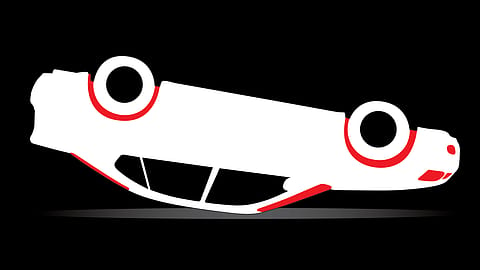

Death of the Sedan

As customers take to SUVs and EV transition picks up speed, the good-old sedan sees a drastic dip in sales.

This story belongs to the Fortune India Magazine August 2023 issue.

ASHISH RAZDAN, a corporate lawyer and partner at Khaitan & Co. in Mumbai, had all along driven a German sedan. Recently, he switched to a Volkswagen SUV. “The most important consideration for buying an SUV was the versatility it offered — comfort and space without compromising on the ride quality,” says Razdan. “The space is handy if you want to take the family and the pets out together, or if you want to load a bunch of cricket kits at the back along with a few buddies.” An SUV also offers high road clearance, especially useful during the monsoon, he adds.

In 2012, the mid-size sedan segment offered over two dozen products that included the Ford Ikon, the HM-Mitsubishi Lancer, Honda City, Hyundai Verna, Maruti SX4, Renault Scala, Skoda Rapid, Tata Manza and the VW Vento among others, according to the Society of Indian Automobile Manufacturers (SIAM). Cut to 2023. There are just seven sedan models, with the SUV category seeing an almost inverse ratio of growth. Today, there are 46 cars in the SUV segment. The sheer magnitude of cars available in the SUV segment is a telling indicator.

Sedans, which had peaked at a volume of 6.5 lakh a year (in a total market of 19 lakh cars), now sell less than 4 lakh annually in a market that has expanded to 38.9 lakh cars a year, according to SIAM. A bulk of the sedans being sold are in the entry-level category where Maruti Suzuki Dzire, Hyundai Aura and Honda Amaze account for 3 lakh of the 4 lakh sedans sold.

The SUV segment that has taken over the sedan’s volumes comprises smaller compact SUVs, mid-size SUVs and large SUVs. While the smaller SUV segment saw market leader Maruti jump in with the Brezza, which drove sales, other categories are growing as well. Maruti now has the all-wheel drive Jimny, apart from Vitara and the Brezza. Shashank Srivastava, senior executive officer, marketing and sales, Maruti Suzuki, says, “We had to launch a vehicle in the mid-SUV category, which was becoming very large. It’s now 22% of the market and includes Hyundai Creta, Kia Seltos, Tata Harrier, Tata Safari and others.”

Compact SUVs, which was about 4-5% of the market in 2016, is now the largest segment, driven mainly by the Brezza, and fuelled by the entry of the Sonnet, Venue, Punch, Nexon, and XUV300.

While motown saw an assortment of upheavals in the last few years — from emissions regulations, supply chain disruptions, inventory shortages to the rise of new EV technologies — one overarching trend has been the fall of the very archetype of the automobile industry — the sedan. Even when it comes to big-ticket launches by companies such as Honda, which have had huge success with the mid-range City, the strategy has shifted to SUVs. Honda recently launched the brand-new Elevate, its competitor to Hyundai Creta.

There are two clear movements in the luxury car market, says Naveen Soni, president, Lexus India. “One, a defining shift towards SUVs over sedans aided by the growth of good road infrastructure where an SUV gives occupants a better sense of security at higher speed, and second, the decline in the average age of buyers.”

More Stories from this Issue

“SUVs are the flavour of the season in every market, which is indicated by the fact that, initially, our ES (sedan) sales were 70-80% of total sales, but now with the stabilisation of products in the category, we anticipate SUV composition to increase from 20-30% to 40-50% in the foreseeable future. Our SUV line-up, including the NX and RX, is gaining popularity and receiving strong feedback,” says Soni.

