-park estimates by Anil Sharma and Aditya Bansal, analysts with Nomura Financial Advisory and Securities (India), an assumed $15 billion payout from Aramco to RIL standalone and 20% of petchem/refining Ebitda being attributable to Aramco, the transaction could be value dilutive by about 6% for RIL’s FY21 standalone EPS. “But, in our view, this transaction will allay investor concerns on Reliance’s high debt levels,” Sharma and Bansal noted.

Both are of the view that the completion of the Aramco transaction will reduce RIL’s net debt by nearly $15 billion from close to $22 billion at the end of FY19, and will pave the way for RIL’s target of being zero net-debt by FY21.

(INR CR)

Also, following the transaction, Aramco’s crude supplies on a long-term basis to RIL could increase up to 500 kbpd (thousand barrels per day) compared to the current 250-260 kbpd. They say the deal should benefit both the parties. The transaction will also provide RIL with access to technology for its chemical business. “Both RIL and Aramco would also look for further investment in value-added chemical,” the duo adds.

Counting upon the RIL–Saudi Aramco deal announcement as RIL’s fourth divestment announcement for the year, Jal Irani and Vijayant Gupta, analysts with Edelweiss Securities, in an August 13 report, noted about RIL’s similar divestment/split spree in 2006 and the share price had jumped 38% thereafter.

The Aramco announcement follows the sale of RIL’s very large ethane carriers (VLEC) to Mitsui O.S.K Lines, announced in April, demerger of tower/fiber assets to Brookfield Asset Management in mid-July, and stake sale to BP for retail service station network and aviation fuels business. “Notably, all the divestments have been monetised at premium valuations with reputed strategic buyers,” note Irani and Gupta, who have a ’buy’ rating on RIL with a 12-month target price of Rs 1,655 a share—a potential upside of 42.4% on the August 9 closing price of Rs 1,162.

The Saudi Aramco deal apart, RIL has spelt out its plans for Jio Fiber, which has some interesting benefits for subscribers, which in turn will benefit its shareholders. But the broader equity markets continue to be in limbo. “Sell-off is all pervasive across the sectors fuelled by less-than-inspiring Indian corporate results and weakening rupee,” says Centrum Broking’s Thunuguntla.

Clearly, market participants are now waiting for pro-market measures by the Indian government after their consultations with various stakeholders in the week gone by. It seems that the sulking feeling is here to stay for a little longer.