Industry cheers draft e-commerce policy

ADVERTISEMENT

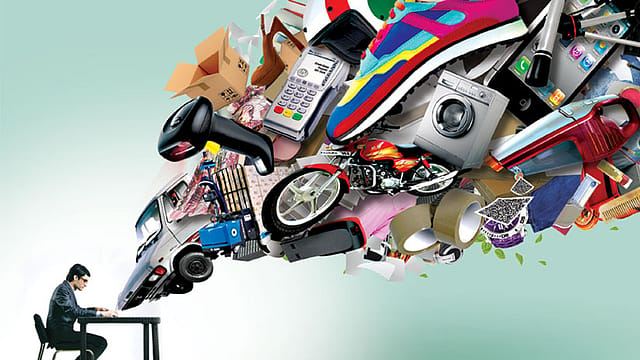

The government’s draft e-commerce policy announced on Monday has a clear indication: it wants to put homegrown players on an equal footing with global players.

In a 19-page draft on electronic commerce in India which Fortune India has seen, the government says that it is set to create a facilitative environment for e-commerce, “including a fair environment for domestic digital firms to find their rightful place”.

While it is still at the draft stage, if the recommendations are accepted, it could make things difficult for foreign-owned online retailers in what is already an intensely-competitive market.

To begin with one of the key recommendations as per the draft is that the restriction imposed on e-commerce marketplaces on influencing directly or indirectly the price of sales of goods and services, would be extended to their group companies. This recommendation, if accepted in the final policy, could adversely affect business strategies of e-commerce players who have subsidiaries or group companies. Singapore-registered Flipkart’s subsidiaries, for example, include Myntra Jabong Pvt. Ltd, PhonePe and FK Myntra Holdings, among others.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

Anil Joshi, managing partner at Unicorn India Ventures, a venture capital firm, points out that it will have a positive impact on hyper-local retailers, but e-commerce especially foreign-owned will be hit. “Going forward, prices may not be the only differentiator, services would matter. Not allowing foreign-owned e-commerce to hold inventory, will increase cost at the same time and logistics challenge will increase. The policy is more to address the concerns of retailers, and to avoid monopoly situation by leaders like Walmart,” Joshi told Fortune India.

The draft further mentions that a bulk of wholesale procurements of branded products such as electronic products, especially mobile phones, white goods and branded fashion “by related-party sellers which lead to price distortions in a marketplace will be prohibited”. This has severe implications for multi-category horizontal e-commerce players as these are among their top revenue generators. Earlier this year, Flipkart said smart phones and TVs are its top cash cows.

Industry experts are cautiously optimistic about the recommendations in the draft. Vinamra Pandiya, founder-CEO, Qtrove, an online marketplace for curated organic food, personal care, and home décor products, believes the government has taken a step in the right direction in formally recognising this industry and addressing the concerns. “What I feel is as e-commerce is growing, there should be a level playing field between online and offline sellers as the e-commerce sector ultimately has to make money. I firmly believe the next decade would be about consolidation and this policy will play its part to ensure that,” he noted.

According to Vidhya Shankar, executive director, Grant Thornton India, the draft policy for e-commerce indicates a strong intent to create a level-playing field among all e-commerce players, accelerate the growth of the sector by widening the base of manufacturers and traders, simplifying GST and taxation, migrating towards high standards of data protection, digitalising the supply chain rather than disintermediation thus moving closer to realising the goal of a digitally-enabled New India.

In what will probably be the biggest blow to foreign-owned or foreign-investor-backed e-commerce firms, the draft recommended that “Indian-owned and Indian-controlled online marketplaces be allowed to hold inventory as long as products are 100% domestically produced. This relaxation on marketplace e-commerce firms is not available for entities controlled by foreign investment”, according to an article in The Economic Times dated July 31.

Harminder Sahni, founder and managing director, Wazir Advisors, a retail consultancy, feels it is a good step to have a comprehensive policy for e-commerce sector. It should help in addressing various issues being raised by different stakeholders. “One of the most important points is to amend relevant provisions to allow founders to have control even if they become minority shareholders. This will bring some balance of power between founders and investors,” Sahni adds.