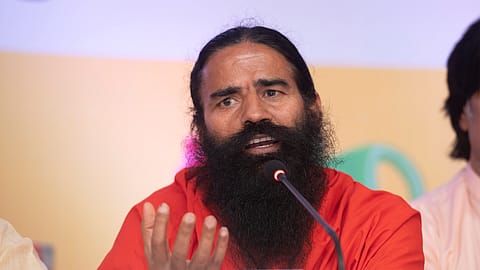

Millets will be ₹1 lakh crore business: Patanjali's Baba Ramdev

"Ruchi Soya-Patanjali will be bigger than HUL. We will beat them in both turnover as well as EBITDA."

"Give up eating rice and wheat, embrace bajra, ragi and jowar," says yoga guru, ayurveda practitioner and Founder of Patanjali Group, Baba Ramdev. He says that deficiencies such as vitamin B12, vitamin E and even lifestyle diseases such as diabetes, arthritis and heart problems are rampant today because we don't include millets in our diet. "Rice and wheat create health problems. I often ask diabetes and hyper-tension patients to give up rice and wheat and switch to bajra and ragi, the moment they do so they start to feel better. Millets on their own are a balanced food."

Though India has over 80 variants of millets which have been a part of our diet for centuries, cultivation of millets took a backseat during the green revolution. The challenge then was hunger and rice and wheat cultivation was more scalable. So, with nutrition taking centre stage and the UN also declaring 2023 as the Year of Millets, what are Ramdev's plans? "We will focus a lot on millet cultivation but more from the lens of social awareness. Millets are more effective when eaten fresh," explains Ramdev.

He also says millets have the potential of becoming a ₹100,000 crore business within the next decade, therefore, launching millet-based products is definitely on the cards. The one big challenge, with millets according to Ramdev, is shelf-life. "To launch millet ready-to-cook or ready-to-eat products we need to focus on research to increase shelf-life, and that's what we are currently doing." The reason most of the recent launches of millet-based products have come from start-ups and not so much the bigger companies is because they are yet to see scale.

Millets are absolutely scalable both from a product as well as a crop perspective, says Ramdev. "When the demand for millets reaches a critical scale, all that you need is 4-6 months to grow them.” Ramdev says that his agenda is to promote healthy food. "We will focus on virgin oils too. We will promote anything that is healthy. The MNCs have forced Indians to eat unhealthy food, we will get the country addicted to healthy food."

Patanjali Ayurved, which acquired Ruchi Soya from the NCLT in 2020, is all set for a ₹4,300 crore FPO. Currently, the ₹30,000-odd crore Patanjali Ayurved Group owns a 98.9% stake in the company and post the FPO Patanjali's shareholding in the company would reduce to 81%. Out of the ₹4,300 crore, ₹3,300 crore would be used to retire debt in the books of Ruchi Soya.

At the time of acquisition of Ruchi Soya, Ramdev had said that his vision was to convert the former into a total foods and nutraceutical company and as part of that it would be moving all the food SKUs that exist under Patanjali Ayurved into the Ruchi Soya fold. Patanjali Ayurved would focus on personal care and ayurveda medicines. "We plan to consolidate the operations of Patanjali and Ruchi Soya to avoid any confusion. Most of the food portfolio will move to Ruchi Soya," explains Sanjeev Asthana, CEO, Ruchi Soya.

The Patanjali group, claims Ramdev, is all set to overtake the country's largest FMCG company, Hindustan Unilever in terms of both revenue and EBITDA. "Ruchi Soya-Patanjali will be bigger than HUL. Wait for our FY22 results, we will be neck-to-neck with HUL," he says.