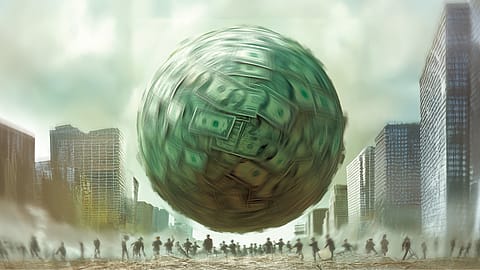

How Spiralling Sovereign Debt Hurts The Poor

Spending on health, education hit as nations work on repayments.

This story belongs to the Fortune India Magazine October 2024 issue.

THE WORLD IS navigating a landmine of debt, riddled with bombs of socio-financial distress. The explosions caused by these lethal trappings often show up as social unrest, civil revolutions and rising tussle in government. Increased social tension and extremist politics stem from unsustainable debt that is preventing governments from spending to alleviate poverty or bridge economic disparities. Record debt and high interest rates have led to social unrest in Nigeria, Kenya, Sri Lanka and Bangladesh. These are manifestations of unequal prosperity generated by high public debt, which restricted the government’s ability to create jobs and spend on social welfare.

A recent UNCTAD report, ‘A world of debt 2024: A growing burden to global prosperity’, sounds an alarm. It highlights an unprecedented surge in public debt — both domestic and external general government borrowing — which reached a peak of $97 trillion in 2023.

The International Monetary Fund (IMF) estimates that at least 100 countries will have to reduce spending on health, education and social protection to meet debt repayments.

This is not the first debt crisis for the world. In the 1990s, Pope Jean Paul II and singer Bono (of rock band U2) had started a crusade of debt relief for poor countries. Their activism was motivated by the plight of debt-ridden African nations whose social welfare systems were paralysed because they were left with hardly any budget to spend on welfare. Neither Bono nor the Pope could have imagined that the same situation would play out in developed nations as well.

Current data from Institute of International Finance Global indicates debt that covers borrowing by governments, households and businesses hit a record $307 trillion in end-2023. Ironically, advanced economies account for the lion’s share. More than 80% of the 2023 debt build-up has come from the developed world, reports Reuters, with U.S., Japan, U.K. and France registering largest increases. The current sovereign debt trap situation is more serious as many of the developed countries that own maximum shareholding in agencies like IMF and World Bank are feeling the pinch.

Roberto Sifon-Arevalo, MD, Global Head-Sovereign & Multilateral Lending Institutions Ratings at S&P Global Ratings, says most sovereign debt accumulation over the past two decades can be largely attributed to government responses to different financial crises, starting with the 2008 Global Financial Crisis and recently the pandemic. Also, the low interest rate environment has been a key factor behind the debt build-up.

Debt Rises, Productivity Declines

More Stories from this Issue

The global debt to GDP ratios were rising for decades before the pandemic. Global public debt (government debt) tripled since the mid-1970s, reaching 92% of GDP or $91 trillion by end-2022, as per IMF. Private non-financial debt tripled to 146% of GDP, reaching $144 trillion in 2022.

China has been a central figure in the increase of global debt in recent times. Similarly, U.S. has contributed to the rise in debt share of GDP. China’s total debt is around $47.5 trillion, still lower than U.S. (close to $70 trillion). In the non-financial corporate debt category, China’s share is 28%, the largest in the world.

The U.S. has amassed government debt of $35.3 trillion and its annual interest payout is a tad over $1 trillion. Moreover, every new dollar of debt now yields a mere $0.58 in US GDP, a stark contrast to $9.80 in the 1960s, as per Bank of America Research.

Rising global debt can hurt global financial stability as debt is rising in the backdrop of slowing economic growth. IMF, in its April outlook report, stated that medium-term growth prospects of the global economy have consistently been revised downward since the 2008-09 global financial crisis. This reflects a downward trend in actual global growth with the slowdown starting in the early 2000s in advanced economies and after the crisis in emerging and developing economies.

(INR CR)

Roberto from S&P Ratings says sovereign debt has increased substantially and credit quality of sovereigns has shown a steady deterioration. “On average, S&P sovereign ratings are almost two notches below the levels they were before the financial crisis and we believe our ratings reflect the severity of the situation, which is not the same in all cases,” he adds.

N.R. Bhanumurthy, director, Madras School of Economics, states advanced countries like U.S. and U.K. are spending money on enhancing social nets through pension and healthcare facilities whereas emerging economies like India are taking debt for investment. “Till the time GDP or economy is growing, absolute debt numbers are not a cause for concern, but emerging nations should fix leakages,” he says. Bhanumurthy points out that populist governments are popping up globally due to rising income inequality as people believe fruits of economic growth have not been equally distributed, which makes him believe debt levels will move up in future as well.

