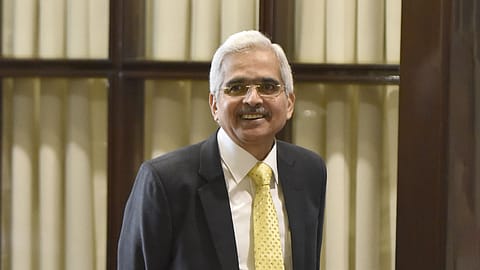

RBI keeping Arjuna's eye on inflation: Shaktikanta Das

The Indian rupee has appreciated against all major currencies barring the US dollar, says RBI governor.

RBI governor Shaktikanta Das on Wednesday compared the central bank's policy measures to target inflation with the great warrior Arjuna from Mahabharata.

"No one can match the prowess of Arjuna, but our constant endeavor is to keep an Arjuna's eye on inflation, which is our primary target," Das says at the annual FIBAC 2022 conference organised by FICCI and IBA.

These comments come at a time when India's retail inflation rate jumped to 7.4% in September from 7% in the month of August on the back of the high food prices in the country.

"We are closely monitoring the inflation trends as well as the effect of our past actions. In our view, price stability, sustained growth and financial stability need not be mutually exclusive," the RBI governor says.

"We keep assessing other related factors like the evolving inflation-growth dynamics; soft indicators like our surveys on consumers and businesses; global macroeconomic, financial and commodity market developments; and financial stability. In other words, our policy measures are based on an assessment of the overall situation. We will continue to steer our policies accordingly," he adds.

On the recent depreciation of the Indian rupee vis-à-vis the US dollar, the RBI governor says that the local currency had depreciated 8% so far in the ongoing financial year while the US dollar has appreciated 13%. On a year-to-date basis, the INR has depreciated by 9.8% whereas the US dollar has appreciated by 15.8%.

"On a financial year basis, almost all major currencies - barring a few like the Swiss franc, the Singapore dollar, the Russian rubble and the Indonesian rupiah - have depreciated against the US dollar by more than the INR. In fact, the INR appreciated against all other major currencies barring of course the US dollar, and a few other currencies," says the RBI chief.

Recommended Stories

The size of the rupee's appreciation was the highest vis-à-vis the Japanese yen (12.4%), the Chinese yuan (5.9%), the Pound sterling (4.6%) and the Euro (2.5%).

The story of currency movements following the war in Ukraine is more about India's resilience and stability in the face of the unrelenting strengthening of the US dollar rather than a story of weakness, says Das.

"The terminal interest rate that the US Fed is targeting is anybody's guess, but it cannot be the case that it will tighten monetary policy endlessly. When the tightening is over, the tide will surely turn. Capital flows to India will resume and external financing conditions will ease. In this complex world in which both push and pull factors are at play, the INR, which is market-determined, should be allowed to find its level and that is what we have been striving to ensure," Das further says.

The RBI governor adds that the most recent shock has been the aggressive monetary policy tightening around the world and the accompanying hawkish forward guidance. "The result has been tightening of external financial conditions, capital flight from emerging markets, sharp currency depreciations and reserve losses. No country can be immune to these developments. Yet the strength of our macro-fundamentals has stood out in comparison with peers," says Das.

(INR CR)