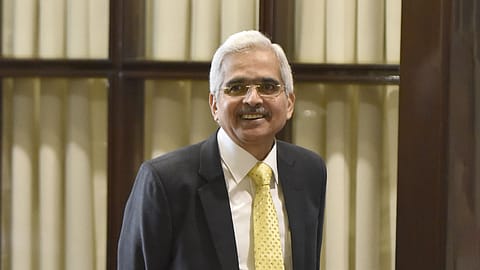

MPC minutes: RBI governor says pausing repo rate hike would be 'premature'

"We need to give time for our past policy actions to work through the system," says RBI governor Shaktikanta Das.

Further calibrated monetary policy action is necessary to keep inflation expectations anchored and break the persistence of core inflation while containing second round effects, RBI governor Shaktikanta Das said at the Monetary Policy Committee Meeting (MPC) meeting earlier in February.

"I also believe that we should taper the pace of rate hike in view of two considerations: (i) we need to give time for our past policy actions to work through the system; and (ii) it would be premature to pause, lest we are caught off-guard and need to do a catching up later," Das said, while voting for an increase of 25 basis points in the policy repo rate to 6.50%.

This order of rate increase provides space to calibrate future monetary policy actions and stance based on evolving macroeconomic conditions, the RBI governor said, as recorded in the Minutes of the MPC released on Wednesday.

"CPI inflation has moderated primarily due to lower vegetable prices. Core inflation (i.e., CPI excluding food and fuel), however, is elevated and sticky at around 6%. CPI inflation excluding vegetables has moved higher. Going forward, the baseline projections indicate that headline inflation is likely to moderate to 5.3% in 2023-24," Das said, adding that these projections also indicate the disinflation towards the target rate is likely to be protracted given the stickiness of core inflation at elevated levels.

Durability of a disinflation process cannot solely rely on food inflation, given its uncertainty and susceptibility to weather events, Das said.

There is considerable uncertainty at this stage on the evolving inflation trajectory due to ongoing geopolitical tensions, global financial market volatility, rising non-oil commodity prices, volatile crude oil prices and also weather-related events, he added.

"We must, therefore, remain unwavering in our commitment to bring down inflation to ensure a decisive and durable moderation in inflation towards the target of 4 per cent over the medium term, while being mindful of growth," the RBI governor said.

Recommended Stories

Das, along with other MPC members Shashanka Bhide, Rajiv Ranjan, Michael Debabrata Patra, voted to increase the policy repo rate by 25 basis points while Jayanth Varma and Ashima Goyal voted against the rate hike.

MPC member Varma, who is a professor at the Indian Institute of Management, Ahmedabad, said that India's monetary policy has become complacent about growth and the country may pay the price for this in terms of unacceptably low growth in 2023-24. "In the second half of 2021-22, monetary policy was complacent about inflation, and we are paying the price for that in terms of unacceptably high inflation in 2022-23. In the second half of 2022-23, monetary policy has, in my view, become complacent about growth, and I fervently hope that we do not pay the price for this in terms of unacceptably low growth in 2023-24," Varma said.