Renewing Praj’s Green Pledge

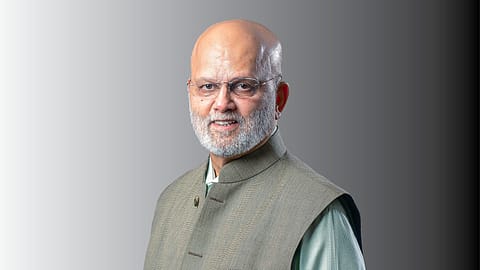

Pramod Chaudhari is getting his company ready to help nations, especially India, shift to cleaner fuels with sustainable chemicals and materials.

This story belongs to the Fortune India Magazine October 2023 issue.

ON MAY 19, Hardeep Singh Puri, Union Minister for Petroleum And Natural Gas, received AirAsia India flight from Pune to New Delhi. It was India’s first commercial passenger flight using indigenously produced blended sustainable aviation fuel (SAF). The SAF used for the flight has been developed by Praj Industries, led by founder and executive chairman Pramod Chaudhari, adjudged the Best CEO in Capital Goods sector, in this edition of Fortune India’s Best CEOs.

Praj, which partnered with U.S.-based Gevo Inc., used an alcohol-to-jet technology for producing SAF from bio-based feedstocks. The four-decade-old Praj made SAF samples at its R&D facility, Praj Matrix. The demonstration flight had 1% SAF blending. “By 2025, if we target 1% SAF blending in jet fuel, India will require around 14 crore litres of SAF per annum. More ambitiously, if we target 5% blending, India will require around 70 crore litres per annum,” Puri said on the occasion. Praj and IOC are launching a 50:50 joint venture to make biofuels, including SAF, ethanol, compressed bio-gas (CBG), biodiesel and bio-bitumen, in India. “We are working out the details of the venture,” says Chaudhari.

Aviation is responsible for about 3% global greenhouse gas (GHG) emissions. International Civil Aviation Organization has released regulations for halving aviation sector CO2 emissions by 2050. Europe and U.S. have already mandated use of SAF. Praj, the only Indian producer, is now looking to build on SAF and other sustainable fuel and chemical technologies to enter a different trajectory. “We are developing two technology platforms to produce renewable transportation fuels, chemicals and materials. That should help us triple revenues by 2030,” says Chaudhari.

Praj has grown substantially over last few years, thanks to focus on offering sustainable energy and engineering technologies. Operational income grew from ₹1,102 crore in FY20 to ₹3,528 crore in FY23. “ It is likely to continue at a healthy rate in next six years,” says Chaudhari. The confidence stems from the size of the order book. Consolidated order book was ₹3,414 crore on March 31. The company got orders worth ₹1,101 crore in Q1 of FY24, 35% from international markets. Profit after tax grew from ₹150.2 crore in FY22 to ₹240 crore in FY23. Profit margins are 6-7% due to heavy investment in research and development (R&D); the company keeps aside about 15% profits for R&D.

Praj is setting up a manufacturing facility to be housed into a new subsidiary, Praj GenX, near a major port in western India with capex of ₹100 crore to tap the growing opportunities in ‘energy transition and climate actions’ segment. “It is an existing facility which is being rebuilt. We hope to commission it by March,” says Chaudhari. Praj has four manufacturing facilities — two in Kandla, one in Wada near Mumbai and another at Sanaswadi in Pune — with total fabrication capacity of more than 16,500 tonnes per year.

More Stories from this Issue

Praj has also developed technology to produce a bioplastic, polylactic acid (PLA), as part of its ‘bio-prism’ renewable chemical and material product basket. PLA is a polyester made from renewable biomass, typically fermented plant starch like corn, cassava, sugarcane or sugar beet pulp. To accelerate commercialisation of bioplastics, Praj is setting up a demo plant for PLA at Jejuri on outskirts of Pune. This pilot facility will be used for production of food-grade lactic acid and PLA. The company is scouting for partners. It is also trying to develop bio-marine fuels, says Chaudhari.

A mechanical engineer from IIT, Chaudhari decided to pursue his entrepreneurial journey in 1983 by foraying into agro-processing solutions. ICICI Venture funded him after five years. This helped Praj set up an ethanol-based R&D centre. It also developed in-house starch and grain-based technology and engineering solutions and diversified into synergistic fields like brewery engineering. Praj went public in 1994. Soon, it started getting international orders, initially from South East Asia. It entered Colombia after that and cornered over 70% market share in ethanol in India. It built U.K.’s largest ethanol plant for Vivergo Bio Fuels and got contracts in Belgium. At present, it has more than 1,000 footprints in over 100 countries in five continents. In 2009, the company set up a cellulosic ethanol pilot plant, a key development for migrating to second generation (2G) ethanol plants. Praj was the only Indian corporate to have an integrated bio-refinery demo project and is now executing three commercial 2G plants for oil marketing companies IOC, BPCL and HPCL. It was also the first to start an integrated demo plant for CBG.

(INR CR)

Apart from this, Praj forayed into critical process equipment and systems as well as wastewater treatment solutions, and in 2012 acquired Neela Systems, a specialist in hi-purity water solutions. Another business Praj is building is complex pharmaceutical machinery; it now generates over ₹300 crore revenue a year. The company now has a diverse portfolio of sustainable solutions comprising bioenergy, critical process equipment, breweries, zero-liquid discharge systems and high purity water systems. High complexity of the technology and tricky fermentation processes are entry barriers, says Chaudhari.

There are many tailwinds for the company, say analysts. The Centre’s focus on ethanol blending is expected to help Praj get massive business from India. India’s Ethanol Blending Programme (EBP) aims for 20% ethanol blending (in petrol) by FY26; it is now 10-12%. EBP was launched in January 2003 with sale of 5% ethanol blended petrol in nine states and four UTs. In 2006, it was extended to 20 states and four UTs. However, challenges such as lack of permission to convert grain to ethanol, high tax on ethanol and limited availability of feedstock and infrastructure delayed the plans. Government came up with the National Policy On Biofuels in 2018 and further amended it in June 2022 to give an impetus to EBP.

Demand for ethanol in U.S, Brazil, Mexico is also going to rise in view of climate mandates. Praj has orders for five large CBG projects worth ₹500 crore from a leading business conglomerate which are expected to be built over next 15-18 months. IOC has also showed interest in 30 CBG projects across the country; Praj is going to be a leading contender. It has large non-bio-energy engineering orders in its various businesses. Praj GenX, a subsidiary for addressing ‘energy transition and climate actions,’ is expected to have a revenue potential of ₹1,500 crore, says Prathamesh Sawant, an analyst with Axis Securities. The brokerage predicts Praj’s revenues will grow to ₹4,033 crore in FY24 and ₹4,561 crore in FY25.

With that kind of climate transition opportunities on the horizon, Praj under Pramod Chaudhari is likely to scale new heights in sustainable businesses.