When Interest Rates Head North…

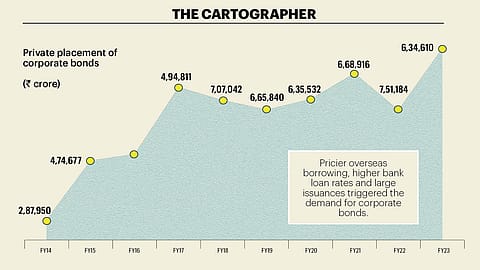

Pricier overseas borrowing, higher bank loan rates and large issuances triggered the demand for corporate bonds.

IDEALLY, A HIGHER interest rate environment should curb the appetite for debt, but the recently concluded fiscal has seen an all-time high mop-up of ₹8.31 lakh crore through private placement of corporate bonds, a 31% spike over the past year. Pricier overseas borrowing, higher bank loan rates and large issuances triggered the demand for corporate bonds. Interestingly, the biggest borrowers were government entities, cornering 40% of the total. Of the top five bond issuers, which raised ₹2.44 lakh crore, the highest mobilisation was by HDFC (₹78,415 crore) followed by Nabard (₹49,510 crore). Not surprising that 59% of the total amount (₹4.93 lakh crore) came at a coupon of 7-8%, while 18% (₹1.47 lakh crore) was in the 8-9% range.