'Energy transition is a huge business opportunity'

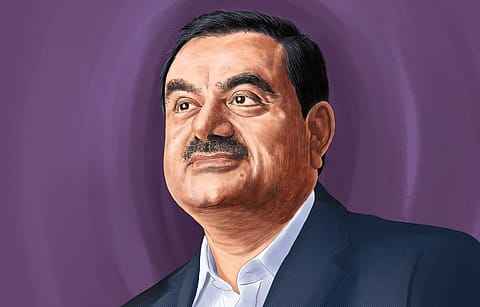

Gautam Adani speaks to Fortune India on what drives his ambition that has stunned the corporate world for his seemingly insatiable appetite for new businesses.

This story belongs to the Fortune India Magazine June 2022 issue.

A Ganpati idol holds a pride of place on the 16th floor chairman’s office of Adani House, the group headquarters in private township ‘Shantigram’ in Ahmedabad. Light semi-classical instrumental music flows in the background in the minimally decorated Chairman’s Lounge. Gautam Adani walks in briskly and settles down at the corner of a sofa with a warm, informal demeanour. He is agile, sports an unflinching air about him and a face that defies that he turns 60 on June 24. Gautam Adani speaks to Fortune India on what drives his ambition that has stunned the corporate world for his seemingly insatiable appetite for new businesses — and a bold $70 billion green mission. Interview by Rajeev Dubey and P.B. Jayakumar

What is the larger vision driving the Adani group?

My vision for the Adani group has always been about nation building. Current global situation offers our nation unprecedented opportunities. Climate change is one of the biggest challenges. But it also opens up huge business opportunities in energy transition — from fossil fuels to renewables and hydrogen. What the world has seen in 100 years of energy forms is set to change in the next 10-20 years. Academia and research are working on how to make green energy affordable. India has a great advantage — geographically, and in producing cost-effective electrons, converting into green electrons. We can be completely self-reliant. India can also eye exporting energy. If India is to grow, we must find ways to increase per capita electricity consumption. We need to sharpen our focus on industries, rather than services and agriculture. Without self-reliance or ‘atmanirbharta’, we can’t serve 1.4 billion people. This is a huge opportunity for India to become ‘atmanirbhar’, and move from ‘atmanirbharta’ (self-reliance), to ‘bharatnirbharta’ (reliance on India). Right now, the world is dependent on what China makes. India can play this role for the world.

How do you bring ‘atmanirbharta’ into energy transition?

We are not going to import anything. Silica (sand) is available here. From silica you can make polysilicon and ingots and wafers. From wafers, you can make PV cells and from the cells you can make solar modules. For making modules, you require glass. You require aluminium frames. About 97-98% value addition can be done within the country.

Will you be able to make all these at the cost of what China produces?

India can produce cheaper than China as their labour costs have increased. This is a huge opportunity and we have to capture it right.

More Stories from this Issue

You announced an even larger $70 billion green investment plan for the next 8 years...

We are the only group to announce huge investments with a 2030 target. This is feasible and the best opportunity for India. We have already started implementing and the manufacturing ecosystem is under development.

We must be willing and capable of capitalising on India’s natural advantages. India is blessed with an abundance of sunshine, which we must economically capture and convert into electrons. At the last COP, Prime Minister Modi announced an enhanced target of 500 GW by 2030 . Quite clearly, India is pushing ahead with green policies.

The government is playing its role. It has announced the right policy structure and is leading the way to ‘atmanirbharta’ with support schemes like the Production Linked Incentive (PLI) scheme. Now corporates need to step up and play their roles in developing the entire green ecosystem. If India commits 500 GW of renewable power, we can’t depend on China for solar panels to create this infrastructure. During Covid, China raised the prices of panels from 18 cents to 30 cents. At 30 cents, your development programme gets stuck and can’t produce cheap electrons. Without cheap electrons, you can’t have a sustainable energy transition.

(INR CR)

How do you pick businesses to get into? You chose energy, logistics, and now you are in so many unrelated businesses…

We follow a model that picks new businesses based on adjacencies to our existing businesses. This ‘adjacency’ business model is a strategy that we have fine-tuned over decades into a hard-to-copy differentiator. Our story is India’s infrastructure story — be it ports, logistics, thermal power plants, green energy, transmission, distribution and now hydrogen. For western economists and management experts who look at core competence, these are diverse industries.

