Laurus Injects Tech In Pharma

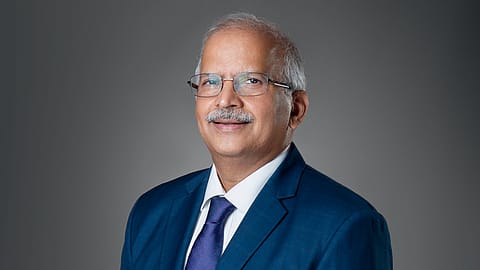

Under Satyanarayana Chava, the company has entered cutting-edge areas such as gene therapy and rare diseases.

This story belongs to the Fortune India Magazine October 2023 issue.

FOR A COMPANY that started with production of active pharmaceutical ingredients (APIs, or key ingredients used to make medicines) just over 15 years ago, Hyderabad-based Laurus Labs has come a long way. Today, it is getting ready to introduce gene therapy products, the first-of-its-kind in India, apart from products to treat rare diseases. “Invest (in capex & technology) ahead of time. That’s our success mantra,” says Satyanarayana Chava, founder & CEO of Laurus.

In June, Laurus signed up with Indian Institute of Technology, Kanpur (IIT-K) to acquire the rights for the institute’s gene therapy products. It will provide a research grant to facilitate launch of gene therapy candidates through pre-clinical development and trials. It will also establish a good manufacturing practice facility at IIT-K’s Techno Park to bolster production of gene therapy products. Gene therapy assets and delivery technologies using adeno associated virus (AAV) vectors that IIT-K is working on are not available in any emerging country. AAV is a virus that can be engineered to deliver DNA to target cells. A vector is a DNA molecule used as a vehicle to carry a DNA segment into a host cell. IIT-K researchers have been developing innovative gene therapies for a number of monogenic (caused by inheritance of single gene mutations) diseases and cancers. “In years to come, the partnership with Laurus Labs will make treatment of some ‘difficult’ disorders affordable,” says Abhay Karandikar, director, IIT-K.

Laurus’ Bio division accounted for an insignificant share of the company’s revenue in FY23. But Chava says it is one of the most promising areas. “If the company has more money than it needs, it will invest more in gene therapy, in rare diseases,” he says.

Chava’s passion for chemistry, drive for quality and a capable team helped him establish Laurus Labs in 2006 as a contract research and manufacturing company. It ventured into APIs and intermediates and later into formulations (final form of medicine). It started investing in biotech and cell and gene therapy two years ago and has acquired a stake in ImmunoAct, an IIT-Mumbai start-up. ImmunoAct is developing first indigenous CAR-T cell therapy, which uses altered T cells, a part of the immune system, to fight cancer. Phase-II clinical trials are over. The company is awaiting approvals from Drug Controller General of India. Laurus has also invested in Bengaluru-based Richore Life Sciences.

“Our company is present in generics, generic APIs, formulations. We are also working with global (biopharmaceutical) companies and helping them carry out phase I/II trials up to commercialisation stage. Our third focus is bio. The division is focusing on making enzymes, animal-free recombinant proteins, growth factors and cell-culture media supplements that are safe, virus-free and sustainable (after Covid, there has been a lot of interest in animal-free ingredients),” he says. Cell culture supplements are additives required for healthy expansion or differentiation of cells. “Our investments in CAR-T and gene therapy are also happening through the bio division. However, two-thirds revenue comes from generics, while bio-division, at a very initial stage, generates only 2%. The rest comes from CDMO (contract development and manufacturing) services,” he says

“We remain positive on Laurus on the back of CDMO segment, limited scope of price pressure in ARV (anti-retroviral) segment and addition of customers and products in non-ARV API/formulations segment,” broking firm Motilal Oswal said in an investor note on July 27. ICICI Direct analysts say growth drivers include global demand for NCE (new chemical entity) substances and setting up of dedicated R&D centre and three greenfield manufacturing units by FY25, scheduled launches in U.S. & Europe with $40 billion target opportunity, increased capacity and commercial scale-up of new fermentation capacity (food proteins).

Investing ahead of time will help Laurus grab opportunities from any shift in supply chain preferences of global companies as part of their China+1 strategy. “When business transformation happens, people don’t have time to wait for 12-18 months. The days of you giving me a commitment and then building production facility are gone. You should be able to say I have the capability to deliver what you want. We took that stand and invested very aggressively in infrastructure. That was one reason we got a lot of business opportunities in last few years,” says Chava. He feels even opportunities such as China+1 may not last long as companies and countries can change policies. “It will be there for a couple of years. After that, China may change policies or companies may grab (other) opportunities. Having capacity to deploy now is the key.”

More Stories from this Issue

Laurus reported ₹6,041 crore net sales in FY23, 22% higher than previous year, with 26% EBITDA margin. Its capex, ₹990 crore, was about 16% of revenues. Close to 20% of its 6,500-plus workforce is into R&D, including about 400 scientists. “That number is significant for a company of our size. We are a research-driven manufacturing company,” says Chava. He says India will become a market that cannot be ignored by global pharmaceutical companies, whose partnerships with Indian firms will continue to increase across the production value chain. “The size of our middle class is bigger than the population of Europe. So, branded companies are not neglecting India for launching products. That trend will increase significantly. The day when people launch (patented) products in India along with U.S. and Europe is not far,” he says.

Laurus, which has partnerships with many global pharmaceutical majors, expects a major chunk of business from global players’ efforts to develop local supply chain and differentially-priced India-specific products. “India is a very diverse market. Even at healthcare spend of 2-3%, when India becomes a $10 trillion economy, its healthcare market will be $300 billion. The Indian pharmaceutical industry is just $50-60 billion today. There are enormous opportunities for companies based out of India as well as big pharma,” says Chava.

The company also puts a lot of emphasis on ESG norms. Chava says some of his global clients prefer to work with companies that focus on ESG. “Our commitment is to give our kids a better environment than what we got from our parents. That’s the way sustainability works,” he says. As part of its environment commitments, Laurus focuses on using renewable energy and energy/water conservation. It is building its own waste water treatment plant. “We also put a lot of emphasis on three Rs — reduce, recover and reuse. We have a very effective solvent recovery and use system, we publish our sustainability reports and we are committed to investing more into that,” says Chava.

Chava, who holds a master’s degree in science from Andhra University, was a research scholar at College of Science and Technology, Andhra University from 1985 to 1992 and went on to get his Ph.D in 1992. He believes the biggest challenge for the Indian pharmaceutical industry will be talent retention. “There is no dearth of money in the country, no dearth of opportunities, but success depends on how one attracts and retains talent,” he says. Laurus claims its overall attrition is lower than the industry average and attrition at manager and above level the lowest in the industry. “I always give credit for growth to my colleagues. The blame, maybe you can take, but credit has to be distributed. I am here because of my colleagues.” This leadership mantra is perhaps what has turned Laurus into an R&D giant.

(INR CR)