Global Luxury’s India Call

India emerges as a major luxury destination as international brands deepen their commitment to the market.

This story belongs to the Fortune India Magazine June 2023 issue.

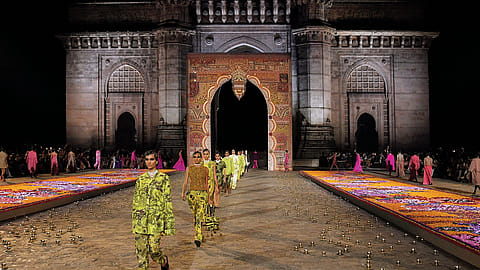

AT THE LAUNCH of his biggest store in Fort, Mumbai, last month, designer Sabyasachi Mukherjee captured the upbeat mood in India’s luxury market. “There used to be a time when India was the backyard of fashion. No more. It’s the front yard,” he said. “This is a great time for India with Dior (which held its pre-Fall 2023 show in India for the first time) and a star-studded event by Nita Mukesh Ambani Cultural Centre (NMACC). You can’t put India in a corner anymore,” With a store in New York City’s West Village and expansion plans, Sabyasachi himself is well on his way to becoming India’s first global luxury brand.

Decades ago, India was the incubator for many of the world’s top luxury houses. Cartier literally built its collections catering to Indian maharajas. Automobile brands such as Rolls-Royce had royal buyers. The Maharaja of Mysore used his Rolls-Royce for state ceremonies (such as visit by Prince of Wales). Maharani of Porbandar is said to have ordered a Packard that matched the colour of her favourite slipper.

The wheel has come a full circle with India taking its place on the world stage. Alia Bhatt is Gucci’s global ambassador. Priyanka Chopra Jonas has been donning Bulgari jewels as global brand ambassador. It’s also a world where Deepika Padukone, brand ambassador for Louis Vuitton, presented an award at the Oscars, while husband Ranveer Singh was invited by Tiffany & Co. for reopening its redesigned crown jewel in New York (‘The Landmark’); he wore a Tiffany & Co. brooch, necklace and rings. Bling is in. Supermodel Gigi Hadid wore an Abu Jani-Sandeep Khosla sari at the NMACC gala in Mumbai.

In fashion and beauty, homegrown luxury beauty brand Forest Essentials opened a store in London last November, one in Dubai this year, and took on Maleesha Kharwa, a Dharavi resident, as one of its new faces.

The steady growth of luxury market is not surprising. The number of Indian dollar-millionaire households is estimated to rise 30% over next five years to six lakh by 2026, says a survey by Hurun India Wealth Report 2021. India also has the third-highest billionaire population globally (145) after U.S. and China, as per a Knight Frank Wealth Report. The size of the luxury market in India is expected to be $8.5 billion by end of 2023, according to Euromonitor. Real estate accounts for the biggest spend with average ultra high net worth individual owning five properties (global average is 4.2 units, says Knight Frank’s Wealth Report 2023).

The Collectibles

India’s luxury market got a push when UHNIs — stuck at home due to Covid-19 — stocked up on collectibles like art, jewellery, watches and accessories, pushing up Knight Frank Luxury Investment Index 16% higher in 2022. Art (up 29%) and classic cars (25%) led. Prospects look good for the two with 59% and 34% UHNWIs, respectively, looking to invest in art and cars globally in 2023.

More Stories from this Issue

Auction houses did some of their largest sales during FY22 with Indians taking part as enthusiastic buyers and bidders. Christie’s says 67% new Indian buyers at global online salesrooms in 2022 were millennials, proving that the younger tech-savvy generation is coming out with a serious intent to buy collectibles online (versus 21% in 2019). Concurrently, Indian art is finding serious buyers internationally. “At our Asian Art Week in New York in March this year, we realised $12 million worth of Indian art,” says Francis Belin, President, Christie’s Asia Pacific. (There were nine artist records, including one for Manjit Bawa’s Untitled, which fetched $1.98 million). “For this, bidders from 12 countries participated,” says Belin, adding: “Of this, 44% were from India, 22% from U.S., 11% from U.K.” India buyers’ contribution by value in global salerooms in 2022 was up 83% from 2019, says Belin.

