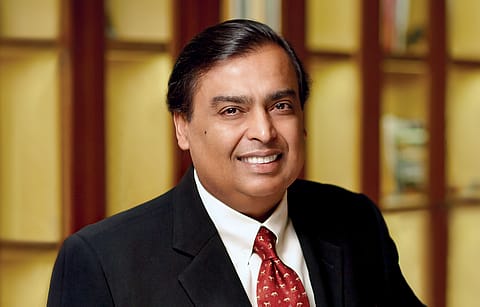

Mukesh Ambani retakes richest Asian tag from Gautam Adani

The spurt in Ambani’s wealth came as the shares of Reliance Industries, which have been rallying for two days, closed near record high on Friday.

Mukesh Ambani has reclaimed the richest person in Asia tag, replacing Gautam Adani on the eighth position among the most affluent billionaires in the world.

Ambani and Adani, the two biggest businessmen in India, have a difference of only $1 billion between their wealth as of Friday, shows the Bloomberg Billionaires Index. Ambani, the chairman of Reliance Industries, has a total net worth of $99.7 billion, whereas Adani commanded a wealth of $98.7 billion.

In the last 24 hours, Adani added $2.96 billion to his net worth, while Ambani added $3.59 billion, as per the billionaires list. Adani, however, remains the most successful wealth creator in the world, adding $22.2 billion to his net worth year-to-date.

The spurt in Ambani’s wealth came as the shares of Reliance Industries (RIL), the largest company in the country by market capitalisation, closed near record high on Friday. The company’s shares closed the day at ₹2,779.50 apiece, up 55 points or 2.02%, compared to their 52-week high of ₹2,855, touched on April 29, 2022. As a result, the company’s market captalisation reached ₹18,80,350.47 crore.

Mukesh Ambani, one of the promoters of the oil-to-telecom conglomerate, holds 8,052,020 shares of Reliance Industries.

Recommended Stories

RIL shares have rallied 6% in two days as the broader market turned positive. Investors have turned optimistic about the conglomerate amid reports that it plans to acquire small and medium-sized consumer goods companies and brands across the country to build its FMCG business which can rival the likes of Hindustan Unilever (HUL), Nestle and P&G. The recent acquisitions also added optimism to the stock.

The financial results for the quarter and year ended March 2022 have also boosted investor confidence in Reliance Industries. For the January-March quarter of 2022, Reliance reported a 22.5% year-on-year growth in its consolidated net profit to ₹16,203 crore on the back of strong performance by digital services and retail segments. The consolidated revenue from operations jumped 36.8% YoY to ₹2.1 lakh crore in Q4 FY22. During the quarter under review, RIL's EBITDA jumped 27.7% to ₹33,968 crore as compared to the corresponding period of the previous year, helped by strong operating performance in retail and digital services business.

(INR CR)

Most analysts remain bullish on the stock in light of these developments. Domestic brokerage firm ICICI Securities had recommended “ADD” rating, with a target price of ₹2,865 per share versus ₹2,960 estimated earlier. Analysts at YES Securities had also given “ADD” call, with a revised target price of ₹2,840 apiece, on sum-of-the-parts valuation (SOTP) basis.