The upside of down

The rupee is handing the economy lemons, but some Indian companies are making lemonade.

There may be clear winners and losers in the short term. But business models are sure to change if the rupee ruination continues for long.

Many companies have also raised capital in the form of foreign currency convertible bonds or external commercial borrowings in the last few years. For example, Tata Motors, India’s leading exporter of automobiles, will not only gain on the revenue side but also strengthen its grip on the Indian market as foreign competitors struggle. However, its balance sheet is weighed down by nearly Rs 2,500 crore of foreign debt.

However, some experts are sceptical of the potential gains. “Ideally, the fall of the rupee should help, but India’s manufacturing footprint is too soft to take advantage of it. With no semiconductor industry in India, consumer electronics manufacturing is out of bounds. Even in other consumer segments, policies such as small scale reservations have precluded corporate investment,” says Arvind Singhal, chairman of Technopak Advisors, a retail consultant. He’s still not advising his retail clients to tweak their sourcing to favour domestic vendors.

This is true for firms in sectors such as capital goods, consumer durables, and tyres, where the Chinese provide tough competition. For instance, Bharat Heavy Electricals, India’s largest manufacturer of power generation equipment, now has to worry less about the Chinese threat. Similarly, Havells, which has plans to start manufacturing pedestal fans in India, expects good demand as imported fans from China become costlier.

It also opens up new opportunities for domestic manufacturers with strong balance sheets and little or no foreign debt. Their ‘made in India’ products will now be more competitive compared with more expensive Chinese imports, which could mean a bigger bite of the domestic market.

Imports may have become costlier, but the currency could set off a chain reaction that could rectify the imbalance. The gains for traditionally export-intensive sectors such as IT, pharmaceuticals, textiles, and gems and jewellery are apparent as they will now earn more rupees for every dollar worth of export.

But even as it means more bad news for Indian investors and businessmen battling the decelerating economic growth, high inflation, higher interest rates, and rising trade and fiscal deficits, a few companies are looking to cash in.

“The rupee’s fall is not cyclical but a result of the underlying macroeconomic imbalance. It may depreciate further in the coming weeks and may even cross Rs 60 to a dollar,” says Dhananjay Sinha, co-head of institutional research, economist, and strategist, Emkay Global Financial Services.

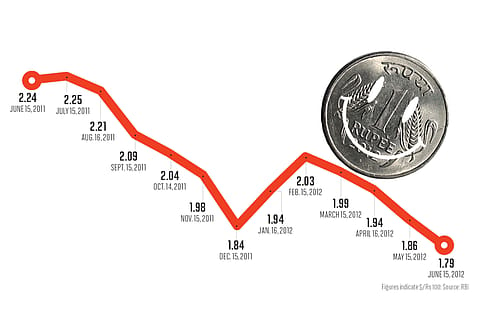

THE RUPEE HAS GONE downhill since the middle of last year and has cumulatively lost over a quarter of its value.