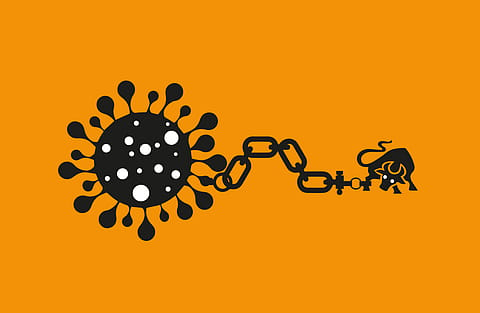

U.K.’s mutant Coronavirus stings Indian equities

Fears over a new strain of the Coronavirus, discovered in the U.K., hit India's stock market on Monday, with benchmark equities witnessing the hardest fall in the past seven months.

For the first two trading hours on Monday, it was life as usual at Dalal Street. The S&P BSE Sensex completed what has now become its daily job of touching a new life-high of 47,055.69 points. The National Stock Exchange’s Nifty 50, too, touched a new life-high of 13,777.5 points.

At today’s 52-week highs, the Sensex and Nifty had gained 95 points (+0.2%) and 17 points (+0.12%) over Friday’s close. Then came the bad news. This time not from Wuhan, but across the continent from the U.K., where a new variation of the SARS-CoV-2—the virus that causes Covid-19—has been causing havoc, and forcing authorities to implement a strict lockdown.

According to experts, the British variant has about 20 mutations, including several that affect how the virus locks onto human cells and infects them. The transmissibility of the variant, based on modelling, is pegged at a whopping 70% higher than average, though there are no laboratory confirmations yet.

While governments got busy sealing borders, and cancelling flights from and to U.K., the bulls in the domestic markets lost their grip to bears. At the day’s low of 44,923.03 and 13,131.45 each on the Sensex and Nifty 50, the benchmark indices shed over 2,132 points (-4.53%) and 646 points (-4.69%), respectively, from the new life-highs hit during the morning trade.

“While the Street was bracing for a correction this week after a sharp up move, the sheer velocity of the fall across broader markets took the bulls by surprise as practically none of the key indices constituents were in the green today," says S. Ranganathan, head of research at LKP Securities. “The new variant of the novel Coronavirus in the U.K. spooked markets as we witnessed intense selling in pivotal throughout afternoon trade,” he adds.

A similar view is echoed also by Ajit Mishra, vice president, research, at Religare Broking. Mishra argues that the markets plunged sharply lower primarily due to unsupportive global cues. “After the initial downtick, the benchmark recouped all the losses but could not sustain at the higher levels as the day progressed,” says Mishra. He has maintained a cautious stance on markets all this while, and reiterates the same for the following sessions too.

For seasoned investors, Mishra suggests avoiding naked leveraged trade in the futures segment, and should instead prefer option strategies until the markets stabilise. “Investors, on the other hand, should utilise this fall and accumulate quality stocks on dips,” he adds.

Recommended Stories

While the benchmark indices took a beating today, the S&P BSE MidCap and S&P BSE SmallCap were hammered relatively more. Before closing lower by over 736 points (-4.14%) and 812 points (-4.57%), the mid-cap and small indices had each lost over 1,044 points (-5.87%) and 1,109 points (-6.23%) at Monday’s lows compared to the day’s highs.

Shrikant Chouhan, executive vice president, equity technical research at Kotak Securities, sees the fall in markets on Monday to have the capacity to erase the gains of the past 11 days. “Nifty could slide to either 13,000 levels, where it has support as per options’ data, or 12,500 which was the highest of the previous up-move (all-time highest levels on Nifty till January 2020),” says Chouhan. “On the higher side, 13,400–13,500 would be the hurdle zone.”

However, there are differing voices. Some feel that a 2,000-point fall on the Sensex, although a worrying factor, they do not think that the bull run is complete. Vinod Nair, head of research at Geojit Financial Services, had expected a higher vulnerability in the market, as the quick gains made in the ongoing rally led to low margin of safety. “Despite which, we do not expect a big correction, rather a consolidation in the short-term, of not more than 7% to 10% in the main indices,” Nair says. “Buying at dips can be considered as a strategy in the falling market.”

Covid-19 apart, selling by foreign portfolio investors (FPIs) is also a probable contributor to the market’s correction on Monday. Deepak Jasani, head of retail research at HDFC Securities, is of the view that a large fall on Monday does not augur well for the week. “Basket selling by FPIs likely triggered the sharp fall in Indian markets,” Jasani says.

(INR CR)

Jasani also adds that the market capitalisation of BSE-listed companies fell by ₹6.64 lakh crore, or 3.6% between December 18 and December 21. At ₹87.9 lakh crore on December 21, the full market capitalisation of the Sensex fell by ₹2.4 lakh crore, in comparison to December 18’s ₹90.3 lakh crore. The advance decline ratio on the NSE on December 21 was the worst since March 23, 2020 when Covid-19 fears were at the peak. “This suggests across the board panic selling/profit booking,” says Jasani. “A breach of 13,209 on the Nifty could result in another 200-250 point fall.”

Akin to Jasani’s belief of FPIs’ contribution to Monday’s market fall, Jaideep Hansraj, MD & CEO of Kotak Securities, too argues that as we head towards the Christmas vacation and calendar year-end, FPI flows are expected to moderate, which could also be one of the reasons behind the steep correction. “Lack of positive news flows has seen the Indian market taking a breather,” says Hansraj. “After all, it’s been a non-stop rally for the past 50 days which started after the U.S. (presidential) elections.”

Going ahead, according to Siddhartha Khemka, head, retail research at Motilal Oswal Financial Services, the market may consolidate in the near-term till the ongoing concerns over the new Coronavirus strain subsides. “However, the overall structure of the market remains positive on the back of abundant liquidity and effective vaccine roll-out,” says Khemka. “The market could also be volatile given monthly F&O expiry this week,” he warns.

While it may be too early for the bulls to say the rally is over, the recent memories of the Covid-19-induced lockdown, and the 52-week low of Sensex—at 25,638.9 points on March 24—are enough to give jitters to investors.