The Rise And Rise Of Equity Cult

The mutual fund industry in India has witnessed significant growth over the last decade, showcasing the increasing trust and participation of investors in MFs as a viable investment option.

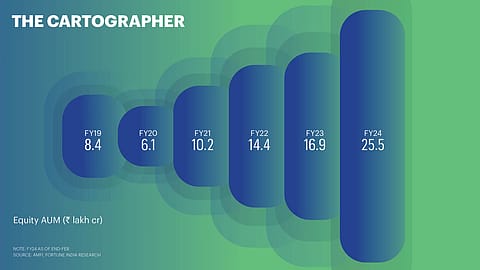

THE MUTUAL FUND industry in India has witnessed significant growth over the last decade, showcasing the increasing trust and participation of investors in MFs as a viable investment option. From February 2014 to February 2024, the industry’s assets under management (AUM) has seen a near six-fold jump, from ₹9.16 lakh crore to over ₹54 lakh crore. This rapid growth is partly owing to the significant rise in equity assets, which now stand at ₹25.5 lakh crore. The equity assets, including equity-linked savings schemes and index funds, have compounded at an impressive rate of 25% since FY19. This growth rate surpasses the 14% rate at which the Nifty has compounded over the same period, highlighting the attractive returns offered by equity mutual funds compared to the broader stock market.