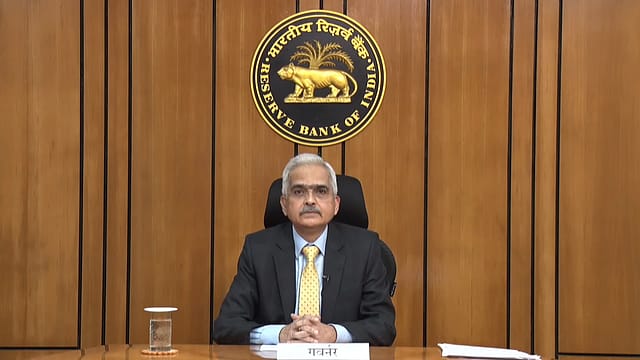

Penalty on loan accounts: RBI asks banks to stop ‘divergent practices’, tweaks norms

ADVERTISEMENT

The Reserve Bank of India (RBI), in a circular issued today, tweaked rules related to banks, NBFCs, and all-India financial institutions imposing “penal interest” over and above the “applicable interest” in case of defaults or non-compliance by borrowers. These instructions will come into effect from January 1, 2024.

The central bank says banks and other regulated entities are indulging in "divergent practices" with regard to the levy of “penal interest” or charges, thus leading to a rising number of customer grievances and disputes.

The central bank says under the extant guidelines, lending institutions have the operational autonomy to formulate board-approved policies for the levy of penal rates of interest.

However, many regulated entities use "penal rates of interest, over and above the applicable interest rates, in case of defaults/non-compliance by the borrower with the terms on which credit facilities were sanctioned".

The basic purpose of levying penal interest or charges is to inculcate a "sense of credit discipline", though such charges are not meant to be used as a "revenue enhancement tool" over and above the contracted rate of interest, the RBI asserts.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

In its latest directions to banks, the apex bank says if they charge a penalty for non-compliance with material terms and conditions of the loan contract, it should be treated as ‘penal charges’ and should not be levied in the form of ‘penal interest’, which is added to the rate of interest charged on the advances.

"There shall be no capitalisation of penal charges i.e., no further interest computed on such charges. However, this will not affect the normal procedures for compounding of interest in the loan account," says the RBI.

No additional component to the rate of interest should be introduced, and banks must ensure compliance with these guidelines in both letter and spirit, the RBI says.

Additionally, such entities should formulate a board-approved policy on "penal charges" or similar charges on loans, and the quantum of penal charges should be "reasonable and commensurate" with the non-compliance of material terms and conditions of the loan contract, without being discriminatory within a particular loan or product category.

Besides, in case of loans sanctioned to ‘individual borrowers for purposes other than a business', says the RBI, it should not be higher than those applicable to non-individual borrowers for similar violations.

Banks also need to clearly disclose the quantum and reason for penal charges to the customers in the loan agreement and most important terms & conditions/key fact statement (KFS) in addition to being displayed on their website under the 'interest rates and service charges' category.

The RBI says whenever customers are reminded of such non-compliance, the applicable penal charges should be communicated. Also, if they are levying penal charges, banks must explain the exact reason.

All banks and regulated entities have been asked to carry out appropriate revisions in their policy framework and ensure the implementation of these instructions. In the case of existing loans, the switchover to the new penal charges regime will be ensured on the next review or renewal date or six months from the effective date of the RBI circular.

These instructions don't apply to credit cards, external commercial borrowings, trade credits, and structured obligations.