HDFC Bank Bets On Cross-selling

A bigger and more stable post-merger balance sheet is creating massive synergies and opportunities in attracting more business.

This story belongs to the Fortune India Magazine July 2024 issue.

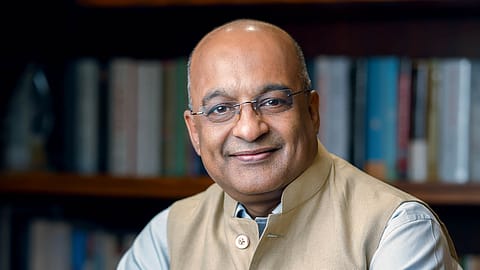

IN HIS NOTE to shareholders in HDFC Bank’s FY23 annual report, Sashidhar Jagdishan made an observation which has not got the attention it deserves — only 2% of the bank’s customers sourced their home loans from it, while 5% did it from other vendors. “The latter is equivalent to the size of our retail book. Home loan customers typically keep deposits that are five-seven times that of other retail customers. And about 70% of HDFC Ltd.’s customers do not bank with us. All these give us an idea about the size of the opportunity,” the HDFC Bank managing director and chief executive officer said while explaining why the merger with parent HDFC Ltd. was a wise decision (though long in the making). While Jagdishan did not mention the technical term for this opportunity, it is cross-sell — the number of products and services hawked to a customer.

The management tells Fortune India the bank is all about “cross-selling across customer segments and within customer segments by networking relationships.” The starting point of the cross-sell game does not matter. What’s important is that once you have on-boarded a customer, she remains hooked on. You may look at cross-sell as air-brushed word for the dated expression, “share of wallet.”

Take HDFC Bank’s home loan synergies now. More than 80% new-to-bank mortgage customers have opened savings accounts with healthy balances, enabling the bank to offer a wider product suite. Consider this: While the long tenure of home loans provides resilience to the balance sheet, the bank is one of the largest consumer durable financiers in the country. “We can easily bundle this with a home loan as a home loan customer has a propensity to buy new consumer durables. This kind of bundling will increase margins. With advantage of lower cost of funds and the phenomenal distribution muscle, it is imperative that we seize this opportunity,” says HDFC Bank. It will be interesting to watch how competitors react to its strategy from here on. Take Axis Bank, which sources more than 80% of its retail assets from existing customers. Three years ago, it made a fresh start with “Aarambh”, a programme to enhance product personalisation and cross-selling.

HDFC Bank could do limited cross-selling earlier as home loan book was with HDFC Ltd. The merger has changed the plot. Let’s pan to the numbers. While year-on-year financials are not comparable due to merger with parent entity HDFC Ltd., net profit for FY24 stood at ₹60,812 crore, up 37.9%. Deposits rose 26.4% to ₹23.7 lakh crore while advances expanded 55.4% to ₹25 lakh crore. Gross non-performing assets were 1.24% of advances in FY24 (1.12% in FY23). The bank’s capital adequacy ratio was 18.8% (19.3% in FY23).

Given the huge opportunity for cross-selling, it is possible that its financials will be turbo-charged in the years ahead. While there is no study on Indian banks’ cross-selling ratio in the public domain, senior bankers put the number at 3.5 (for every customer, 3.5 products are sold.) Wells Fargo is the world leader in cross-selling with a ratio near six. Cross-selling reduces customer acquisition cost and conserves capital.

Of course, it helps that there are also other marquee names within the larger HDFC family to cross-sell: HDFC Life Insurance, HDFC Ergo General Insurance and HDFC Asset Management. “Group HDFC” is a true-blue financial services conglomerate. “And what is important in this suite of products is that most of it is being digitally orchestrated and getting broad-based across other products,” says the bank.

Another factor that will propel HDFC Bank is commitment to technology upgrade and digital transformation through launches like BizExpress, SmartWealth app, PayZapp 2.0. You also have the hinterland, which will be a force multiplier. “The expansion of the branch network reflects dedication to accessibility. It has 8,738 branches; over 50% in semi-urban and rural areas. This enhances reach and brand visibility,” says the management.

More Stories from this Issue

Bigger games are afoot. Jagdishan spelt this out in Annual Report FY24, and it will be visible in full flow in the coming years. “A bigger balance sheet post merger will enable HDFC Bank to take a larger exposure in infrastructure projects. This means we can participate more meaningfully in India’s growth story and contribute to nation building. In light of all this, the pace at which we aim to grow, we could be creating a new HDFC Bank every four years.”

There’s also something to be said of the corner-room occupant, Jagdishan, as a person. Reverse mergers in banking are not new: we had ICICI Ltd.-ICICI Bank and IDBI Ltd.–IDBI Bank. But in both cases, the offsprings, ICICI Bank and IDBI Bank, were much smaller compared to their parents. HDFC merger was a coming together of behemoths. Jagdishan had quite a task on his hands after the exit of his mentor, the redoubtable Aditya Puri, who had led the bank since inception; plus, post merger, Deepak Parekh also signed off from HDFC Ltd. The task of chiselling HDFC Bank 2.0 fell on Sashidhar Jagdishan. He has pulled it off and, in the process, come out of the shadow of the giants.

The self-effacing and media reticent Jagdishan can be brutally frank as well. In his first annual report, he was candid: “In last 28 months, we have been in the spotlight for the wrong reasons when it comes to technology. Also, there have been deficiencies in compliance.” He was referring to Reserve Bank of India banning HDFC Bank from issuing new credit cards, putting on hold new launches under its Digital 2.0 initiative and third-party audit of IT systems.

HDFC Bank’s new avatar will probably be more exciting.

(INR CR)