“Choose your investor just like you choose your spouse”

“Picking an investor and board member is as important as picking your co-founder. Never be enamoured by the brand of an investor, be concerned about the person who will be on board.”

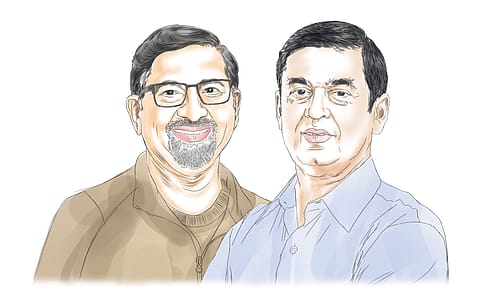

Icertis runs an AI-powered contract management platform on the Cloud, which ensures compliance and minimises contractual risks for big companies. The start-up’s proprietary language-processing software helps clients ramp up business deals by building predictive models that optimise contracting processes and uncover contracting insights. The models are trained on the more than 10-million contracts Icertis manages for its customers worldwide. A $115-million funding round in 2019 catapulted it to the unicorn status, and another $80 million in March this year made it India’s second-most valuable SaaS unicorn. Founded in 2009 by Samir Bodas and Monish Darda, Icertis has grabbed an envious roster of clients, including Microsoft, 3M, Airbus and Cognizant by processing over 5.7-million contracts in 40-plus international languages.

The Idea!

Samir Bodas: I was moving out of Aztec Software in 2009 after it was bought over by Mindtree, and co-founder Monish, who was the head of R&D at BladeLogic, was moving on after it got acquired by BMC Software. Though both of us thought of retiring, our wives warned us: “We will go work, if you guys retire!” So, we said, “no, we will work”. That’s how we founded Icertis in 2009 — just to have a job! The initial years were more like we-will-figure-it-out mode. Then, at a cocktail party, a friend of mine, who worked for Microsoft, suggested we could look at contract management software. To cut a long story short, we found our first customer in Microsoft.

Early Struggle

We built the first version of the product in 2012. We had Microsoft as a customer but we were still trying to find a product-market fit, which other customers might be interested in as well. We got a couple of small customers as we went about figuring our sales pitch and getting the right features in. We did build a platform but essentially incorporating features that Microsoft wanted, and we started selling those features to other customers as well. For the next two years, we kept trying to figure out our product.

Make Or Break Moment

In 2014, we hit our rhythm with a million-dollar revenue and clients Johnson & Johnson, Genpact and the likes coming on board. But the question was: do we continue down this path or go big? Continuing down the same path meant we would grow depending on the cash generated and what we put back in. In 2015, Greycroft Partners along with Eight Roads Ventures India invested $6 million at a valuation of $22 million and we were off. In five years we went from $1 million to $100 million-plus and, today, we are clocking much higher numbers.

More Stories from this Issue

The Business Model

While the first million was hard work, targeting the next $10 million meant scaling up sales and marketing, making the product broader, and ensuring it delivers to a lot more customers. Luckily, we started off with big clients such as Microsoft, and they continue to be with us. Initially, I functioned as the salesman and the project manager, while Monish was the coder and the engineering leader. We found a good CRO in Anand Virkar, we got a chief marketing officer, and built the sales force. I think phase 0 to 1 is about product-market fit, but 1 to 10 is about making sure you scale up the sales force. We went from $1 million to $3- $9 million in three years, and in five years hit $100 million.

Tech Challenge

Contracts are a unique artefact of data. There is unstructured data that is in English and which you can understand such as a liability clause, and then there is data for numbers, for eg, you will pay me so much for this amount, etc. But nobody has applied AI to a combination of structured and unstructured data — the English and the numbers — to figure out the risk and the opportunity in the document. Doing that involves natural language processing, and then applying AI and machine learning to these numbers and words to give intelligence to CXOs to say there is opportunity in this body of contracts and there are risks.

(INR CR)

HR Challenge

When I came out of the B-School in 1992, I thought culture and values were all bullshit. I believed that if you put enough money in people’s pockets, they will work hard. If you don’t pay them, they won’t work. But as I grew older, I began to appreciate culture. We articulated and encapsulated five values of our company in an acronym FORTE — fairness, openness, respect, teamwork and execution.

Managing Investors

Choose your investor just like you choose your spouse. Picking an investor and board member is as important as picking your co-founder. Because when things are going well everyone is happy, but the moment things go downhill, you need sage council and calmness in the boardroom. Never be enamoured by the brand of an investor, be concerned about the person who will be on board. Also, don’t over promise and under deliver, better, under promise and deliver. VCs call the first board meeting after they invest, the “Oh shit” meeting—when they find out the reality after the promises. Make sure there are no such meetings.

Sales & Marketing Lessons Always hire ahead of the curve — a year or two before you need that person. Sales force efficiency metrics are very important in enterprise SaaS. How many people you have, how productive they are, how quickly they get productive, what is the most they can produce, and average revenue rate — all these are extremely important.

Riding Through Toughest Times

Covid 19 was the toughest learning curve, when we came up with four rings of responsibility — taking care of self, family, community and business.

When Did You Think You Had Arrived?

I would say I’m blessed. When you say “arrived” it caters to the ego and being blessed keeps you grounded in reality.

What Next?

We are trying to solve some fundamental problems. We are in a category that is burgeoning and nobody has figured out how to apply AI and solve these problems. It’s fun to figure this out and build a company that’s growing, grounded in values we believe in.