Our core competency is infrastructure. The issue with some overseas companies developing greenfield projects in India is that they expect returns to be provided to them. What one needs to keep in mind is that India is a developing country and, like in any other developing country, one has to take risks and work with the local processes and systems to succeed. You have to be long on India.

What philosophy drives entry into a new business?

We started as a trading house. In 1994, we listed our trading platform. Two years later we realised the issue. People said Adani does not purchase any assets. In their eyes it was a finance or trading company with individual expertise and no assets.

Then India started opening public-private partnerships. We entered ports because we were into trading and were using over 20 ports. That is how our infrastructure journey started. When you have a port and a large tract of land next to it, and being the largest importers of coal, it was natural to get into thermal power plants.

In 2006-07 there was a huge energy crisis. In 2003, the Electricity Act was amended and in 2006, the rules were changed. That is how the cycle with energy started. After 4-5 years of power generation, it was natural to get into transmission and then distribution. When the government started focussing on renewables, we started renewables.

About 10-15 years ago, when the gas policy was not clear, the Gujarat government started piped gas distribution. It was an opportunity for us to develop city gas distribution in Ahmedabad. In 2014, CM Narendra Modi became Prime Minister and visualised what he did in Gujarat for gas distribution for the entire country. We participated in all the bids and won many. That is why we have a huge energy portfolio.

Then we looked at other areas. Delhi and Mumbai airports were privatised after 2005. Airports in Hyderabad and Bangalore were developed by state governments. Then the government came up with privatising six more airports. We thought of it as an extension from ports to airports. These are adjacencies and we entered at the right time. We did not enter telecom because there is no connection for us.

But you entered food and agri business...

We were the largest importers of edible oil. Our partner Wilmar approached us 25 years ago, when we started developing the port. They had the vision of port-based agri-refineries. Everyone sees India as a huge market. When anyone sees 1.4 billion people, it is a huge opportunity. You have to work on tapping the opportunity. As part of adjacencies and areas that are essential to be aligned with the government’s policy and India’s growth, we see media and healthcare becoming big businesses in future.

What about data centres, water management, defence, etc?

Defence is nothing but how to secure our country. To strengthen your economy, you have to strengthen your defence. Otherwise, your economy could go for a toss. After 70 years of Independence, we are still the largest importers of defence equipment. Don’t you think that is a shame?

How do you assess political risks of new geographies? Your announcement of investment in Bengal was a surprise...

I can tell you Bengal is a huge opportunity...Orissa, Jharkhand, etc...somehow it has not been explored to potential. There are many reasons. Once upon a time it was a great state, but it deteriorated. Mamata also understands the same and importance of development of the state. When you want to work with the government, you also have to understand such issues will come.

I am clearly seeing the changes happening in every state. Orissa, Jharkhand, Bihar, Kerala. In infrastructure long-term view is needed. One thing is you go and then go on complaining. I always look at how things are improving and how we can keep working with them. There are positivities and negativities...you have to go with the positivities. In Kerala we start with ₹10,000 crore. In Gujarat we can start with ₹50,000 crore. I can’t look at the political system and what I am going to get in that state. I can’t go everywhere expecting the same treatment I get from Gujarat or Rajasthan. And so, I can’t decide I will not go to Kerala or West Bengal. They also want to start working with you.

How does entry into cement and Holcim fit in with your ESG goals?

We recognise the cement industry needs to be greener. We are positioned to become the world’s greenest cement manufacturer and provide affordability that every Indian consumer needs. India’s per capita cement consumption is 240 kg, against the global average of 525 kg. An apt comparison would be China with per capita consumption of 1,600 kg. Acceleration will come from infrastructure: 100 smart cities, 200 new airports, housing for all, concrete highways and the ministry mandate stipulating minimum 25% of concrete volume in national highways, expressways, the rise of dedicated freight corridors — the possibilities to drive cement consumption are endless. It is a game of supply chain and energy efficiency. Our natural adjacencies look highly attractive. Be it mining, ensuring raw material availability, fuel sourcing, supply of power, or efficient logistic capabilities, all are existing synergies. The ability to utilise fly ash from power plants and use it in cement production is a significant advantage. There could not have been a better way for us to jump-start this business. From the current 70 million tonnes, we expect to reach 100 MT in 3-4 years and 130 MT in six years.