India’s largest corporations

Though the numbers for Fortune India 500 this year are an improvement over last year’s, the swelling top lines and median growth do not inspire optimism. Here’s why.

ONE YEAR, IT SEEMS, can be a long time in the life of a corporation. Last November, when we were closing the first Fortune India 500 rankings, there was optimism in the air. Corporate boardrooms across the country were bubbling with the excitement of possibilities for Indian entrepreneurs and their businesses. In the 12 months since then, that optimism has given way to anxiety about the challenges that lie ahead.

It’s tough to see how these fears will play out because, judging by the Fortune India 500 rankings for this year, there seems hardly any evidence of the impending economic slowdown. In many ways, numbers for fiscal 2011 show an improvement over the last year. This year, Fortune India 500 companies grew their top line by 21.4%, with median growth even higher at 25%. This translates to high double-digit volume growth, taking the rate of inflation to around 10% last year. This is much better than the 5% year-on-year growth in the combined top line of Fortune India 500 companies in 2010.

The encouraging numbers might have to do with the fact that nearly 90% of the 500 companies follow the April-March financial year. This means that the results reflect the economic developments during calendar year 2010 and the first quarter of 2011. That’s the data we use when compiling the Fortune India 500. Since then, companies have declared results for the first two quarters of 2011-12, and the trends are not encouraging. Revenue growth has been lower than expected, while profitability has been hit by the combined effect of rupee depreciation, higher inflation, and uncertainty in the global economy.

Some hint of impending trouble can be seen in profit growth, which has fallen from 27.1% last year to 21.6% this year. For most of the Fortune India 500 companies, erosion in profitability has been severe. This is evident from a low 6.4% profit growth for a median-sized Fortune India 500 company. These could be early signals of a deterioration in financial ratios, with all sizes of companies reporting a slower growth in their networth and asset creation.

In fiscal 2011, a typical Fortune India 500 company reported 71.1% growth in networth, indicating a widening difference between its assets and liabilities. Not surprisingly, the companies seem to have gone slow on new capex, with a median-sized Fortune India 500 company reporting only 13.8% growth in its total assets as compared to 17.5% in the previous year. This means slower expansion and fewer greenfield projects in the near future.

Obviously, ratios indicating profitability of companies have only worsened. For instance, the net profit margins of a typical Fortune India 500 company declined to 6.6% of revenues as against 7.6% last year. Further, return on equity/networth has fallen by nearly 1.5% to 12.4% and now borders on banks’ prime lending rate. Not surprisingly, investors are jittery about equities. A little over 90% of the Fortune India 500 companies are listed and publicly traded; these include all companies that make up India’s two leading indices—the 30-stock BSE Sensex and the 50-stock S&P CNX Nifty.

In the universe of Fortune India 500 companies, 452 companies are listed and publicly traded on major stock exchanges in India. The rest are closely held. Many large and unlisted companies are not on this list as they had not declared financial results by our cut-off date. Some of these biggies include India’s largest media house Bennett, Coleman & Co, Samsung India, and Hyundai Motor India.

Another reason for the decline in investors’ appetite for equity is the slower pace of rise in dividend income. This year, the combined dividend pot for companies on our list grew by 15.4%—sharply down from 35.2% last year.

As usual, the list is dominated by the oil and gas sector, led by Indian Oil Corporation, Reliance Industries, and Bharat Petroleum Corporation. The biggest losers are banks, with the top two lenders, SBI (ranked 4) and ICICI Bank (12), slipping on the rankings. Twenty-eight of 46 banks have fallen; only 15 have gone up on the list. Next year could be even worse given the slowdown in loan offtake and increases in nonperforming assets.

The gainers are automobile firms and their ancillary suppliers. Except for two companies, all have gone up the rankings this year in light of strong revenue growth in fiscal 2011. These firms also reported a sharp rise in their profitability last fiscal.

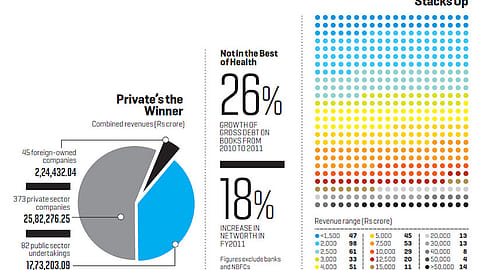

The government continues to play a big role in business, with a total 82 government-owned companies on this year’s list.

Mumbai has remained the natural home of India Inc. despite the growth of other cities. Over a third of companies in our list, 177 to be precise, are headquartered in the financial capital. This is followed by Delhi and its suburbs, which hosts 111 corporate head offices. Surprisingly, Kolkata continues to be a major corporate city with 38 Fortune India 500 companies, ahead of IT capital Bangalore (25 headquarters) and Chennai with 34. Pune, Ahmedabad, and Hyderabad are far behind, home to 22, 19, and 17 firms respectively.

(INR CR)