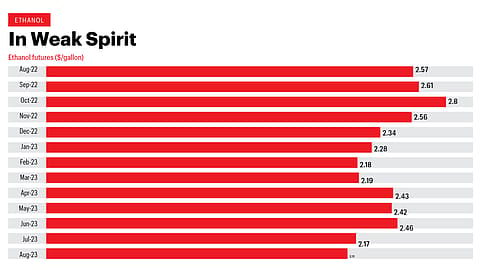

In Weak Spirit

Ethanol futures dropped to $2.11 per gallon, marking the lowest level since February 2022, owing to production expansion, adjusted blending mandates, and increased stockpiles.

Ethanol futures dropped to $2.11 per gallon, marking the lowest level since February 2022, owing to a combination of anticipated production expansion, adjusted blending mandates, and increased stockpiles. The ethanol industry’s recovery from Covid-19 disruptions, aided by clean fuel policies and the expectation of the second-largest corn crop on record. Lower prices is good news for India, a net ethanol importer for industrial, medical and beverage usage. With exports restricted to 120 million litres owing to increased local demand and lower sugar feedstock availability, domestic sugar producers will be left with a bitter taste.

The Zing Is Back!

Copper futures rose beyond the $3.75 threshold, a climb from the over two-month low of $3.6362 reached in August, driven by policy measures aimed at supporting China’s wavering economic recovery. Copper had been rising at the start of the year. The industry is considered a leading indicator of global economic health and is used widely in renewable energy technologies, electronics, vehicles, and electrical grids. Increased prices would impact the margins of Indian electrical goods manufacturers which tend to rely more on imported copper.

Aluminum: The Melting Point

Aluminum futures extended losses to below $2,150 per tonne, the lowest in five weeks owing to uncertainty around global growth. However, demand for aluminum back home is expected to improve as the auto industry is the biggest consuming industry of the light metal. Given the increasing focus on higher per-unit usage of aluminium to improve fuel efficiency and rising spend on infra, ICRA has estimated the domestic aluminium demand growth to remain healthy at around 9% in the next two fiscals.