The Gold Rush for India's SuperApp

One ring to rule them all. More accurately, one app to serve them all. For the country’s largest conglomerates, blue-chip banks and e-commerce majors, the SuperApp is the next battleground.

This story belongs to the Fortune India Magazine February 2022 issue.

Late last year, when billionaire entrepreneur Gautam Adani announced his undisclosed investment in online travel aggregator Cleartrip — part of the Walmart-owned Flipkart group — the motive was explicit: to build a SuperApp by bundling a host of services on a single platform. For Adani, it means encapsulating an empire spanning fast-moving consumer goods [FMCG], power & gas utilities, airport management, data centres, ports and real estate. “The Cleartrip platform will become an essential part of the broader SuperApp journey we have embarked upon,” says Gautam Adani, chairman, Adani Group.

Besides Adani, the who’s who of India Inc. have embarked on to the next frontier in e-commerce—the SuperApp. Clouded in secrecy, some of India’s biggest conglomerates, etailers, banks and aggregators are capitalising on the growing App-fatigue to deliver an all-inclusive digital experience to consumers with an eye on their loyalty — and spending power. Their weapon of mass invasion: the SuperApp.

Reliance Industries Ltd. [RIL], the Tata group, Amazon, Flipkart, and Paytm are keeping the details of their SuperApp close to their chest but their actions leave a trail of their aspirations. Even large banks such as the State Bank of India, HDFC Bank and Kotak Mahindra Bank see it as a natural extension of their businesses.

In an age defined by hyper-targeting, hyper-personalisation and multi-platform consumers, the power of one is increasingly the superpower that everyone is after, says Piyush Sharma, executive-in-residence, UCLA, and a C-suite+ and start-up advisor. And that power can come from a SuperApp.

The opportunity is being thrown open by India’s booming consumer digital economy. Pegged at $90 billion in 2020, it is projected to be an $800-billion market by 2030, of which online retail will be a large slice, according to a RedSeer report. The online retail market is likely to grow to $350 billion in gross merchandise value (GMV) — the value of goods sold on a platform, barring discounts and returns — over the next decade from $55 billion this year. No consumer company can afford to miss this pie. According to an Ericsson Mobility Report, India already has 810 million smartphone subscriptions which will drive the app usage.

SuperApp 1.0

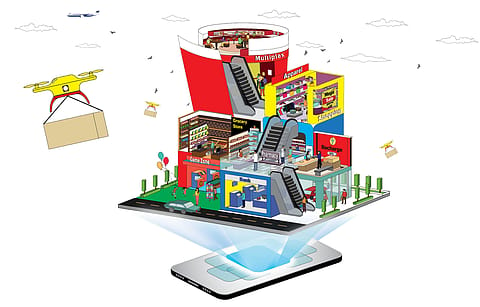

What is a SuperApp — a term coined by Blackberry founder Mike Lazaridis in 2010? It is a one-stop virtual platform that offers the convenience of diverse products and services such as marketplaces, ride hailing, food delivery, financial services, online messaging, social media, utilities and others under one umbrella. The best exponents of a SuperApp are Chinese tech conglomerate Tencent’s WeChat and Alibaba’s Alipay. Reason: The convenience of using a single app for any product or service a customer may need on a daily basis. Another one is Indonesia’s Go-Jek that started off as a two-wheeler ride-hailing service. Today, Go-Jek, which has expanded to Vietnam and Singapore, is used for ordering food, digital payments, shopping, hyper-local delivery, getting a massage and two dozen other services.

More Stories from this Issue

“A successful SuperApp will be more than just a platform-based business model. It will first need a killer habit for high-frequency usage with zero friction. Think WhatsApp or Paytm. On top of that, it will need to bring together a unified ecosystem. Think [RIL’s] Jio and its latest play for bundling over-the-top [OTT] streaming platforms,” says UCLA’s Sharma.

SuperApp will cover at least 40-50% of online transactions made by a large customer segment, adds Arpit Mathur, Partner at AT Kearney.

In The Race

Mukesh Ambani’s RIL has taken rapid strides in the past year-and-a-half towards consolidating services and products under its Jio umbrella — e-commerce (grocery, shopping, pharmacy, furniture), OTT, payments, ticket bookings and Cloud storage services. It built its own e-commerce platform JioMart — a joint venture between Reliance Retail and RIL’s digital services arm Jio Platforms. JioMart delivers grocery and daily essentials through a scheduled delivery model from nearby stores.

