Chinese exports to US decline; India, Mexico, Vietnam compensate

The report suggests that computers and electronics exports from Vietnam, India, and Taiwan to the US witnessed the steepest growth during this period with a CAGR of 42%, 38%, and 27%, respectively.

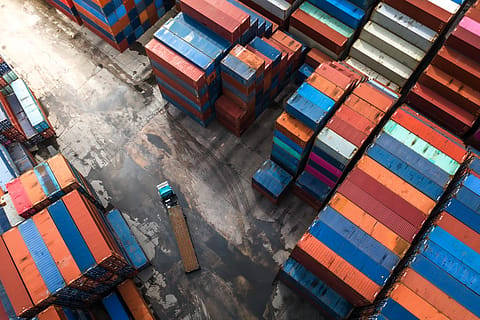

Exports from China to the US have contracted in the past five years. Major emerging markets like Mexico (+$111 billion), Vietnam (+ $78 billion) and India (+ $31 billion) have increased their exports to the US. The increase in the export of these countries to the US can be attributed to both trade creation as well as trade diversion signalling a potential decoupling in global trade, says CareEdge Ratings in a recent report.

The report suggests that computers and electronics exports from Vietnam, India, and Taiwan to the US witnessed the steepest growth during this period with a Compound Annual Growth Rates (CAGR) of 42%, 38%, and 27%, respectively over the past five years. However, India’s electronics exports to the US were substantially smaller in value terms, amounting to just $ 2.9 billion compared to Vietnam's $35 billion.

The report points out that the current export value of computers and electronics products from India to the US mirrors Vietnam's 2013 export of the same items to the US. “Vietnam's electronics exports to the US gained momentum after 2008, following the implementation of the US-Vietnam Trade and Investment Framework and Agreement (TIFA). Conversely, India's surge in electronics exports to the US started to gather momentum post-2018. Similar to Vietnam, other Asian countries like Taiwan, Malaysia, Thailand, South Korea and Japan already have a larger footprint in the US in terms of electronics export. However, even with a slow start, India stands to benefit from the trade diversions emerging from the decoupling of the US and Chinese economies”, it said.

In addition to electronic items, product categories such as electrical appliances, machinery, plastic and rubber products, metals, and chemicals from India have also experienced double-digit annualized growth in exports to the US over the past few years. The report noted that the government initiatives, such as the Production Linked Incentives (PLIs), coupled with increased interest from foreign firms establishing manufacturing units in India triggered this growth.

The key challenge, at least in the case of India’s electronic exports, is to achieve higher domestic value addition, in contrast to the current scenario where most of the growth is driven by local assembly units, the report said.