HDFC Bank Makes A Splash

Bank reports bumper profits as single-minded focus on customer acquisition pays off.

This story belongs to the Fortune India Magazine July 2023 issue.

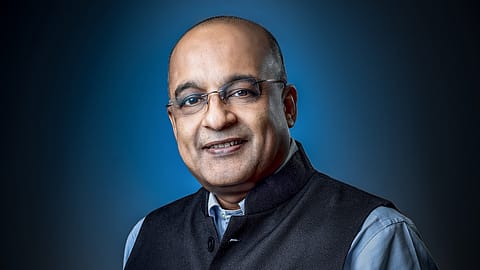

SASHIDHAR JAGDISHAN had baptism by fire when he took over as managing director and CEO of HDFC Bank in October 2020. The largest private sector bank, struggling to regain momentum post first wave of Covid-19, was facing disruptions due to technical glitches, RBI freeze on acquiring credit card customers and ₹1 crore fine for non-compliance with KYC norms. Undeterred, Jagdishan stayed focused on doing the basics right.

Years later, HDFC Bank weathered the storms and emerged as the third most profitable listed company in India after Reliance Industries and SBI in FY23. It posted a 20.9% jump in consolidated net profit at ₹45,997 crore in FY23. Total income rose 22% to ₹2.05 lakh crore. Management cites customer acquisition as one of the biggest reasons for such fast growth. "We have been adding three-five million customers annually for four-five years. In FY23, we acquired almost 12 million customers. This increased product penetration and improved financial performance," says an executive.

The bank tapped rise in discretionary spending after the pandemic to expand its retail book. Rise in borrowings by micro and small enterprises also supported growth. Domestic retail portfolio grew 20.8% in FY23, commercial and rural banking loans by 29.8% and corporate and other wholesale loans by 12.6%. Balance sheet grew 19.2% to ₹24.66 lakh crore. When banks were competing to reduce rates to attract corporate clients, HDFC Bank didn't compromise on margins, he says.

Jagdishan stays shy of cheering profits above the targeted 17-20%. He believes it is par for the course as the bank is well-placed to grow even in difficult times on the strength of its ₹16.14 lakh crore loan book, second only to SBI, and customer base of 83 million. Loan book expanded 16.9% to ₹16.14 lakh crore in FY23 — ₹6.34 lakh crore retail, ₹6.29 lakh crore commercial and rural and ₹4.09 lakh crore wholesale (mostly corporate). The management has traditionally been conservative in accumulating corporate loans as its retail, rural and commercial portfolios have been growing consistently. This helped the bank when corporate defaults shot up. Net NPAs were 0.27% of net advances in March. As economy picks up steam, the bank is looking to expand its offerings and maximise use of technology at branch level. It will focus on customer retention and increasing wallet share of existing customers. Credit card penetration among its customer base is just 21%. Personal and consumer durables loans are at 14%. Vehicle loan is 5% while mortgage is 2%. "Partnership with customers across their lifecycle encompassing relevant financial solutions enabled through predictive analytics and need-based conversations is the endeavour the bank," says Arvind Vohra, group head, Retail Branch Banking, HDFC Bank. Technology and AI will play its part in this transformation. "We want to become paperless in next three-four years," he adds.

Subsidiaries of the bank have also been doing well. A subsidiary, HDB Financial Services, a non-deposit-taking non-banking finance company that offers loans and asset finance products to individuals, emerging businesses and micro enterprises, reported a 93.7% increase in profit to ₹1,959.4 crore in FY23. According to the executive, the bank's business model is not extraordinary. "We know we are in India where 60% economy is consumption-driven. Government spending on infrastructure is high. We are present in every segment of the country's GDP, including consumer, retail, corporate, MSME and agriculture," says another executive.

The management wants the bank to grow steadily at 17-20% but without compromising on margins, returns and risk. "Under-penetration of infrastructure and increase in mortgages and national services offer an opportunity to grow," he says.

Merger Goals

More Stories from this Issue

According to chairman Deepak Parekh, HDFC-HDFC Bank merger will expand balance sheet, increase net worth and credit growth. The merger will lower net interest margins (NIMs) this year, say brokerages. The bank expects NIM, a key profitability measure, to fall to 3.7-3.8% in FY24 from 4.1% a year ago, says a Nomura report. However, lower credit costs and operating leverage will largely offset the impact. The management told analysts they expect to maintain return on assets at 1.9-2.1% for FY24 compared to 2.1% in FY23. The management plans to add over 1,500 branches every year for next four-five years, say the analysts. A significant chunk will be in rural and semi-urban areas, which already account for 52% branches. The bank is looking to increase its deposit base by 1.5-2 times the industry growth.

The merger will help HDFC Bank build its housing loan portfolio. It will also enable cross-selling of entire suite of banking products like car/personal loans, mutual funds and insurance to customers of HDFC Ltd. On the other hand, the bank's platform will provide the mortgage business a diversified and low-cost funding base, thanks to the massive current and savings accounts base. The merged entity will have a balance sheet of around ₹26 lakh crore, though it will still be smaller than SBI's ₹45 lakh crore.

That sure will be the start of a new journey for the bank.