(INR CR)

In the September quarter of FY22, Reliance Retail Ventures, a subsidiary of RIL, inked a couple of key deals to bring in more categories under its retail platform. It acquired online grocery store Milkbasket, local search engine platform Justdial, home-styling company Portico and a controlling stake in Ritika, the holding company of fashion house Ritu Kumar. It also entered into a franchise agreement with 7-Eleven Inc. for the launch of its convenience stores in India. In FY21, Reliance Retail acquired online pharmacy store Netmeds and furniture retailer Urban Ladder, and in January 2022 bought a 25.8% stake in quick commerce player Dunzo for $200 million (around ₹1,488 crore).

The company’s MyJio app is an integrated platform with mobility, fibre services, e-commerce, e-medicine, OTT, music, games, bill payments and UPI, and also connects to JioMart. In addition it offers chat, conferencing, entertainment and news.

Keeping RIL company is the salt to software major, the Tata group, one of India’s oldest conglomerates. It is also quietly working towards its ambition of building a SuperApp — Tata Neu — expressed in no uncertain terms by chairman N. Chandrasekaran. In June 2021, Tata Digital — which set up operations in August 2019 to build consumer-centric digital businesses across multiple verticals — named Mukesh Bansal, co-founder and CEO of CureFit, as its president. It is testing out Tata Neu first among its employees, even as the group continues to add new components to the App. In May, Tata Digital acquired a majority stake (around 64%) in online grocery store BigBasket for $1.3 billion. It also invested $75 million in healthcare and wellness start-up CureFit and acquired 1mg, an online healthcare marketplace.

Last year, Tata Consumer Products bought Kottaram Agro Foods — the maker of Soulfull brand of breakfast cereals and millet-based snacks — to back its e-commerce business. Tata Digital’s recent deals could be a precursor to the group’s larger plans of building the SuperApp encompassing grocery, healthcare, retail, travel, bill payments, e-medicine, e-learning, financial services, and fashion among others, say experts. It also has a bunch of software applications being created by Tata Digital and TCS. Tata Digital declined to comment on the details of its SuperApp.

Meanwhile, Adani has entered the fray. In September 2021, Adani Enterprises set up a wholly-owned subsidiary, Adani Digital Labs, with the object of transforming consumer businesses to digital-first businesses by creating an omnichannel, integrated platform enabling customers to interact with all B2C businesses of the Adani Group. Spearheading the Adani digital play is chief digital officer Nitin Sethi, who was with IndiGo earlier. The acquisition of a stake in Cleartrip in end-October was among the first moves by the group to create the SuperApp.

The Shriram Group, which is in the process of merging Shriram City Union Finance [SCUFL] and Shriram Capital with STFCL to create one of the largest non-banking financial companies [NBFCs] in the country, is also planning to launch a SuperApp for its financial products as well as for selling products of its partners — a comprehensive platform for purchasing all types of automobiles at discount, besides accessing financial products, including loans, mutual funds and insurances. The work for building the app has started, says Y.S. Chakravarti, chief executive officer, SCUFL. “We will be building digital marketplaces at every company in the group, and will add businesses until the merger process completes. These individual applications will be combined to form the SuperApp after the merger. Customers will be able to buy products and avail services from the SuperApp,” he adds.

FMCG major ITC has been an early mover in creating an agro SuperApp. During the annual general meeting in August 2021, chairman Sanjiv Puri had said the company will launch ITC MAARS (Metamarket for Advanced Agriculture and Rural Services) to offer agricultural solutions to small farmers. “ITC-MAARS will lend new wings to ITC e-Choupal and create a robust ‘phygital‘ ecosystem to deliver seamless customised solutions to farmers, anchored by FPOs, while creating new revenue streams, strengthening sourcing efficiencies and powering the company’s brands. It will offer a ‘full complement’ of agricultural solutions while its micro services structure will enable plug-ins for a range of agri-tech solutions. This comprehensive suite encompasses hyperlocal services, AI-based personalised advisories, as well as online marketplaces,” he had said. He also announced the company’s plans to invest $2 billion (around ₹14,851 crore) as part of the ‘ITC Next’ strategy, a part of which would be used to identify “new growth areas” such as plastic substitute and ITC MAARS.