The Cost Of The Pay-Back

The U.N. Report reveals 3.3 billion individuals reside in nations where interest payments exceed spending on either education or health. In Africa, the average person’s spending on interest ($70) surpasses spending on education ($60) and health ($39) per capita. A staggering 769 million Africans, accounting for nearly two-thirds of the entire population, live in countries where interest payments outweigh investments in either education or health.

A world of Debt Dashboard developed by UNCTAD reveals Latin America and the Caribbean show an average public debt-to-GDP ratio of 73.7%, with countries spending 4.4% of GDP on interest payments, which is nearly equal to expenditure on education (5.2% of GDP) and healthcare (4.6% of GDP). Interest payments represent 14.7% of government revenues. And some nations like Sri Lanka are paying over half of their revenue collection (see: The Debt Burden). In 2023, developing nations paid $847 billion in net interest, a 26% increase from 2021. They borrowed internationally at rates two to four times higher than U.S. and six to 12 times higher than Germany.

The rapid rise in interest costs is limiting budgets in developing countries. Presently, half of them designate a minimum of 8% of government revenues to debt servicing, a number that has doubled in the last 10 years.

While in 2010, only 29 nations paid over 10% of revenue as interest payment, in 2023, 54 developing nations (almost half in Africa), dedicated a minimum 10% of government funds to debt interest payments. Number of African countries with debt-to-GDP ratios above 60% increased from six to 27 between 2013 and 2023. Meanwhile, repaying debt has become more costly, and this is hitting developing countries disproportionately.

As per IMF Annual Report 2023, 60% of low-income countries and 25% of emerging market economies are at risk of debt distress. Debt-restructuring processes have been sluggish. Meanwhile, inequality persists within and across countries, and a record 350 million people in 79 countries face acute food insecurity.

Roberto from S&P Ratings believes high debt is a serious problem for several emerging and low-income economies. The increase in interest rates has added a serious complication to a very difficult fiscal position in many of these cases, which sometimes leads to social unrest, like that seen recently in Kenya and Nigeria, he adds.

India At A Glance

As per RBI’s handbook of Statistics on the Indian economy released in mid-September 2024, India’s real GDP growth from FY18-FY24 was 4.8% per annum while real per capita GDP growth was just 3.7% per annum. In the same period, the government borrowed heavily, which shows even this meagre growth was fuelled by excessive government borrowing.

As per budget documents, India’s public debt tripled in the past decade and zoomed from ₹56.51 lakh crore to ₹181.69 lakh crore. Estimated interest payment in FY25 is ₹11.63 lakh crore, which is more than the announced central government spending on infrastructure of ₹11.11 lakh crore.

Interest outgo in the current fiscal is almost equal to central government cumulative spending on defence (₹6.22 lakh crore), health (₹90,659 crore), education (₹1.25 lakh crore), MGNREGA (₹86,000 crore) and food subsidy (₹2.05 lakh crore).

The worrisome part of higher debt is declining per capita consumption in India. In FY14, rolling five-year CAGR of private final consumption expenditure was 13.8%, which came down to 8.6% in FY24, as per DSP Netra September Report. Consumption forms nearly 60% of India’s GDP and it needs to grow at GDP+ pace to kindle stronger outcomes on private capex and the wider economy. On one hand, consumption growth is on a decline while on the other hand, government gross tax collection has almost tripled in the past one decade and scaled up from ₹11.58 lakh crore to ₹33.6 lakh crore. Amid high government debt, a disruptive turn to tax hikes and spending cuts could weaken economic activity, erode confidence and sap support for reform.

Word Of Caution

American investment banker Henry Paulson, who served as the 74th United States Secretary of Treasury from 2006 to 2009, had vociferously opposed the increase in public debt saying, “When you run a company, you want to hand it off in better shape than you found it. In the same way, just as we shouldn’t leave our children or grandchildren with mountains of national debt and unsustainable entitlement programmes, we shouldn’t leave them with the economic and environmental costs of climate change.”

With the climate change crisis intensifying, actions to limit global warming have become urgent. However, developing countries are currently allocating a larger proportion of their GDP to interest payments (2.4%), than to climate initiatives (2.1%). Debt is limiting their capacity to tackle climate change.

More than a decade back, economist Raghuram Rajan had pointed out that availability of cheap credit allows elected representatives to perpetuate the myth that capitalism makes everyone rich. He argued that this myth was a key fault line leading to the financial collapse of 2008, and that it will continue to cause a credit crisis if rising levels of inequality are not tackled by political means.

Unfortunately, the voices of the likes of Rajan and Paulson have been drowned in the popular narrative about debt being good for development. However, the current data that reveals the cost of debt-servicing may also be showing the tell-tale signs of an impending socio-economic doom.