The emergence of SUVs has impacted all segments of the Indian car market. “But the most notable is on sedans,” says Suraj Ghosh, an analyst who has tracked the industry for IHS Markit. “Throughout the first decade of the century, sedans possessed utmost aspirational value. There weren’t many manufacturers offering proper sedans and that added to the sense of exclusivity for consumers,” adds Ghosh.

Cars such as the Skoda Octavia, Honda Civic, Toyota Camry, Chevrolet Cruz, and the Hyundai Elantra were positioned as top-of-the-line premium purchases. Lower down, those like the Honda City inspired several carmakers to enter the segment but few could come close to Honda’s success, says Ghosh. Examples include the Maruti Ciaz, the Hyundai Verna and others.

“The growth of the sedans peaked in 2010 and stayed that way until FY16 when the car industry was going through major changes, especially the removal of subsidies on diesel and the emergence of SUVs. The SUV juggernaut continues to roll on but the recent sedan launches by the Germans (Skoda and VW), alongside incumbents Honda, Hyundai and Maruti Suzuki somewhat resemble only a mini revival of the segment,” adds Ghosh.

(INR CR)

Even when demand for sedans was at its peak, Mahindra & Mahindra was probably the only automaker who never made a homegrown sedan from scratch. Rajesh Jejurikar, executive director and CEO, says the company will continue to focus on SUVs. “Historically, too, we have been market leaders in SUVs with the Bolero and the Scorpio, and the trend continues.” SUVs will be the mainstay going ahead, driven by changing consumer preferences towards higher ground clearances and seating positioning, he adds.

The net result has also led to new micro segments within the SUV space.

“We assess market needs and introduce appropriate models in the micro segment from time to time,” says Soni. “Our upcoming launch of the Lexus LM is being planned towards the third quarter of this year. With roads and infrastructure improving, people would like to use vehicles which are not only luxurious and enhance their status, but also practical and comfortable, and can be used as mobile offices while travelling. The Lexus LM would be a one-of-a-kind vehicle, especially for travel between cities within a range of 200 km.”

Most agree that SUVs are definitely more comfortable, given their space and ground clearance. “Roads in India are getting better over the years, even in remote corners. Our SUVs give customers across geographies a wide range of choices — from the Bolero to Thar 4X4, Thar RWD, Scorpio N, XUV700 and the electric XUV 400,” says Jejurikar.

Others agree. Gaurav Gupta, deputy managing director, MG Motor India, which has only rolled out SUVs since it launched in the country, says, “the share of SUVs and crossover sales in total passenger vehicle sales was 42% in 2022, up from around 8% in 2011.” That shows the trend of Indians purchasing SUVs only going one way: Upward. MG’s Hector SUV, the first vehicle launched by the company in India, has been a top seller.

“The main reason behind the shift to SUVs is their commanding road presence and elevated driving position, which gives better control to drivers,” says Gupta. “The perception that SUVs are a status symbol also draws customers to this segment. Their high ground clearance lets the driver negotiate Indian roads better,” he adds.

Another reason why automakers also prefer SUVs to sedans is because the former gives original equipment manufacturers (OEMs) juicier margins, which, according to analysts, can range anywhere between 30% and 50% more than sedans and hatchbacks.

One of the advantages of SUVs is their practicality on Indian roads due to their tall and high bodyline, says Gupta. They can be driven in all kinds of roads and terrains and go beyond what regular hatchbacks or sedans can deliver.

Is a preference for more advanced tech also a factor for the decline of sedans? “One of the key factors is the price parity of compact SUVs compared to premium hatchbacks and mid-size sedans. Consumers find compact SUVs to be a more compelling option as they provide a similar price range with added benefits such as higher ground clearance, more interior space, commanding road presence and advanced features, including personal AI (artificial intelligence) assistant and level 2 autonomous technology,” says Gupta.

Experts, however, agree that sedans will never vanish even though they have been marginalised, with their share depleting in the last two decades.

“Amidst the SUV onslaught, sedans offer a fresh and unique proposition to buyers and that’s a big positive working in its favour. However, it will be very difficult to witness another sedan peak in this decade. Even the electric vehicle (EV) transition is inclined towards the SUV body style at the moment,” says Ghosh.

The jury is still out on whether sedans can ever regain their share in the EV era.