The Mahindra group is also planning to integrate agriculture, finance, automotive and even used cars and tractors under one app, but prefers to call it the Farmer App.

And it’s not only conglomerates. There are others as well. Take e-commerce giant Amazon for instance. Though it has officially not talked about developing a SuperApp, over the last one-and-a-half years, the e-tailer has made aggressive moves to build a larger ecosystem of services under one roof. It plans to bring one million offline retailers, mostly small local shops across the country, on its online marketplace by 2025. In April 2020, it launched a programme to digitise businesses of small local shops. Amazon claims over 50,000 shops across 450 cities on its platform. It has launched a $250-million venture fund, which helps in digitisation of small and medium businesses. Amazon has also ramped up Amazon Pay offerings such as ticketing and bill payments services, besides launching a food delivery service in Bengaluru in 2020.

“Amazon is a customer obsessed company…Today, 100s of millions of customers trust Amazon for multiple needs in addition to shopping. From paying their bills, sending money, buying flight tickets, ordering food from restaurants, medicines from pharmacies, to playing games and winning rewards, accessing Prime Music, video and much more,” says Kishore Thota, director, customer experience and marketing, Amazon India. “Our focus remains on making it easy and convenient for our customers to fulfill all their needs through the Amazon app, while building new cases which customers would value,” he adds.

Its streaming video platform, Amazon Prime Video has launched Prime Video Channels, a video entertainment marketplace that brings together premium content from multiple partners on the Prime Video app. The customer engagement strategy is hardly unique. The online consumer is typically vendor-agnostic, and that’s the reason the e-commerce marketplace has become a hunting ground for the best offers and services.

Walmart-owned Flipkart, which did not discuss its plans, has also gone hyperlocal in the last one-and-a-half years through its Flipkart Quick and Flipkart Wholesale services besides running one of India’s largest marketplaces. Launched in Bengaluru last year and currently available in Delhi-NCR [National Capital Region], Hyderabad and Pune, Flipkart Quick offers a 90-minute delivery service for Covid-related essentials, fruits, vegetables, grocery and other items. Flipkart Wholesale, an online business-to-business [B2B] marketplace, serves over 1.5 million customers across the country.

But all SuperApps are not necessarily being built ground-up. Instead, aggregator SuperApps will be collaborative. Digital payments services firm PhonePe allows partners Ola, redBus, Swiggy, Grofers, AJio, booking.com, Decathlon, and Delhi Metro to integrate their existing apps or mobile sites onto a single platform. Consumers can access different categories such as food, grocery, wellness, shopping, entertainment and travel on its Switch platform. The company — which has the largest share in terms of unified payments interface [UPI] transactions among third-party apps—has over 300 million registered users.

Paytm has not hidden its ambitions of creating a SuperApp. The fintech major realised early that payments is a utility driven business and people use it for different purposes. The Noida-based company decided to enter categories where the frequency of payments is maximum — shopping, food, telecom, utility, and transportation. Today the Paytm ecosystem covers categories such as payments, e-commerce, insurance, and others into one app.

Meanwhile, banks have also understood the potential of a single portal with multiple offerings, since banking is no more about plain vanilla financial products and services. Top-tier Indian banks are pepping up their mobile apps with virtual e-commerce sites offering discounts and deals. The motive is to build customer stickiness. Like large retailers, e-commerce and fintech players, banks are now vying for customer wallets to cross-sell products beyond financial services.

Take, for instance, State Bank of India [SBI], the country’s largest lender. It now allows customers to apply for loans, invest in mutual funds, buy insurance, do shopping and travel bookings, avail pharmacy and diagnostic services — all on its mobile banking and lifestyle app Yono [typically referred to as You Only Need One]. ICICI Bank’s iMobile Pay app is also positioned as a one-stop platform, which provides banking services, utility bill payments, offers on shopping, travel bookings and dining to customers of any bank.

SBI chairman Dinesh Kumar Khara explains why the bank’s digital platform Yono is a SuperApp. “It has three broad components — banking, subsidised products and a marketplace.” At present, SBI has a customer base of over 450 million, of which only four million have registered for the Yono app. The bank has around 90 million online customers. So, there is a lot of room for the lender to grow its user base for the app.

