Crypto-currencies: RBI's jurisdictional enigma

Govt seems to regard crypto transactions in the same manner as alcohol consumption which is considered bad for the consumers, but good for tax revenue.

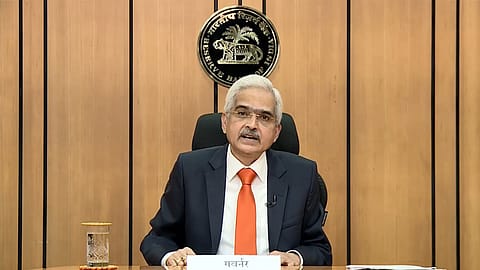

Reserve Bank of India (RBI) Governor Shaktikanta Das recently termed crypto as a ‘gambling’ instrument and opined that it should be banned. He pointed out that crypto can neither be classified as a financial asset nor a financial product, as ‘crypto does not have any underline.’

All financial assets have one or more underline, like cash flow, dividend, or interest-paying capacity through which the value of the asset is derived. A casual commentator may term crypto as a gambling instrument but such words carry deeper implications when stated by the governor of RBI.

Gambling, or any game of chance, is banned in all but a few states of India. Gamblers, gambling establishments, and even casual bystanders attract penal provisions in an unauthorised set-up.

Ironically, the online gaming industry, which runs on ‘games of skills’, is heavily regulated in India but crypto, alleged to be a gambling business by the RBI governor, is totally unregulated.

Cryptos: RBI's regulatory dilemma

Crypto, so far, has been a jurisdictional enigma. It is neither banned nor is it officially recognised as a financial instrument or an asset class.

The government pulled the RBI backwards when it took a stand against the crypto in 2018. The RBI had banned banks and other financial institutions from dealing with crypto businesses by issuing a circular on 6th April 2018. The Supreme Court judgment against the RBI hinged on the fact that the government had not taken any stand against crypto. The apex court also judged in 2020 that the RBI failed to prove its apprehensions of crypto businesses being used for money laundering and other criminal activities.

Forward to Circa 2022, crypto has revealed its criminal avatar. The Directorate of Enforcement (ED) is following the money trail of many criminal activities where profits have been siphoned off from India through crypto exchanges. Crypto exchanges like WazirX have had their assets frozen by authorities at one point, and almost all of them are under ED’s scanner.

Even the lobby that challenged the RBI in the Supreme Court, the Internet and Mobile Association of India (IAMAI), shunned dealing with crypto businesses and dismantled its Blockchain and Crypto Assets Council in July 2022. But the RBI is still carrying the burden of the 2020 judgement even when it can take fresh action against crypto in the light of new developments.

What exactly did SC Rule in RBI Vs IAMAI?

For the uninitiated and even the legalese-challenged, the Supreme Court did not rule that crypto businesses should be allowed in India. The Supreme Court merely set aside a 6th April 2018 circular issued by the RBI that barred entities regulated by the RBI from dealing with any person, business or individual, dealing with crypto-currencies. In effect, the Supreme Court made that particular circular ineffective.

(INR CR)

Does that mean that the RBI cannot issue the same kind of circular in future? The SC judgement does not remark anything regarding any future course of action by the RBI. This means that Shaktikanta Das has more power over the crypto businesses in India than has been exercised.

Govt -- the biggest tacit champion of crypto in India

In a perverse manner, the 30% tax on income from crypto and related assets like NFTs etc., has given recognition to crypto businesses. The government seems to regard crypto transactions in the same manner as alcohol consumption. It is considered bad for the consumers, but it is good for business and tax revenue.

The government’s equivocal stance on crypto has the Directorate of Enforcement dealing with multiple cases of money laundering and abetment to suicide on one end, and the Income Tax Department raking in the moolah on the other.

The government, which is bringing regulation for all sorts of digital activities, including WhatsApp forwards and posts on Twitter, is silent when it comes to the issue of crypto in India.

With 30% taxation, the government hopes to collect revenues from Indians, who have already lost money in the 2022 global crypto-bubble-burst.

However, the legislature does not realise that probably many times the amount of anticipated tax revenue has been lost through money laundering via crypto exchanges.

Meanwhile, the mega-slump in the crypto-currency market has already wiped out considerable investments of the enthused Indians, who played the crypto gamble. Coupled with the double whammy of 30% taxation on money earned, the innocent public will probably move away from crypto on its own accord, leaving only the criminal elements with nefarious intents to make the most out of the unregulated landscape.