Oil India’s New Profit Engine

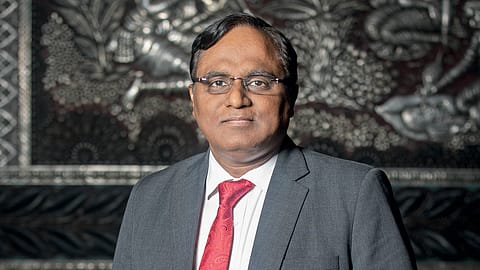

Ranjit Rath takes to new techniques to monetise discoveries, upgrades infrastructure, boosting the market cap of the Maharatna CPSE.

This story belongs to the Fortune India Magazine October 2024 issue.

OIL INDIA has had an unforgettable FY24. The country’s second-largest state-owned oil and gas producer received the ‘Maharatna’ status in August 2023, making it the youngest and the 13th Maharatna Central Public Sector Enterprises (CPSE). The upgraded status will help the six-decade-old company take financial decisions on large investments on its own.

Led by Ranjit Rath, a man with over 27 years in geosciences, who took charge on August 2, 2022, the PSU achieved the highest-ever oil & oil equivalent of gas (O+OEG) as well as natural gas production last fiscal, thanks to the adoption and use of new techniques to arrest decline from old fields, monetisation and quick development of new discoveries, production optimisation, and upgradation of surface facilities & infrastructure. It also led to Oil India’s highest-ever drilling — a total of 61 wells in FY24, including 17 exploratory and 44 development wells.

In terms of stock performance, Oil India turned a multibagger in 2024 and consistently outperformed the sector as well as benchmark indices, something that’s rare in the energy space which has a track record of underperforming more often than not. The oil and gas heavyweight has delivered 210% returns to its shareholders in the last one year and 135% on a year-to-date (YTD) basis (as of September 18), with market capitalisation crossing ₹1 lakh crore, thanks to strong earnings, improved margins, and efficient management.

An alumnus of IITs Bombay and Kharagpur, 52-year-old Rath has donned diverse roles across the industry, spanning from strategy, business development and upstream asset management to application of geosciences and exploration geology in vital projects, including creation of India’s strategic petroleum reserves. Before joining Oil India, he was CMD of Mineral Exploration & Consultancy Ltd. under the Ministry of Mines.

The appointment of Rath, among the youngest to have occupied the corner office at a public sector unit, came on the heels of Oil India’s recent diversification into hydrocarbon value chain and expansion in international markets with exploratory rights in seven countries. “Efforts are underway to enhance the current recovery of hydrocarbon resources from deeper horizons through replacement & infill development wells,” Rath said at the 65th annual general meeting last month.

The oil major has enhanced its gas production and added new geographical areas under City Gas Distribution (CGD) bidding rounds in partnership with oil marketing companies (OMCs), says Rath. In the recent CGD bidding rounds, the consortium of Oil India (50%) and BPCL (50%) won the geographical area of Arunachal Pradesh, while Oil India’s JV firm HPOIL Gas Pvt. Ltd. bagged Nagaland.

The company plans to invest ₹2,040 crore in clean energy projects to achieve its net-zero goal by 2040, says Rath. As part of the plan, the PSU aims to expand its green and alternate energy portfolio by setting up renewable electricity generation capacity (solar, wind, geothermal), building green hydrogen plants and constructing compressed biogas and ethanol plants. As of March 31, 2024, Oil India’s total installed capacity for renewable energy was 188MW, including 174MW from wind energy and 14MW from solar.

More Stories from this Issue

Financial Behemoth

Oil India, which operates exploration and production assets mostly in the northeast, ended FY24 on a steady note, posting gross sales and PAT of ₹36,304 crore and ₹6,335 crore, respectively. Subsidiary Numaligarh Refinery (NRL) contributed significantly to the company’s performance. The company made a capital expenditure of ₹14,676 crore during the fiscal. It also declared a dividend of 145%, amounting to ₹14.5 per share, and announced a bonus issue (1:2) in July 2024.

Besides, Oil India continues to be one of the largest contributors to the government, which holds a 56.66% stake in the firm, in the form of duties, taxes, and dividend. During FY24, it paid `11,418 crore to the exchequer, against ₹12,330 crore in FY23.

Oil & gas production stood at 6.541 million tonnes of oil & oil equivalent in FY24, the highest ever since its inception. Oil production grew 5.76% YoY to 3.359 million metric tonnes (MMT), while sales stood at 3.288 MMT. The company also achieved its highest-ever natural gas production of 3.182 billion cubic metres of gas in FY24.

(INR CR)

Fuelling Future Growth

Along with its dominance in the domestic markets, Oil India has bagged exploratory rights in seven countries, including Russia, Bangladesh, and Venezuela. Analysts believe the company will be able to sustain the growth momentum. Oil India’s earnings are expected to grow at 15-17% CAGR over the next three-five years, driven by 20-30% output growth aided by the commissioning of the Indradhanush gas pipeline and expansion of the NRL refinery from 3 MMTPA to 9 MMTPA, brokerage JM Financial says in a report. It maintains a ‘BUY’ call on Oil India, citing high oil price scenario and strong earning story over next three-five years.

“Oil India is the strongest player in exploration and refineries with strong fundamentals and positive long-term outlook, contributing almost 10% of India’s crude oil production,” says Prashanth Tapse, senior vice president, research, Mehta Equities. “Over the years, Oil India has diversified its presence across the entire hydrocarbon value chain and made investments in renewable energy to achieve net-zero emissions by 2040,” he adds.

The oil major is poised to double its gas production over the next five-six years. It has already outlined plans to increase gas output by 50% during FY24-26, with an ambitious target of drilling 100 wells by FY27. “To support this growth, Oil India is also constructing a gas pipeline connecting the North Brahmaputra fields. This strategic infrastructure expansion positions Oil India for 100% growth in gas production,” says Santosh Meena, head, research, Swastika Investmart.

“Although falling crude oil prices present a near-term headwind, the company’s long-term growth prospects remain strong. With these factors in mind, a target price of ₹880 (for the stock) over the next year seems achievable,” he adds.