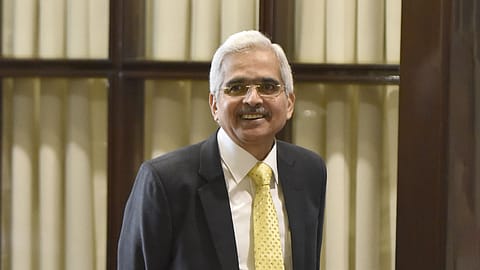

Inflation moderating but last mile sticky: RBI governor

The final leg of this disinflation journey may be tough, says RBI governor Shaktikanta Das

Reserve Bank of India governor Shaktikanta Das on Friday said inflation is expected to fall below 4% in the second quarter of 2024-25 but that may not lead to a rate cut because inflation is again forecast to rise in the succeeding quarter.

The last mile of our journey towards the 4% inflation target is pretty sticky, says the RBI governor during the post-monetary policy press conference. “When we have confidence that inflation will stick to 4% and not go up, then we will act on further monetary policy action,” Das says.

Inflation has to align with the 4% target and be there on a durable basis, he adds.

The monetary policy committee (MPC) expects inflation to be at 4.5% in 2024-25 with Q1 at 4.9%; Q2 at 3.8%; Q3 at 4.6%; and Q4 at 4.5% if the monsoon is normal.

The MPC decided by a majority of 4 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target.

Recommended Stories

Inflation continues to moderate, mainly driven by the core component which reached its lowest level in the current series in April 2024. Food inflation, however, remains elevated. While the MPC took note of the disinflation achieved so far without hurting growth, it remains vigilant to any upside risks to inflation, particularly from food inflation, which could possibly derail the path of disinflation.

Das says while inflation is easing, the final leg of this disinflation journey may be tough. Sustained price stability would set strong foundations for a period of high growth, he says.

(INR CR)

CPI headline inflation softened further during March-April, though persisting food inflation pressures offset the gains of disinflation in core and deflation in the fuel groups. Despite some moderation, pulses and vegetables inflation remained firmly in double digits. Vegetable prices are experiencing a summer uptick. The deflationary trend in fuel was driven primarily by the LPG price cuts in early March. Core inflation softened for the 11th consecutive month since June 2023.

“According to our projections, the second quarter of 2024-25 is likely to see some correction in headline inflation, but this is likely to be one-off on account of favourable base effects and may reverse in the third quarter,” says Das.

“At the current juncture, the uncertainties related to the food price outlook warrant close monitoring, especially their spillover risks to headline inflation,” he adds.

“On inflation, we are on the right track, but there is still work to be done. Globally, there are concerns that the last mile of disinflation might be protracted and arduous amidst continuing geopolitical conflicts, supply disruptions and commodity price volatility,” the RBI governor says.

"In India, with growth holding firm, monetary policy has greater elbow room to pursue price stability to ensure that inflation aligns to the target on a durable basis. In its current setting, monetary policy remains squarely focused on price stability to effectively anchor inflation expectations and provide the required foundation for sustained growth over a period of time," he says.