India’s third-largest private sector lender Axis Bank’s online marketplace Grab Deals — also accessible through its mobile app — has around 45 partners across multiple categories, including Amazon, Flipkart, Ajio, Tata Cliq, OYO, Pepperfry, Zomato, Tata 1mg, and others. Sameer Shetty, president and head, digital business and transformation, Axis Bank, points out that shopping events on Grab Deals — launched in October 2020 — helps the bank facilitate increased interaction and engagement, with the customer boosting the usage of the bank’s payment instruments such as debit and credit cards during a transaction. “The idea was to have a one-stop solution for customers. Given the footfall and trend, the platform has seen positive response from customers and merchants,” says Shetty.

Similarly, Kotak Mahindra Bank’s KayMall allows consumers to shop and transact across verticals such as digital banking, online shopping, travel and hotel bookings, and magazine subscriptions. Kotak has over 10 partnerships with key players across categories in e-commerce.

“Our focus at Kotak [Mahindra Bank] is to transition from offering our customers a mobile banking app to offering an integrated platform and ecosystem experience. We started to look at use cases that involved not just helping customers manage their money and facilitating transactions, but also encompassing lifestyle and consumption habits,” says Deepak Sharma, president and chief digital officer, Kotak Mahindra Bank.

Experts feel while super apps developed by banks would help financial institutions analyse customer behaviour and spending patterns to cross-sell products, a lot would depend on user experience as well. It should function with minimal hassle, slicker and simple interface for easy navigation. The app shouldn’t be clunky and slow.

“A customer will come to a single app to do multiple tasks only when the user experience is seamless. It all depends on quality of service. That is the reason we have not seen a true SuperApp in India yet,” says a venture capital investor.

Challenges Ahead

Building a SuperApp is a long-term play which requires heavy investments, partnerships and collaborations. It takes at least a decade to build a SuperApp into a considerable size.

Globally successful SuperApps have been largely modelled around grocery, hyperlocal delivery, social media, messaging, foodtech, mobility, and digital payments. Indian SuperApp ambitions —though still vastly under wraps — appear to be following that pattern too.

Analysts say any large business can build a version of the SuperApp, but it is most difficult to pull off. In the end, probably one or two SuperApps may emerge. “Execution at scale is key to how a SuperApp will unfold,” says Ankur Bisen, senior vice president, retail and consumer products, Technopak, a retail consultancy firm.

Conglomerates like Reliance and the Tata group will have an edge over others due to sheer scale. They have a deeper assortment of products and services and a robust supply chain. “To have a successful SuperApp, one needs to have deeper market penetration,” says an analyst.

“To be a SuperApp, a company will need a high user base, core high frequency use case and resources. Only if more people use the app, can a company cross sell other services and create more use cases,” says AT Kearney’s Mathur. “The challenge in India is the depth of the market. Companies may find it difficult to have a paid user base beyond the first set of 20-30 million people. They will then have lesser resources to go after the next use cases.”

Agrees Mohit Mittal, partner, technology and internet at Praxis Global Alliance. “A ‘one-size fits all’ approach may not work due to the sheer diversity of India. Unlike China where people are largely consistent in terms of their shopping behaviour, Indians like to explore various options as they look for discounts, coupons and other offerings before reaching a purchasing decision,” he adds.

“But even those apps may not be a winner-take-all market,” says Ankur Bisen, “They will be catering to a certain set of consumers.”

Outside China, two SuperApps have emerged from leading ride-hailing platforms: Indonesia’s Go-Jek and Singapore’s Grab, which now offer a range of other services. In India, too, players like Ola are looking to build their own SuperApp. “The most sophisticated apps like [Tencent’s] WeChat and [Alibaba’s] Alipay in China bundle together online messaging [similar to WhatsApp], social media [similar to Facebook], marketplaces [like eBay] and services [like Uber]. One app, one sign-in, one user experience,” say KPMG’s Andrew Huang and Mitch Siegel in a report.

Currently, the only guarantee all players are seeking is the market opportunity. In India, there is no dearth of that.

Game on.

(With inputs from Asmita Dey, Nevin John and P.B. Jayakumar)