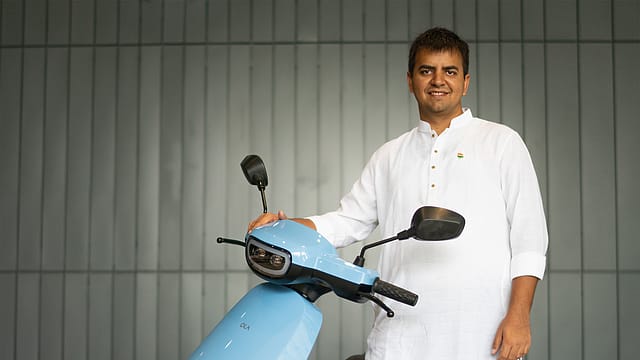

Commercial production at cell gigafactory early next year: Bhavish Aggarwal

ADVERTISEMENT

Ola Electric CEO Bhavish Aggarwal says trial production at the company’s battery cell gigafactory is going on currently and commercial production will start early next year.

Ola claims its ‘4680 cell’ is five times bigger than existing lithium-ion cylindrical cells used in electric vehicles.

“There are two main technologies – LFP and NMC. LFP is voluminous but cheaper while NMC is high in energy density but slightly costlier. Our 4680 cell is compatible with both LFP and NMC. We are first coming out with NMC variant of the cell because our vehicles use NMC. But in the future we can do LFP on the same format,” says Aggarwal.

Ola has secured the biggest 20 GWh (gigawatt hour) allocation under the production-linked incentive scheme of the government.

The company plans to build the 20 GWh capacity in phases. Phase 1 of 1.4 GWh is already completed.

On the initial public offering, Aggarwal says part of the IPO proceeds goes to capex, part goes to retiring some debt and part of it goes into R&D for the future.

“As we scale up our India business and manufacturing we will look to tap the export opportunity in the future,” he says.

India’s overall two-wheeler market is about 17-20 million units a year and one-third is scooters and two-third is motorcycles. Scooters have already achieved 15% EV penetration, says Aggarwal.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

“We have been working on our motorcycle portfolio. We will deliver motorcycles to customers starting early next year,” he says.

“Every product portfolio – scooter or motorcycle – will be built on the same platform. That gives us a lot of scale benefits. Every generation reduces the cost. Generation 2 platform introduced last year reduced the cost by 23% compared with Generation 1,” says Aggarwal.

The Ola Electric CEO says there will be cyclical ups and downs due to subsidy changes.

Ola Electric’s revenue jumped 90% year-on-year to ₹5,009 crore in 2023-24 from ₹2,630 crore in FY23. The electric two-wheeler maker’s losses widened by 8% to ₹1,584 crore in FY24 from ₹1,472 crore in the year-ago period.

The Bengaluru-based company has set the price band for its upcoming initial public offering (IPO) at ₹72-76 per share that will start for subscription on August 2, 2024. The anchor book will open for a day on August 1. The three-day issue will close on August 4. The listing date for shares of Ola Electric on the BSE and NSE is August 9.

The IPO of Ola Electric comprises a fresh issue of ₹5,500 crore and an offer for sale (OFS) of up to 8.49 crore shares by promoters and existing shareholders. At the upper end of the IPO price band, the company looks to garner ₹645.96 crore via OFS, taking the total issue size to ₹6,145.96 crore.