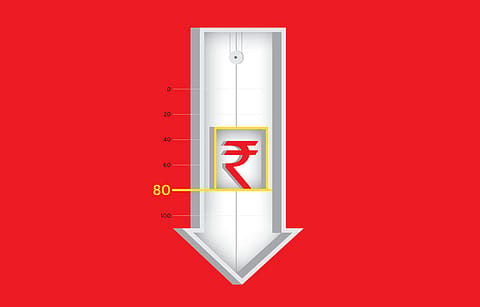

The Brief: Rupee At 80: Is This The New Normal?

The U.S. rate hike trajectory and crude oil prices to keep currency on the boil for now.

This story belongs to the Fortune India Magazine August 2022 issue.

“I have learnt that it’s foolish to make a forecast. In these turbulent times, you have to be insane to predict a rate and a date for the rupee!” The comment from forex expert Jamal Mecklai, founder of Mecklai Financial Services — a firm focused on treasury risk management, just goes to show the abstruse outlook experts have on the partially convertible rupee.

On a constant slide for the past 14 weeks, the rupee on July 15 briefly crossed 80 for the first time against the dollar, even as the greenback gained parity with the euro, a first in two decades. The fear is that the rising interest differential will further weaken the rupee as the market expects the U.S. Federal Reserve to opt for a further hike post the 75-bps hike on July 27 meeting as inflation remains red hot — hitting a four-decade high of 9.1% in June. The Fed’s actions come in wake of the geopolitical crisis that has also kept crude oil prices on the boil, above $100.

But unlike the U.S., India remains vulnerable to crude prices with 85% of its daily requirement of 5 million barrels being met through imports. The worry is that if prices average $100 per barrel against the Union Budget estimate of $75, GDP growth will be hit and fiscal deficit will rise significantly. Reserve Bank of India (RBI) estimates show that a 10% spike in oil prices can depress real GDP growth by 20 basis points over the baseline.

The fear is already showing up in the currency, which has fallen 5.06% (₹4.01) paise since the Russia-Ukraine crisis began on February 24, taking its calendar-year decline by 7% against the greenback to 79.27 (as of July 29). However, the depreciation in the rupee has been much lower than that seen during previous episodes such as the global financial crisis of 2008 and the Taper Tantrum of 2013. (See: Losing Currency).

The fall is also being precipitated by foreign portfolio investors rushing for the exit — taking out ₹2.18 lakh crore from equities year-till-date, higher than the cumulative flows seen between May 2020 and March 2021. As a result, the RBI has had to intervene in the forex market, which has further pulled down forex reserves to $580 billion from $620 billion in July 2021.

Indranil Sengupta, economist and head of research at CLSA India, believes the RBI can’t do much in the current scenario. “There is no point intervening in a cross-currency move, this is unlike 2013-2018 where it was a rupee movement rather than a dollar movement. In the current scenario, it is the dollar that has significantly appreciated to hit an all-time high.”

With earnings downgrades likely to kick in post Q1 FY23, foreign portfolio investors (FPIs) will continue to sell equities and if the Fed prepones its hikes, even the debt market could see outflows. Already ₹16,187 crore has gone out from this segment.

More Stories from this Issue

Mecklai believes the Fed is way behind the curve and the hikes are too late in the day. “Unlike the Volcker era in the '70s when the Fed aggressively hiked interest rates, the Fed of today is mollycoddling the markets by assuring participants about a quarter-to-quarter bps hike. The Fed is way behind the inflation curve and will have to aggressively hike much beyond what it has budgeted.”

That means more pressure on the rupee. On a real effective exchange rate (REER) basis, the currency stood at 104.90 as of May, which indicates it is still overvalued since an index reading of over 100 indicates overvaluation. According to a Citigroup report, the central bank is unlikely to let it slip past 81.

The central bank’s data show that it has sold $16 billion worth of dollars in the spot market to protect the currency even as it depleted its forward dollar book by another $16 billion in the two months through May. But can the RBI continue to sell dollars in the event of a global market sell-off, or if the geopolitical crisis spirals out of control?

Too much intervention, however, will stir a hornet’s nest. In April 2021, the US retained India on its watchlist of currency manipulators, after first putting it on the list in December 2020. Ila Patnaik, an economist and a professor at the National Institute of Public Finance and Policy, mentions in an article that defending the exchange rate by selling reserves only heightens speculation around the currency. “When people see that the RBI is selling reserves, they expect that when reserves will fall to a very low level, the central bank will be forced to stop intervening and the currency will weaken. Foreign as well as domestic investors start taking money out before this event materialises. Their speculative attack on the currency ends up hastening the currency depreciation,” writes Patnaik.

(INR CR)

While being dubbed a speculator is least of its concern, the most challenging task for the RBI would be to tame inflation without further hiking interest rates.

“Given the negative gap between the estimated optimal and actual forex reserve, the RBI’s ability to prevent rupee depreciation and still manage low rates amid growing inflationary pressure looks very tricky,” says Dhananjay Sinha, managing director and chief strategist at JM Financial.

Mecklai sees downward pressure on the rupee as long as inflation remains on the boil in the US. Back home, higher dollar demand from oil importers amid elevated crude oil prices will keep widening the trade deficit.

But Sengupta believes the RBI has more firepower to prevent the rupee from sliding considering that combined forex reserves (including forwards) is in the range of $630-640 billion. “We have room on the reserves to go down further to $590 billion,” says Sengupta.

But more than intervention, he expects the dollar to cool off. “Once the European Central Bank rate hike kicks in, you will see a tempering in the dollar. A stronger dollar will not help the US economy either,” feels Sengupta.

While Mecklai does not want to hazard a guess on where the rupee will be in the interim, Sengupta sees the currency coming back to 76.50 levels by March 2023. “In the short-term, it is anybody’s guess where the rupee will go, but by March a combination of factors — ECB hike, crude price weakening and trade seasonality easing in the second half — will push the rupee back,” says Sengupta.

While March is still some time away, the rupee’s roller-coaster ride will continue.