Crude Pains for OMCs to Persist

Given a weak global macro outlook, reports indicate crude prices will stay sanguine in the $75-85 range for the year

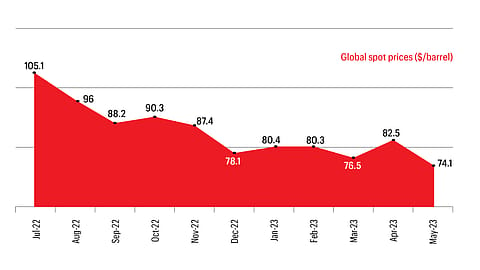

After hovering at record highs, Brent crude prices have lost steam and are down to $75/bbl, currently. Given a weak global macro outlook, reports indicate crude prices will stay sanguine in the $75-85 range for the year. While that is good news for companies whose input costs are based on crude derivatives, it will be a negative for state-owned oil marketing companies (OMCs) which have had to bear the brunt of higher losses in FY23 as they could not hike fuel prices. Analysts expect PSU refiners’ gross refining margins to trend lower at $10.3-16.5/bbl owing to poor crude oil realisation.

Wheat Prices to Sizzle

Though the FAO Cereals Price Index has shown a fifth consecutive monthly decline, prices in India are still elevated. Cereal inflation has reached a new peak of 15% for urban India and 18% for rural India. Prices of wheat and paddy, which account for 80% of India’s total cereal production, are expected to stay high as India is exporting wheat since the Russia-Ukraine war has impacted supply from these two countries which account for 20-25% of global supplies. Food companies will have to take a hit on their gross margins if cereal prices stay elevated.

Weak Rubber To Stretch Tyremaker Margins

Rubber futures traded at 131 cents /kg, holding close to their lowest in 13 weeks, amid ongoing concerns about faltering demand from the biggest consumer, China. Natural rubber prices are now near a two-year low. But the downward trend in prices will improve margins for tyremakers. Analysts predict that for every 10% change in natural rubber, synthetic rubber and carbon black prices, operating profit margin will change by 160 basis points, 80 basis points and 100 basis points for tyremakers.