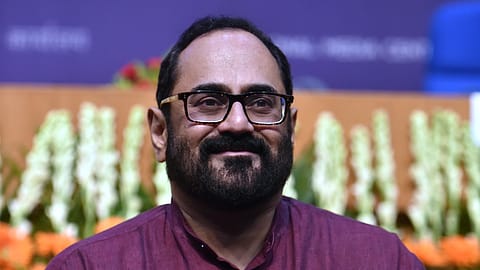

Byju's tried to grow too fast sans corporate discipline: Rajeev Chandrasekhar

"If you don't learn from those who came before you, you will make mistakes and I think, Byju's is that mistake," says Rajeev Chandrasekhar.

Union minister of state for electronics and information technology Rajeev Chandrasekhar says edtech startup Byju's tried to grow too fast without following much corporate discipline.

"It was a company that tried to grow too fast, without creating the rigour and corporate discipline that a growth company like that should have at a time when money was flowing and equity was cheap. Eventually, that cycle always turns," Chandrasekhar says at the Mumbai Tech Week organised by Tech Entrepreneurs Association of Mumbai.

"So if you are not smart at that time and don't learn from those who came before you, you will make mistakes and I think, Byju's is that mistake," he says.

Byju's, once valued at a staggering $22 billion, has seen its valuation vanish over the past two years. In January, U.S.-based asset manager BlackRock slashed the implied valuation of the Indian startup by 95% to $1 billion.

In November 2023, Prosus had cut Byju's valuation to less than $3 billion. The tech investor holds 9.6% stake in Byju's parent Think & Learn Pvt Ltd.

Byju's is now looking to raise $200 million from investors at a valuation of less than 2 billion to pay its vendors. Some investors have called for an Extraordinary General Meeting (EGM) on February 23. The agenda for the EGM is the governance, financial mismanagement and restructuring of its board. These shareholders are reportedly seeking the ouster of Byju's co-founder Byju Raveendran.

Raveendran, his wife Divya Gokulnath and brother Riju Raveendran hold around 26% of the company, while the miffed shareholders who called for the EGM, account for around 25% stake.

Recommended Stories

Byju's investor board members from Prosus, Peak XV, and Chan Zuckerberg Initiative had stepped down last year.

Beleaguered Byju's grew rapidly on the back of an acquisition spree before troubles began. The edtech company shelled out $2.5 billion on acquisitions that included Aakash Educational Services for nearly $1 billion, U.S.-based Epic, kids' coding platform Tynker, professional education firm Great Learning and exam prep platform Toppr.

The losses of the edtech startup widened manifold to ₹8,245 crore for the financial year 2021-22, dragged down by losses in its coding unit White Hat Jr. Byju's posted a loss of ₹4,564 crore in FY21.

Byju's statutory auditor Deloitte Haskins & Sells quit last year citing a long delay in the edtech startup's financial statements for the year ended March 31, 2022. Following the auditor's resignation, Byju's appointed BDO (MSKA & Associates) as its new auditor.

(INR CR)

In 2023, the Enforcement Directorate (ED) conducted searches at the premises of Byju’s and the residence of Byju Raveendran and seized documents pertaining to investments received and made by the company.