The mathematics of fuel pricing

If social media is your guide, you may not know if fuel prices have gone up or down. Here’s how it adds up, and here’s why it matters.

“Who buys petrol? Somebody with a car, somebody with a bike. Certainly they are not starving. Somebody who can afford to pay has to pay,” claimed Alphons Kannanthanam, minister of state, Ministry of Electronics and Information Technology. This was in response to the public anger over the fact that there has been an 8% jump in petrol and diesel prices in less than three months.

The response, predictably, was swift and severe. “This is arguably not the best approach to mollify a simmering country, where the cost of transportation is a major burden for most,” wrote Shashi Tharoor, member of parliament (INC) from Thiruvananthapuram.

Meanwhile, social media, particularly Twitter, was ablaze with opinions and “facts”. Amit Malviya, whose Twitter profile introduces him as “Incharge of BJP’s national Information and Technology, ex-banker and an early stage investor”, kicked things off with a tweet intended to set the record straight. Using an infographic to show that fuel prices were high because of state taxes and states claiming their share of central taxes, Malviya’s version, unfortunately, promoted some dubious calculation. Showing the amount for states, Malviya, a former banker, adds Rs 14.98 and Rs 9.02 to arrive at a total of Rs 27.44. (To save you the trouble, that should have been Rs 24.)

Alert readers jumped on this, and the math was revised; when the official handle of the BJP shared the graphic, the numbers were correct. But this has been flogged to death on social media. What we are talking about here is the fact that the ruling party, in its zeal to present a price hike as a good thing, may just have misrepresented some facts.

The numbers (sans wrong calculations) have been sourced from the August 2017 price reckoner issued by the Petroleum Planning & Analysis Cell (PPAC), which comes under the Ministry Of Petroleum and Natural Gas. According to this, the retail selling price for petrol (Rs 70.48 a litre in Delhi) is arrived at by adding central taxes of Rs 22.04, state taxes of Rs 14.98, and dealer commission of Rs 3.24 to the actual price of petrol (Rs 30.22).

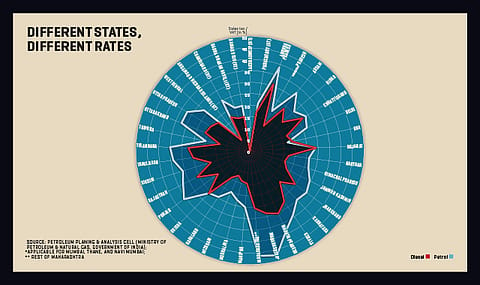

That sounds perfectly above-board. Except that the catch is in the state taxes. The party issued infographic simply ignores the fact that taxes on petrol and diesel differ from state to state. The example it has gone with is Delhi, where the taxes are among the lowest in the country. (For the record, Goa levies the lowest taxes/VAT at 17%.)

Maharashtra has the highest sales tax/VAT among all the states, 46.52% on petrol and 25.36% on diesel. Within Maharashtra too, the levies in Mumbai, Thane, and Navi Mumbai are higher—47.64% on petrol and 28.39% on diesel. The charts give you a glimpse of varying sales tax/VAT rates applicable across states and union territories, which are effective from Sept. 1, 2017.

Recommended Stories

Similar to the varying state-specific levies, there’s also a major difference in states’ share of central taxes on fuel. The BJP’s infographic suggests that 42% of central excise duty is transferred to state governments. In fact, according to the 14th Finance Commission, corporation tax, income tax, customs duty, excise duty, and service tax collected by the centre is to be split up among states (see bar chart). The division has been spelled out by the commission. For example, Uttar Pradesh has close to 18% share of revenue, while Bihar has 9.67%, much higher than the 5.5% share of Maharashtra. States like Manipur and Meghalaya get 0.6%. Interestingly, Delhi finds no mention.

So here’s the thing. Yes, rising petrol and diesel prices are inevitable. But to present misleading facts seems more than a little disingenuous. Of course, the fact that the party is in election mode must not be forgotten. No wonder, effective October 4, the government reduced the central excise duty on petrol and diesel by Rs 2 per litre and also requested state governments to reduce VAT “so as to give more relief to consumers”. However, the next time it wants to put a positive spin on negative news, it will remember to doublecheck its calculations.