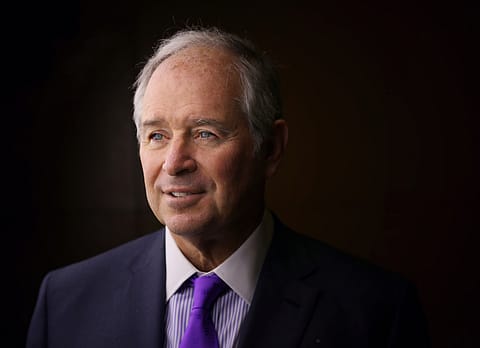

Rate cut not a solution to coronavirus impact: Stephen Schwarzman

Global PE giant Blackstone’s chairman says a toll on the global economy is inevitable, but the epidemic would also lead to business opportunities for those with access to capital.

There is little doubt that the growing contagion of the novel coronavirus, also known as Covid-19, will have a “significant negative impact on global growth,” according to Stephen Schwarzman, chairman, chief executive officer, and co-founder of American private equity and asset management firm Blackstone.

Schwarzman, who was in Mumbai on Wednesday as a part of a tour to promote his new book, What it Takes: Lessons in the Pursuit of Excellence, said that most experts Blackstone consulted seemed to think that a cure to the virus could take around a year to 15 months to come to market and the question would be how deeply would the issue impact the global economy till then.

Commenting on the recent move by the U.S. Federal Reserve to slash interest rates by half a percentage point to stimulate an economy that is threatened by the virus, which is spreading to new countries every day, Schwarzman—who preferred to greet his audience with a Namaste rather than the customary handshake—stated: “I don’t understand how interest rate cuts can cure you of the coronavirus. It [interest rate cut] is an attempt to stimulate the economy when the supply chain is not functioning. It is difficult to assess how long this will go on. There is a level of panic among people and if certain countries go into a recession because of this, it will be difficult for them to come out.”

“When you lower interest rates it makes life difficult for financial institutions,” Schwarzman, 73, said. “The attempt (U.S. Fed’s interest rate cut) to instil confidence didn’t work, at least as far as yesterday’s market reaction was concerned.”

Schwarzman, who has an estimated net worth of $13 billion and a majority of which he has pledged to be donated to charity, said the current crisis would also lead to new opportunities for companies. If the system is disrupted, people with access to capital will have a lot of scope for doing business with those that need capital and will find it difficult to get that in the post-coronavirus order of things.

Blackstone, which has assets under management of $571 billion globally, has deployed close to $16 billion in India over the past 15 years. In the last year-and-a-half alone, Blackstone has invested $6 billion across businesses like private equity, real estate, and tactical opportunities (distressed assets and special situation financing).

Speaking about the future business potential in India, Schwarzman said Blackstone had seen great outcomes in India since entering the market. “India is a highly unusual country. India has had so much growth for so long that if you select the right things your chance of having a good outcome is really good,” Schwarzman said. “India has remarkable assets like its people and an improving education system and these are all preconditions for continued expansion, which will create investment opportunities for people like ourselves.”

Recommended Stories

Schwarzman said he realised that the Indian economy had slowed down of late, inflation was high, and business confidence had taken a hit, exacerbated by challenges in the financial system. But, he said he hoped the country would make the necessary changes and improvements.

In his book, which has become a New York Times bestseller, Schwarzman delves into his storied entrepreneurial career and references personal anecdotes to eke out real-life management and leadership lessons, relevant to individuals at various stages of their careers. Schwarzman said the book was meant to help professionals “mobilise” people to buy into their dream.

The key to building an enduring institution, according to Schwarzman, was to treat the organisation like an intimate place where everyone feels important and empowered. After media, financial services was a business where people had big egos, he said, given the talent they possess. Only six-tenth of a percent of all applicants are accepted to Blackstone, Schwarzman said, and it was essential for the organisation to acknowledge the talent and contribution of these employees.