The Vanguard At Motherson

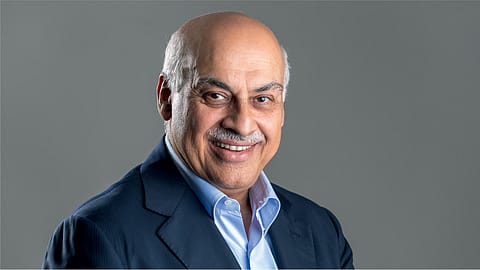

Vivek Chaand Sehgal sees Motherson go beyond automotive business as a global diversified engineering company.

This story belongs to the Fortune India Magazine October 2024 issue.

BUSINESS AND SPIRITUALITY rarely blend seamlessly, but when an entrepreneur uses spiritual philosophy as a foundation for decision-making, it’s worth paying attention. For Vivek Chaand Sehgal, spirituality is more than a personal ritual — it serves as the core of a company generating close to $12 billion (₹97,779 crore) in revenue. His guiding force? The Bhagavad Gita, which he reads daily, drawing from its wisdom to navigate the complexities of modern enterprise.

That deep spiritual connection was enshrined into a life-guiding philosophy by his mother, Swaran Lata Sehgal, when her son embarked on his entrepreneurial journey at the age of 18, founding Motherson — a silver trading business that would eventually evolve into a global automotive ancillary juggernaut. “Mother has six digits, and you, my son, have three. So, it will be six-three — six parts for me, three for you and one part will always be for Lord Krishna,” Sehgal fondly remembers.

For Sehgal, the company itself is “the mother”. In his eyes, everyone who works at Motherson — whether it’s himself, his son Vaman, the top management, suppliers, or the workers — is a child of the company, thus fostering an environment of trust, unity, and shared responsibility. Unlike typical “vision and mission” statements that usually adorn annual reports, Sehgal has, indeed, walked the talk.

With this simple but profound belief, Motherson has grown from a modest ₹1,000 seed capital to a multinational with over 450 plants in 44 countries. Its clients include automotive giants such as Ford, General Motors, Stellantis, and Volkswagen. Not surprising that Vaman Sehgal says the company has no headquarters. “We live on the plane and serve our customers globally,” says Vaman.

Yet, Motherson’s growth wasn’t driven by a desire to dominate but to build on a deep customer-centric approach. “Our strategy is to solve the problems of our customers,” Sehgal tells Fortune India. This adaptive mindset has guided the company through decades.

M&A: A Means, Not An End

Motherson’s growth has been powered by 44 acquisitions — not motivated by a hunger for more but a desire to solve client problems. The 11 acquisitions made in FY24, including key deals like Yachiyo’s 4W business, AD Industries, Dr. Schneider, and SAS Autosystemtechnik, are designed to enhance Motherson’s capabilities and deepen its relationships across both established and emerging sectors. For instance, the integration of Yachiyo’s sunroof and fuel tank business has not only expanded Motherson’s product offerings but also paved the way for a strategic partnership with Honda San. By incorporating these new capabilities, Motherson is positioned to cross-sell a broader range of products to global OEMs and offer a comprehensive suite of solutions, especially to underrepresented Japanese OEMs.

More Stories from this Issue

“Acquisitions are like double-edged swords,” explains Sehgal. “They can cut both ways.” Unlike companies that use acquisitions as a shortcut to growth, Motherson, which cumulatively spent over $150 million for the buyout binge, sees each deal as an opportunity to collaborate and solve a unique challenge with its customers.

From the start, Motherson stayed the course on trusting its employees. While the automotive industry is known for its cut-throat competitiveness, Motherson embraced collaboration — especially while acquiring struggling businesses. Unlike other companies that relocate or shut down failing plants, Sehgal believes in solving the problem at source. “Most of the companies we buy are troubled assets that others won’t touch,” he says. “But the workforce is key. If you give them the tools and the opportunity to succeed, they will turn the company around.”

An example of this philosophy is the Marysville experiment in Michigan. In the late 2000s, Motherson acquired a struggling plant near Detroit. Instead of relocating the operations to a cheaper location or laying off workers, Sehgal took the collaboration approach. “Today, that plant has grown six-fold,” Sehgal says, adding, “It wasn’t about the machines or geography — it was about the people. The same people who were there before, who now had a second chance.”