Global Brands: India Calling

Global giants are also realising the potential of India’s luxury consumer base. In hospitality, the announcement of Hilton’s luxury brand Waldorf Astoria in Jaipur was a major milestone, while the Accor group wants to increase its count in India from 56 to 200 over next three years. A year ago, luxury wellness tourism got a leg-up with Six Senses Fort Barwara (venue of Katrina Kaif-Vicky Kaushal’s wedding), the chain’s second opening since Six Senses Vana in Uttarakhand.

In automobiles, India had one of its best years in 2022 when Audi, Merc and BMW sold 31,277 vehicles compared with 22,771 in 2021. McLaren made its India debut last year with its first showroom in Mumbai where McLaren 765 LT Spider, the most expensive supercar in India, was snapped up for ₹7 crore. The next stop is electric. On January 22, Mercedes-Benz launched its first luxury EV in India, EQC SUV. BMW, while launching its first all-electric i7 this January for ₹1.95 crore, said 30% sales will be EV by 2025. “The BMW i7 demonstrates how an exclusive driving experience can be combined with an unwavering commitment to sustainability,” said Vikram Pawah, president, BMW Group.

(INR CR)

Luxury that’s consumable, like retail, is also booming with foreign players bringing coveted brands into India and foreign retailers like Galeries Lafayette from France setting up shop in Delhi and Mumbai. It will also set up e-commerce operations in India. Reliance Brands India, which has brought in brands like Bally, Ermenegildo Zegna, Emporio Armani, is opening the first Balenciaga (one of the world’s most coveted fashion brands) boutique in India in partnership with Balenciaga’s parent group Kering.

While stores mushroom, online retail has picked up pace. India’s e-tail market is estimated to be $150-170 billion by 2027, according to a report by Bain & Company. This implies 25-30% annual growth and doubling of market penetration to 9-10% over next four-five years. International online retailers are quick to realise that.

This March, Swiss-based TimeVallée launched its first ever digital boutique, in India, with luxury online retailer Tata CLiQ Luxury. It is offering six iconic watch brands (Cartier, IWC Schaffhausen, Jaeger-LeCoultre, Panerai, Piaget and Roger Dubuis). “This is a space where we bring heritage and contemporary luxury together,” Michael Guenon, CEO, TimeVallée, said during the launch. “This is a one-stop destination for watch enthusiasts. We are launching iconic collections online–Cartier’s Tank, Panerai’s Luminor, IWC’s Pilot watches. We have 130 unique pieces and jewellery from Piaget. It’s exciting because in India these price points are moving online,” says Gitanjali Saxena, chief business officer, Tata CLiQ Luxury.

Espousing values of sustainability, pre-loved fashion, which is being embraced by Gen Z, became mainstream when Vestiare, a global online platform for second-hand fashion, got $216 million funding from Kering Group two years ago. The resale market value for apparel, footwear and accessories is $100-120 billion worldwide, according to Boston Consulting Group, which paired up with Vestiare for the study in October last year. “In India, resale is still a new concept whereas international re-sellers are growing from strength to strength,” says Pernia Qureshi, who co-founded pre-loved South Asian fashion platform Saritoria in July 2021 with fashion entrepreneur Shehlina Soomro. It allows users to start selling pre-loved clothing from home. Other pre-loved online fashion retailers include Confidential Couture, Revivify and Retag, where you can get designer brands like Tarun Tahiliani, Anamika Khanna and Anita Dongre. “It’s a win-win for all. You can become an entrepreneur from home by selling pieces in your wardrobe. One can find designer brands at never-before prices. Additionally, you can achieve all of this while supporting sustainable shopping practices,” says Pernia. The global touch, it seems, is here to stay.