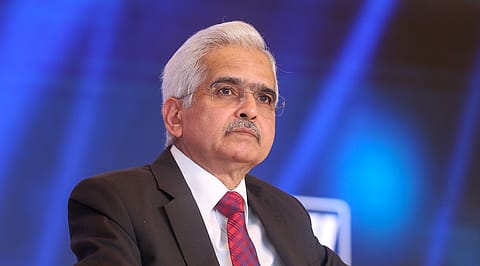

'Be cautious': RBI warns against 'deepfake' videos of Governor circulating online

The central bank says people should be cautious against engaging with and falling prey to such "deepfake videos" circulated over social media

Amid a significant rise in deepfake videos online, the Reserve Bank of India (RBI) has cautioned the public about "deepfake videos" of its top management being circulated over social media, giving financial advice.

"It has come to the notice of the Reserve Bank of India that fake videos of the Governor are being circulated in social media that claim launch of or support to some investment schemes by the RBI. These videos attempt to advise people to invest their money in such schemes, through the use of technological tools," an RBI statement says.

The central bank says its officials are "not involved" in or support any such activities and these "videos are fake".

"RBI does not give any such financial investment advice."

The apex bank has said people must be cautious against engaging with and falling prey to such "deepfake videos" circulated over social media. '

Notably, like other countries, India is also battling the mounting deepfake crisis, sparking widespread concerns. From political arenas to entertainment, the surge in doctored media sometimes blurs the lines between reality and fiction.

The current RBI warning comes two months after it cautioned against fraudulent activities in its name. It said that "unscrupulous elements" were using various methods to defraud people using its name in some capacity.

Recommended Stories

The RBI said fraudsters use its "fake letterheads and fake email addresses", impersonating its employees, and luring people with "fictitious offers" such as lottery winnings, fund transfers, foreign remittances, government schemes, etc. "Victims are made to part with money in the form of currency processing fee, transfer or remittance or procedure charges, etc."

The fraudsters also approach small or medium businesses by posing as government or RBI officials and ask them to pay a “security deposit” under the garb of a government contract or scheme, with the promise of attractive payments.

Some even use "intimidating tactics", where victims are contacted over IVR calls, SMS, emails, etc., and threaten to freeze bank accounts and convince them to share personal details, such as PIN, OTP, etc. or install some "unverified application" using a link.

Notably, the RBI does not maintain any account in the name of individuals or companies or trusts in India to hold funds for disbursal. It also does not open accounts for individuals or ask them to deposit money in those accounts. The central bank also does not send emails "intimating" lottery funds. The central bank has asked people to be aware of such calls, emails, and any other communication by cybercriminals.

(INR CR)