Future rate hikes by RBI to either pause or be of lower magnitude: SBI

Notwithstanding the increase in CPI inflation, how the CPI is measured by CSO is also a worrying phenomenon, says the SBI Research report

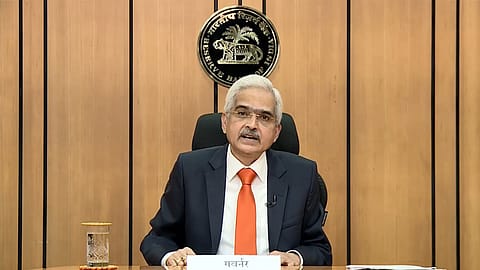

The minutes of the meeting of the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) reveal a dilemma of dissent and unison, which is CPI data discrepancy and re-rating dangers of emerging economies that can further exacerbate the play, SBI's research wing SBI Research said in its latest report. The RBI on Wednesday released the minutes of the MPC, which showed the two external members expressing dissent.

Das, along with other MPC members Shashanka Bhide, Rajiv Ranjan, and Michael Debabrata Patra, voted to increase the policy repo rate by 25 basis points, while Jayanth Varma and Ashima Goyal voted against the rate hike. Varma, who is a professor at the Indian Institute of Management, Ahmedabad, said India’s monetary policy has become complacent about growth and the country may pay the price for this in terms of unacceptably low growth in 2023-24.

The MPC decision reflects a heterogenous conglomerate, says the report, adding that there has been considerable dissent in the MPC meetings and members, especially academicians, have taken a minority approach against the policy decision. "Our current Skewness Index is indicating that going forward, rate hikes will either pause or be of lower magnitude (15 bps). Thus, space for further rate hikes looks low at the margin," says the report.

Those who opposed the rate hike said the excessive interest rate hike has implications for economic growth as raising real policy rates could reduce demand and have a stronger effect on growth than it does on inflation and one should take into account the lags in policy transmission. One of the members also pointed out the fact that India does not have to follow the US Fed as large excess demand, tight labour markets and an unprecedented deviation from the inflation target are prompting the Fed to continue hiking rates and these are absent in India.

Notably, the US Federal Reserve minutes, which were coincidentally released on Wednesday, showed some FOMC (Federal Open Market Committee) members vocally considering higher interest rate hikes last January 2023, making a 'compelling case' for a 50 bps hike at the next policy meeting in mid-March to get to the level of sufficiently restrictive rates as soon as it could.

Recommended Stories

"This, however, also signals the flux situation emerging globally that poses a ‘re-rating’ risk for the emerging markets, as tightening of global financial conditions together with heightened currency and funding risks percolate eventually to credit risk for corporates. This is a not-so-good omen for ring-fenced investors, who may be willing to sit on the sides, ‘timing’ the investments to otherwise attractive destinations," says the SBI report.

The report says notwithstanding the increase in CPI inflation, how the CPI is measured by CSO (Central Statistics Office) is also a worrying phenomenon. Currently, CSO measures CPI based on the Consumer Expenditure Survey (CES) of 2011-12. It shows a clear downward trend in expenditure on food but data is not available beyond FY12 and thus latest CPI data based on such CES survey may be "misleading and overstated", the SBI report says.

(INR CR)

"CSO needs to find suitable ways of rectifying the anomalies," suggests SBI.

Notably, CSO had revised the base year of the CPI to 2012 (from 2010=100) in Jan’2015, following the weighting pattern based on the CES of 2011-12. "Many improvements have been undertaken by the CSO in the new series, though none of such can address the stark divergence between weightage of food at 46% based on CES in CPI and 32.5% in consumption expenditure published by National Account Statistics (NAS) that can bring down CPI by as much as 70 basis points applying such weightage," says the SBI report. Thus, the January CPI inflation actually declines to 5.69% against 6.52%, says SBI, considering the NAS food weights at 32.5% instead of 46% as is given in CPI.