Similarly, when the Australian car industry collapsed in 2018, Motherson kept two plants running even as others closed theirs. “Everyone else had given up, but we knew the solution was to face the problem, not escape it,” recalls Sehgal. This decision not only saved jobs but also turned the plants profitable in a declining market.

(INR CR)

In doing so, Motherson has maintained strong relationships with customers while expanding its global footprint.

Focus On Diversification

While Motherson’s roots are firmly in the automotive industry, the company has expanded into non-automotive sectors such as aerospace and medical technology. This expansion wasn’t driven by a desire to diversify for its own sake but by customer requests. “If you can guarantee two-micron accuracy in automotive, why can’t you do it for aerospace?” customers would ask.

For Sehgal it was a natural extension as Motherson stayed with its core competencies: Engineering, precision, and quality. Non-automotive sectors now make up a growing share of the company’s business, and Sehgal expects this trend to continue. The company’s five-year plan aims to generate 25% of revenue from non-automotive sectors. “It’s not about replacing automotive,” he clarifies. “It’s about complementing it with areas where our engineering skills can make a real difference.”

Long-term View

Motherson’s five-year plans have become fables within the company. The first was laid out in 1995, when the company was generating around ₹14 crore in revenue. Sehgal set an ambitious goal: Grow the company 10-fold within five years. “Everyone thought I was crazy,” he recalls, adding, “Six of our top executives resigned because they didn’t believe it could be done.” Though Motherson didn’t quite hit the mark, reaching ₹82 crore by the end of the period, Sehgal wasn’t disheartened. “We didn’t mind,” he says. “Full effort is full victory,” says Sehgal, quoting the Bhagavad Gita. “Victory isn’t in hitting the exact number; it’s in the effort, the process, and the commitment,” explains Seghal.

This philosophy has shaped Motherson’s approach to growth. Unlike other companies focused on short-term results, Motherson takes the long view, stressing on consistent, incremental improvement. “Our only competition is what we did yesterday,” says Sehgal.

Even during the Covid-19 pandemic, when the company’s plans to reach $18 billion in revenue were disrupted, Sehgal remained grounded. Motherson’s vision is now to hit $36 billion (gross revenues) by 2025, and despite the challenges posed by the pandemic, the company is on track to meet its target.

Motherson’s five-year plans are centred around continuous improvement and a philosophy of “3CX10,” which ensures no customer, country, or component accounts for more than 10% of total revenue. This strategy has helped the company mitigate risks and weather disruptions, making Motherson resilient in the face of global challenges. The group has an automotive booked business of approximately $83.9 billion (excluding Yachiyo Industry Co.) as of March 31, 2024, which represents the estimated sum of lifetime sale value of orders yet to start production and orders currently under production.

Though analysts are keeping a hawk-eye on return ratios given the management’s stated objective of achieving 40% RoCE from the current annualised 18%, Sehgal is not too perturbed. “Nobody is going to sell a company that’s delivering 40% RoCE. Our job is to take companies that are struggling and help them improve, step by step. Eventually, they too will hit that 40% mark, but it takes time and commitment. It’s a process of continuous improvement, and we don’t rush it,” says Sehgal.

As Motherson moves toward its $36 billion goal, Sehgal remains focused on the same values that have guided him from the beginning: Full effort, solving problems, and trusting in the process. The approach also extends to the way he manages shareholder expectations. With the company delivering 35% top-line growth annually since inception and consistently delivering over 30% CAGR to shareholders, he is nonchalant about short-term market pressures. “Referring to the compounding value of Motherson’s shares, Sehgal says: “If you had invested ₹25,000 in Motherson in 1993, today it would be worth ₹11 crore.”

Sehgal emphasises it’s not just him at the helm. “The company runs on its people,” he says. “I stepped down as managing director in 1995, and we put professionals in charge. My job is to trust them, give them the encouragement they need, and let them do what they do best.”

That philosophy is the reason why Sehgal is now the only Indian after Ratan Tata to be inducted into the Michigan-based Automotive Hall of Fame. But the 67 year old remains grounded as ever: “Though I admit that I can’t fully comprehend the Bhagvad Gita, what’s clear is that if it’s good for me and good for my people, it will happen. If not, we move on.”