Ready to take rate action when required: RBI governor

Providing liquidity on tap for market participants is the RBI’s strategy to combat the coronavirus fallout.

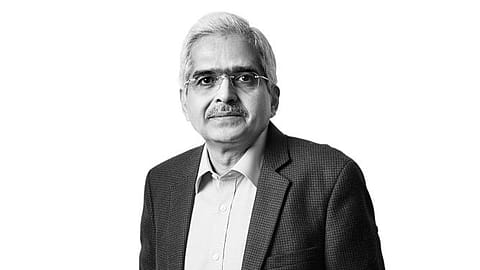

No rate cuts but a promise to do whatever is required at an appropriate time was Reserve Bank of India governor Shaktikanta Das’s message to market participants seeking a solution to the economic fallout of the coronavirus outbreak.

“We will use various policy instruments from time to time depending on the requirement. Our response will be calibrated. Our effort is to see that our responses are neither premature nor delayed,” Das said at a press conference in Mumbai on Monday.

A rate cut decision, said Das, will be taken in the Monetary Policy Committee (MPC) meeting. “I’m not ruling out any possibility (on rate cut). We are estimating the impact of Covid-19 and we will give our growth estimates in the MPC. India is relatively insulated from the global value chain, but there will be some impact,” he said.

Das was quick to agree that the coronavirus outbreak had impacted sectors like tourism, hospitality, airlines, with the fallout spreading to more and more sectors. There was also considerable uncertainty about the duration of the pandemic. The RBI has taken some calibrated measures to ensure financial markets and institutions remain sound and resilient.

With this move, the RBI has taken a different stand from the other central banks like the U.S. Fed and the Bank of England, which has reduced their bank rates by 50 basis points; the Canadian central bank has cut its rate by 100 basis points.

Das also assured YES Bank depositors that their money is safe in the bank and the restructuring scheme of YES Bank—a partnership between public and private sector banks—is a credible and sustainable revival plan. For RBI deputy governor N.S. Vishwanathan, the choice was between reconstruction and amalgamation. “In the case of YES Bank, we decided reconstruction was more viable,’’ he said.

Realising the importance of ensuring ample liquidity in the financial markets, especially in terms of dollar requirements, the RBI governor proposed to conduct another U.S. dollar/rupee sell-buy swap on March 23. The signalling is clear that in case any market participant needs dollars, the RBI has opened a window for them. Corporates and others will no longer have to arrange dollars at a high interest rate.

To ensure greater liquidity at home, the RBI also said that it will conduct long-term repo operations (LTRO) in multiple tranches up to a total amount of ₹1 lakh crore at the policy rate. “This will be followed by a review of the performance of LTRO,’’ Das said.

These measures, according to Satish Kumar, research analyst at Choice Broking, would maintain the stability of the rupee and provide ample liquidity in order to keep interest rates low and tackle the economic impact due to the coronavirus outbreak.

Keki Mistry, vice chairman and CEO of HDFC Bank, said the situation in India did not warrant a rate cut right away. “Ensuring liquidity is more critical than cutting rates at this moment,’’ he said.

Economists agree that cutting interest rates at this time would not boost consumption nor result in greater investment. With little space for a further repo rate cut, the RBI has done well to keep its firepower for another day.

(INR CR)