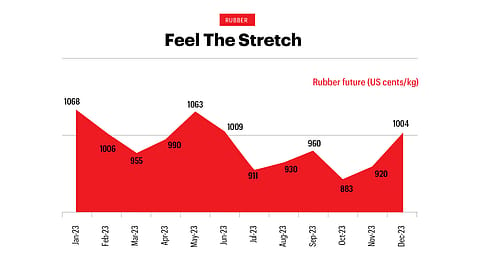

Feel The Stretch

The rise affects the tyre industry and producers of rubber products such as footwear, bearings, and rollers, potentially impacting their profit margins due to higher raw material costs.

This story belongs to the Fortune India Magazine February 2024 issue.

Rubber futures have risen above 1,000 US cents/kg, the highest since July 2022, driven by expectations of increased demand linked to anticipated rate easing by global central banks in 2024. The rise affects the tyre industry and producers of rubber products such as footwear, bearings, and rollers, potentially impacting their profit margins due to higher raw material costs.

The Sheen Is Back

Platinum futures climbed above $950, reaching a six-month high, driven by a weaker dollar and expectations of sooner-than-expected interest rate cuts by major banks in 2024, following weak economic data from the U.S. and Europe. The metal's price is also supported by anticipated supply deficits for 2023 and 2024, with a projected shortfall of 1.07 million ounces this year, according to the World Platinum Investment Council. Used in making detergents, fertilsers, plastics, explosives, and acids, as well as in jewellery, higher platinum prices may reduce demand and impact sales.

A Smooth High

Butter prices have risen by 388 euro/tonne, a 7.53% increase since early 2023, according to the contract for difference (CFD) tracking the commodity's benchmark market. Historically peaking at 7525.00 in April 2022, butter prices are currently at a record high due to reduced production leading to supply constraints, especially as demand surges during the holiday season. Incidentally, India's import of milk products soared by over 1,000% to $4.77 billion, coinciding with a surge in export of fat items such as clarified butter (ghee) to record levels, propelled by high global prices.