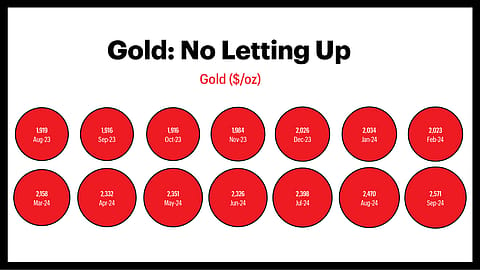

Gold: No Letting Up

Macroscopic review of bullions market.

GOLD HELD STEADY around $2,600 per ounce in September, trading near record highs, largely driven by its appeal as a safe-haven asset amid escalating geopolitical risks. In India, MCX spot gold prices in Mumbai surged to a new all-time high of ₹75,750 per 10 grams last month-end, while MCX Gold Futures for October reached ₹76,000 per 10 grams, setting a lifetime record. Globally, gold prices have risen by approximately 30% this year. According to Goldman Sachs Research, the yellow metal is forecast to hit $2,700 by early 2025, supported by anticipated interest rate cuts in the U.S. and increased purchases by central banks in emerging markets.

SILVER PRICES CROSSED the $30 per ounce mark as heightened tensions in West Asia fueled demand for safe-haven investments. Bank of America projects silver prices to average $28.14 per ounce in 2024, with the potential to reach $35.38 per ounce the following year. Silver has gained over 24% year-to-date, with rising demand for jewellery, industrial usage, and the prospect of interest rate cuts providing upward momentum for the white metal. If the West Asia conflict intensifies, precious metals will continue to see investor interest.

HOT-ROLLED COIL (HRC) STEEL prices have plummeted 33.94%, down to $370.95 per tonne since the start of 2024, according to contracts for difference (CFD) tracking the benchmark market. HRC steel hit an all-time high of $1,945 in September 2021. Domestically, Indian HRC prices have dropped from a peak of ₹76,000 per tonne in April 2022 to ₹51,000 per tonne, their lowest in three years. The decline in domestic prices is attributed to a surge in steel imports, which rose by 38% to 8.319 million tonnes in 2023-24, making India a net importer of steel and contributing to weakened domestic demand. In other words, margins for domestic steel players could be under pressure in the coming quarter.