Uncertain future for Biyani’s Reliance Retail deal

The ongoing legal battle between the retail giants has raised several concerns. The delay in sewing up the deal may spell trouble for the cash-strapped Future Group.

There is an uncanny stillness lingering at Knowledge House, the headquarters of Future Group on the crowded Jogeshwari-Vikhroli Link Road, in Mumbai. A day after the Delhi High Court delivered a verdict restraining Kishore Biyani from going ahead with the ₹24,713-crore sale of Future Retail Ltd (FRL) to Reliance Retail, it’s business as usual for a raft of senior employees. But the disquiet is palpable.

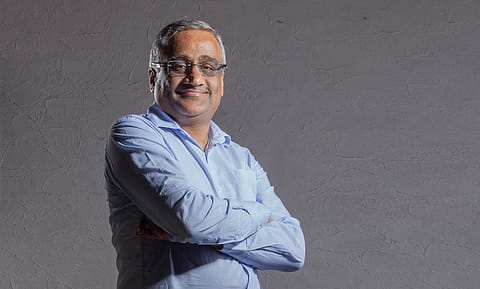

At a town hall meeting a few days ago, Biyani was as poised as ever as the group fought a fierce battle with Amazon after the American e-commerce giant took FRL to an international arbitration in Singapore over an alleged breach of contract. “This is a tussle; am enjoying it,” a senior employee recalls Biyani as saying, boosting the morale of the employees at the town hall. He also promised appraisals and pay hikes to bring their salaries back to the pre-Covid-19 levels and even higher. The group companies had begun settling the long-pending "full and final" dues of all employees who had left. During the pandemic year, the group had seen a dramatic rise in staff attrition.

The Delhi High Court order on March 18, upholding the Singapore Emergency Arbitrator's (EA) order, has predictably raised several eyebrows within the group. The order came on Amazon's plea seeking direction to order enforcement of the award by Singapore's EA. Justice J.R. Midha held that Biyani-led FRL has wilfully violated the Singapore EA's order and directed it not to take further action on the deal. The court directed the presence of Biyani and others in the court on April 28 as well as attachment of their properties. It asked them to show cause as to why they not be detained for three months in a civil prison for violating the EA's order. The court also directed the Future Group and its directors to deposit ₹20 lakh in Prime Minister's Relief Fund for providing Covid-19 vaccines to senior citizens who belong to the below-poverty-line category.

Just a week ago, on March 8, International Women’s Day, a composite group of women employees of the Future Group—the Women of Big Bazaar SOS—appealed to the prime minister and sought his support to protect their livelihoods as the court battle is bound to delay the merger process between FRL and Reliance Retail. The group claimed to represent more than 2 lakh women, including 10,000 employees and another 2 lakh women indirectly earning their livelihoods by working or supplying products to Future Group’s retail chains such as Big Bazaar, Central, and Brand Factory. “Future Retail and Reliance had entered into an arrangement through which Future’s retail stores will continue to be operated by Reliance. Reliance has also committed to clear all debts and dues owed by Future Retail to suppliers and vendors,” said the letter.

Earlier this month, the All India Consumer Products Distributors Federation (AICPDF), a traders’ body, and Public Response Against Helplessness and Action for Redressal (Prahar), a non-governmental organisation (NGO), in an open letter, asked Amazon to “back off” from stalling the deal. They claimed that small vendors and suppliers have become “collateral damage” in the ongoing tussle between Future Group and Amazon. They said around 6,000 Indian small vendors and suppliers have dues worth ₹6,000 crore from the Future Group. “These dues are pending for payment since March 2020. The announcement of the Future-Reliance deal in August 2020 had given us hope that our dues will be cleared soon,” the federation and Prahar said in the letter.

Amazon repeatedly submitted at the Singapore International Arbitration Centre (SIAC) as well as the high court that the Future-Reliance deal was a violation of an earlier deal that Amazon had signed with the Biyani-led group. In August 2019, Future Group had signed a ₹2,000-crore deal with Amazon to sell 49% stake in one of its unlisted firms, Future Coupons Ltd, which in turn owns 7.3% equity in BSE-listed Future Retail through convertible warrants. Amazon claimed that the deal had a ‘call’ option, which enabled it to exercise the option of acquiring all or part of Future Retail’s shareholding in the company, within 3-10 years of the agreement. The deal, according to Amazon, also required Future Group to inform the U.S. giant before entering into any sale agreement with any third party. Final arbitration proceedings at the SIAC are yet to start.

Future Group and Reliance Retail had maintained that the order of the EA was not recognised under Indian laws. Future Group has already moved the division bench challenging the earlier status quo order by the court. It had also moved the National Company Law Tribunal (NCLT) seeking approval of its merger with Reliance Retail.

More Stories from this Issue

The legal fight has been on since October 2020 when Amazon dragged Future Group to arbitration at SIAC. It first filed a plea before the single judge for enforcement of the arbitration order, which came on October 25, 2020. After the SIAC’s EA order, Amazon had written to the Sebi, stock exchanges and the Competition Commission of India (CCI), urging them to take into consideration the arbitrator’s interim decision as it is a binding order. Subsequently, FRL moved the high court to restrain Amazon from writing to the regulators about SIAC’s order, claiming that it amounts to interfering with its agreement with Reliance. By then, CCI, the anti-trust regulator, had already approved the sale of Future Group’s wholesale, retail, warehousing, and logistics business to Reliance Retail.

A single judge on December 21 last year had passed an interim order allowing Amazon to write to the statutory authorities, but said that prima facie it appeared its attempt to control Future Retail was violative of the FEMA and FDI rules.

Reportedly, Amazon had asked for $40 million in compensation from Future Group for going ahead with the Reliance deal.

On March 18, the high court held that the order of the EA was not a nullity as claimed by Future Retail and Reliance Retail and that it was enforceable under Indian laws. As expected, on March 19, shares of Future Retail plunged 10% and hit the lower circuit at ₹55.85 per share on the BSE. Its market cap has tumbled to ₹3,029 crore. Meanwhile, shares of Reliance Industries moved up 3.6% to ₹2,082 per share.

(INR CR)

India Inc. is keenly watching the fight between the retail titans. A further delay in sewing up the deal may spell trouble for the cash-strapped Future Group.